Bitcoin may get a boost during US presidental campaign

- Andrew Yang supports the idea of comprehensive cryptocurrency regulation.

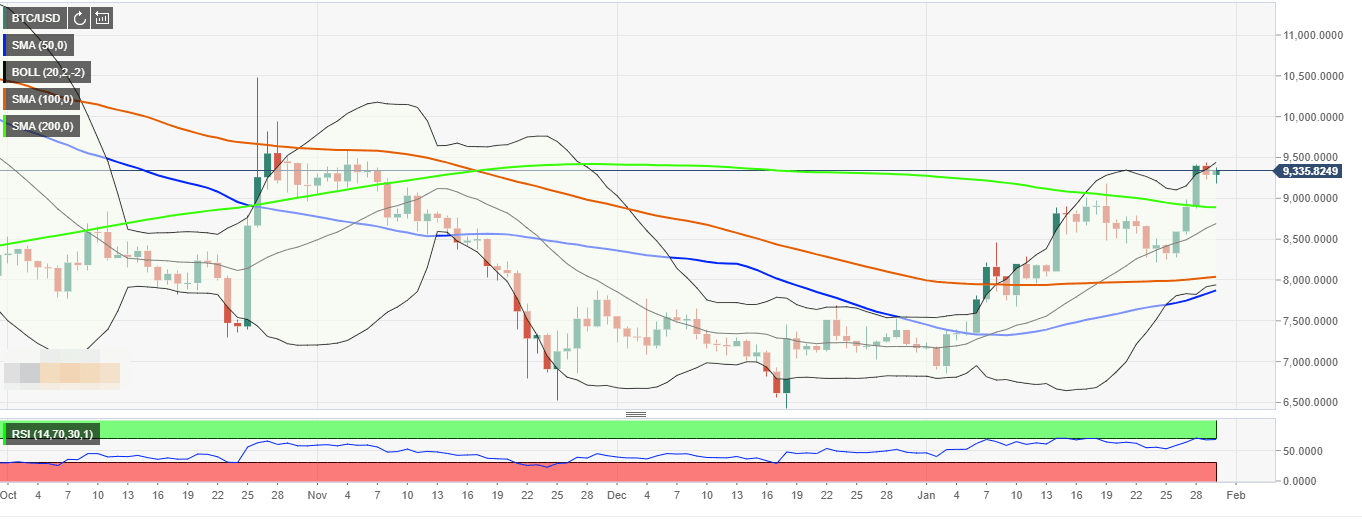

- BTC/USD retreated from the recent high, still above critical support.

Bitcoin (BTC) topped at $9,432 on Wednesday, January 29, and retreated to $9,330 by the time of writing. The first digital asset has entered a range-bound mode and stayed mostly unchanged both on a day-to-day basis and since the beginning of Thursday. Bitcoin market dominance emerged to 66.4%, while an averaged daily trading volume settled at 418 billion.

Andrew Yang says Bitcoin needs coherent regulation

The existing US political establishment is rather conservative and even hostile towards digital assets; however, the situation is about to change as the candidates for the US presidency choose a more friendly approach towards the nascent industry to attract young voters. According to recent researches, millennials and the younger Generation Z are more likely to invest in digital assets to protect their assets during recessions. Moreover, they are the main users' fo cryptocurrencies on a day-to-day basis. Thus, it stands to reason that they would be more loyal to pro-bitcoin candidate, who wants to support blockchain innovations and create a favorable environment for digital currencies.

Andrew Yang, an American businessman and a candidate for the US president believes that cryptocurrency industry needs a clear and uninformed regulation. Speaking in the interview with Bloomberg, he said that at this stage there is a some sort of hodge-podge sets of rules created by states separately, which is bad both for investment purposes and technology innovations.

He also added, that creating a clear and transparent rules for digital assets would be one of his priorities. Yang believes that underlying technology of cryptocurrencies has a huge potential and we should support its development and investments to maintain competitiveness on the global scale.

BTC/USD: technical picture

Bitcoin stopped the three-days bullish sprint and printed the first red candle of the week on Wednesday. The first digital currency extended the decline during early Asian hours on Thursday and hit the intraday low of $9,183. Despite the correctio, the coin continues moving within a strong bullish trend. It is well-positioned for another attempt higher as long as it stays above $9,000.

If the above-said support is broken, the sell-off may be extended towards the next important level of $8,900 reinforced by SMA200 daily. Once it is cleared, $8,650 followed by the middle line of the daily Bollinger Band. Once it is out if the way, the downside momentum will gain traction and push the price towards $8,000.

On the upside, a sustainable move above the recent high of $9,432 will bring $9,600 into focus, which is regarded as a pivotal level before the move towards $10,000.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst