Bitcoin outlook: Establishes above 100K

BTC/USD

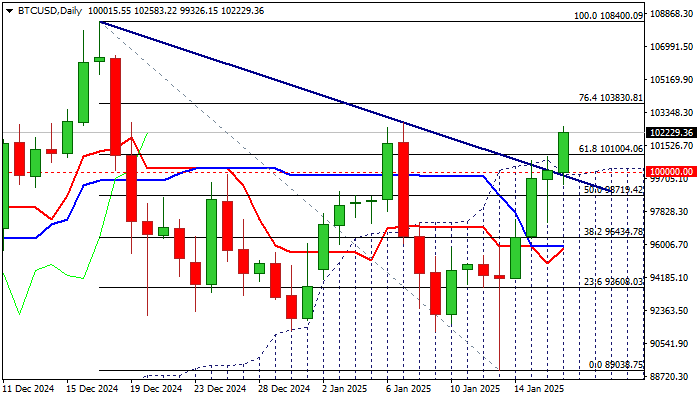

BTC/USD continues to trend higher for the fourth consecutive day and is on track to register a firm break above 100K level (psychological barrier reinforced by daily Ichimoku cloud top and bear trendline off new record high).

Fresh strength reflects overall bullish sentiment, which is primarily fueled by expectations that pro-crypto Trump’s administration may start easing current crypto market regulations and possibly declare a Bitcoin Reserve in the first days of the term.

Recent crack of strong 90K support zone raised fears among traders, but dip proved to be short-lived and strong bids at this area quickly lifted the price out of bearish formation and generated positive signal on formation of bear-trap pattern on daily chart.

Converging daily Tenkan/Kijun-sen are about to form a bull-cross, which will further strengthen near-term structure, as the price is likely to register a weekly close above 100K (for the first time in five weeks) and eyeing next targets at 102770 (Jan 7 lower top) and 103830 (Fibo 76.4% of 108400/89038).

Large weekly bullish candle with long tail contributes to positive signals as BTCUSD retraced over 61.8% of 108400/89038 pullback during this week.

As mentioned in the previous report, the rise in bitcoin’s price will be directly proportional to the pace of Trump’s action in the crypto market.

Bitcoin may retest the all-time high (108400) if things go in line with expectations but may accelerate further on potential euphoria in the market if the administration gives top priority to their task in crypto’s.

Break of 108400 pivot to expose psychological 110K barrier, violation of which to open way towards 120K, with a number of Fibo projections seen as intermediary barriers (111260, 113260; 116500).

Broken Fibo 61.8% (101000) marks initial support, with potential extended dips (daily studies are overbought) expected to hold above 100K and keep near term bulls in play.

Res: 102770; 103830; 104030; 106520.

Sup: 101000; 100000; 99326; 98719.

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.