Bitcoin open interest crosses $46B as Polymarket bettors raise Russia-Ukraine ceasefire odds to 78%

- Bitcoin price gains 3%, reclaiming territories above $83,000 on Wednesday.

- Ongoing Russia-Ukraine talks pushed Polymarket ceasefire odds up 14% in 24 hours.

- BTC open interest climbed 0.4%, breaching the $46 billion mark despite a 22% decline in trading volumes.

Bitcoin price rose 3% in the last 24 hours, reclaiming territories above $83,700 after forming a local bottom around $76,000 on Tuesday. Early market signals after the latest United States (US) Consumer Price Index (CPI) data suggest the latest BTC upside momentum could linger.

Why is Bitcoin going up today?

Bitcoin price rose as high as $84,539 on Wednesday, fueled by two major bullish catalysts: softer-than-expected US inflation data and easing geopolitical tensions between Russia and Ukraine.

The latest CPI report from the US Bureau of Labor Statistics showed inflation cooling more than expected. This boosted demand for Bitcoin, particularly among macro-sensitive investors.

Bitcoin price analysis, March 12

Many of these traders had previously moved away from risk assets when President Donald Trump announced tariffs in early March, fearing a more hawkish Federal Reserve (Fed) response to potential inflationary pressures.

With inflation concerns easing, investors are reallocating capital back into Bitcoin, reinforcing its short-term recovery prospects.

Russia-Ukraine talks pushed Polymarket ceasefire odds up 14%

Beyond the US CPI data, the latest updates from ceasefire talks between Russia and Ukraine also contribute to Bitcoin’s mild price uptick.

On Wednesday, the BBC reported that the US Secretary of State Marco Rubio outlined a joint Ukrainian and American proposal for a 30-day ceasefire with Russia, marking a decisive step toward de-escalation of the three-year war.

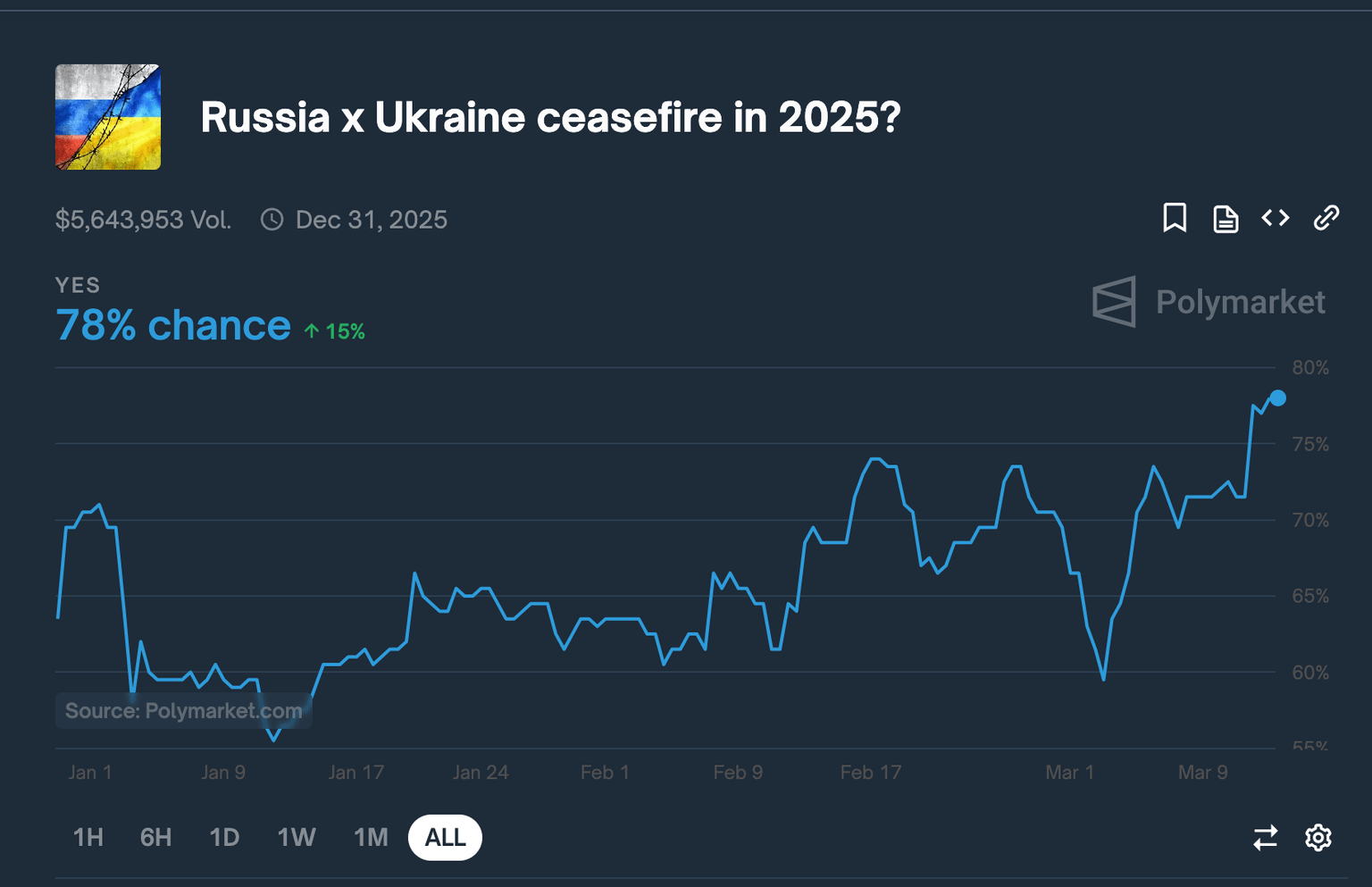

Russia-Ukraine Ceasefire odds surged to 77%, March 12 | Source: Polymarket

Global markets responded favorably to the development, with risk assets showing mild optimism.

Within the crypto sector, traders on Polymarket—a blockchain-based predictions market—quickly adjusted their bets, resulting in a 14% increase in ceasefire odds.

At press time on Wednesday, crypto bettors are pricing in 78% chances of a ceasefire deal before December 31, 2025, with over $5.6 million in active market volumes.

Polymarket has historically served as a barometer for sentiment among crypto traders regarding major geopolitical and macroeconomic events.

The uptick in ceasefire expectations suggests traders are pricing for reduced uncertainty, which could encourage greater capital flows into Bitcoin and other digital assets.

While Bitcoin’s price remains range-bound below the $85,000 support, derivatives market signals indicate growing optimism among speculative traders.

How would a Russia-Ukraine ceasefire influence Bitcoin’s price?

Market reactions indicate that the US proposal for a Russia-Ukraine ceasefire could pave the way for negotiations to end the war.

This development may have a bullish impact on Bitcoin for two key reasons.

First, the reintegration of Russian energy supplies into global markets could lower operational costs for Bitcoin miners and AI-integrated blockchain projects.

Additionally, capital flows from Russia may regain access to global crypto onramps, increasing liquidity and institutional inflows.

These factors could fuel long-term gains for BTC. Early data from Bitcoin derivatives markets on Wednesday shows that short-term speculative traders are positioning for an upside move.

Bitcoin price outlook: Derivatives market data hints at prolonged BTC rally

Despite BTC price stagnating below $85,000, key derivatives metrics signal bullish momentum.

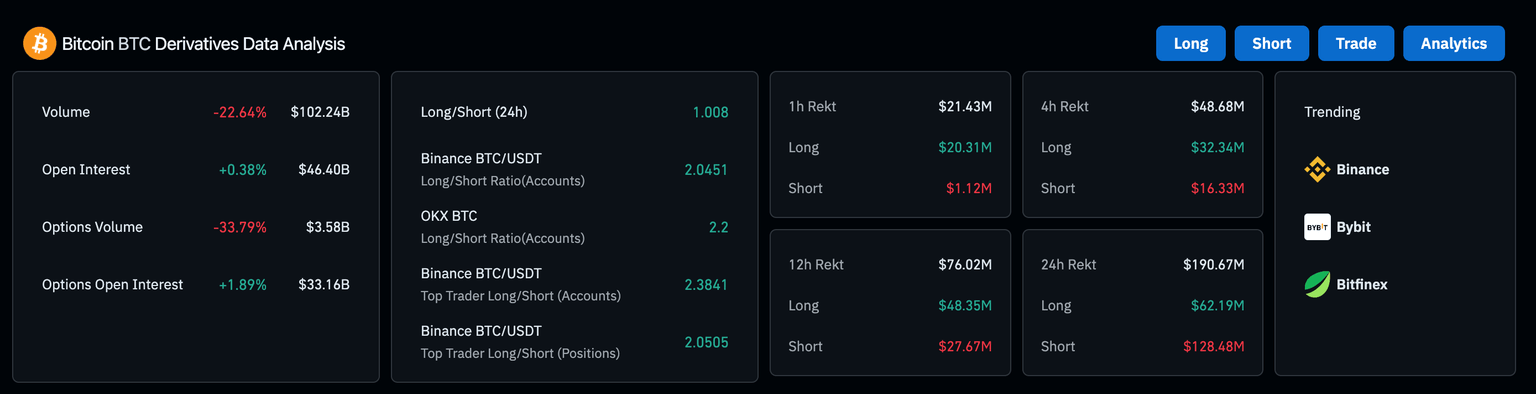

- Bitcoin trading volumes: Declined 22.64% to $102.24 billion, signaling reduced speculative activity after prolonged bearish dominance.

- BTC Open Interest: Increased 0.38% to $46.40 billion, suggesting fresh positions are being deployed as the BTC spot prices swung into a positive directional phase on Wednesday.

Bitcoin Derivative Market Analysis | March 12 | Source: Coinglass

- Options Open Interest: Rose 1.89% to $33.16 billion, indicating new bullish positioning.

- Long/Short Ratio (24h): 1.008, reflecting a balanced market but tilting bullish among retail traders who dominate exchanges like Binance (2.0451) and OKX (2.2).

Liquidation data further supports a bullish bias. In the last 24 hours, $190.67 million in positions were liquidated, with $128.48 million in shorts compared to $62.19 million in longs—a sign that bearish bets are getting squeezed.

This shift in derivatives positioning suggests growing confidence in a BTC price recovery.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.