Bitcoin network’s carbon emission jumped 17% after China ban

Bitcoin network’s proof-of-work mining consensus has been a topic of environmental, social and governance debates for a long time, and a new study may only add to the growing controversy around Bitcoin’s carbon footprint.

A new research report titled “Revisiting Bitcoin’s carbon footprint” published in the peer-reviewed scientific journal Joules has highlighted that the Chinese crypto mining ban might not have contributed to the reduction in the carbon footprint of the Bitcoin network as propagated by many Bitcoiners; on the contrary, it has increased by 17%.

China was the primary hub for Bitcoin miners before May 2021 and accounted for more than 60% of the total Bitcoin network hash rate. However, the blanket ban imposed by the government led to the migration of most of the mining farms out of the country. China’s Bitcoin mining hash rate share fell from over 60% in May to near zero in August, with miners moving to the United States, Russia and Kazakhstan.

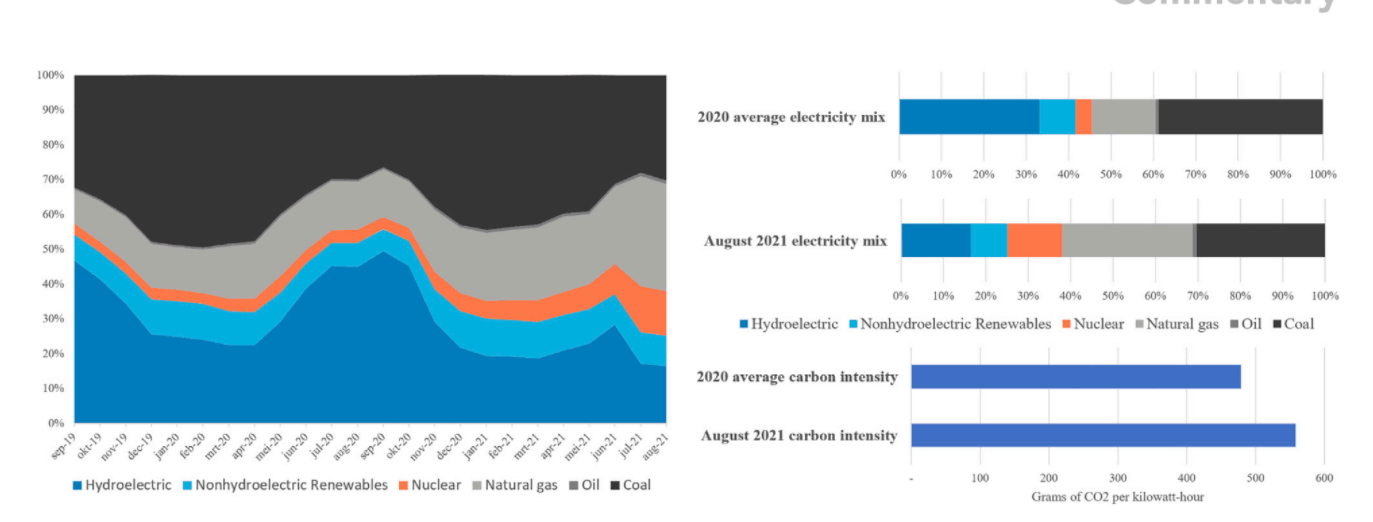

Crypto pundits predicted that the migration of miners out of China would not only make BTC mining more decentralized as well as greener, but the new Joule report shows otherwise. The new research report highlighted that the amount of renewable energy used to power BTC mining has declined from 42% to around 25% since last August.

Top electricity sources for Bitcoin Mining. Source: Joule

The study tracked the source of electricity powering mining operations to calculate the carbon emissions of the Bitcoin network and found that the top crypto blockchain emits 65 megatons of carbon dioxide annually. The study concluded that miners in China were more renewable energy-focused than most of the top mining countries today.

Alex de Vries, one of the authors of the report, told Cointelegraph:

“The study in general highlights how Bitcoin mining got even dirtier after the Chinese mining crackdown of last year. A lot of the hydropower miners previously had access to here have now been replaced by natural gas (in the U.S.). On top of that, the coal-based electricity in Kazakhstan is also dirtier than Chinese coal-based electricity. Altogether, that makes proof-of-work mining even more carbon-intensive than it already was.”

The Joule journal study further contradicts a report pushed by the Bitcoin Mining Council led by MicroStrategy CEO Michael Saylor, which claimed that the Bitcoin network utilizes up to 66% sustainable energy.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.