Bitcoin leads, altcoins consolidate, upside pressure builds

Perhaps it’s just another sign of a maturing market, but we haven’t seen a lot of that familiar whipsaw action in crypto lately.

Indeed, after months of high volatility — first to the upside, then to the downside — intraday price movements have been more subdued in the past couple weeks.

Underneath the surface, however, we see crypto assets establishing a solid base for a potentially explosive rally as we head into the final quarter of 2020.

So, that’s the context for crypto-index performance this week.

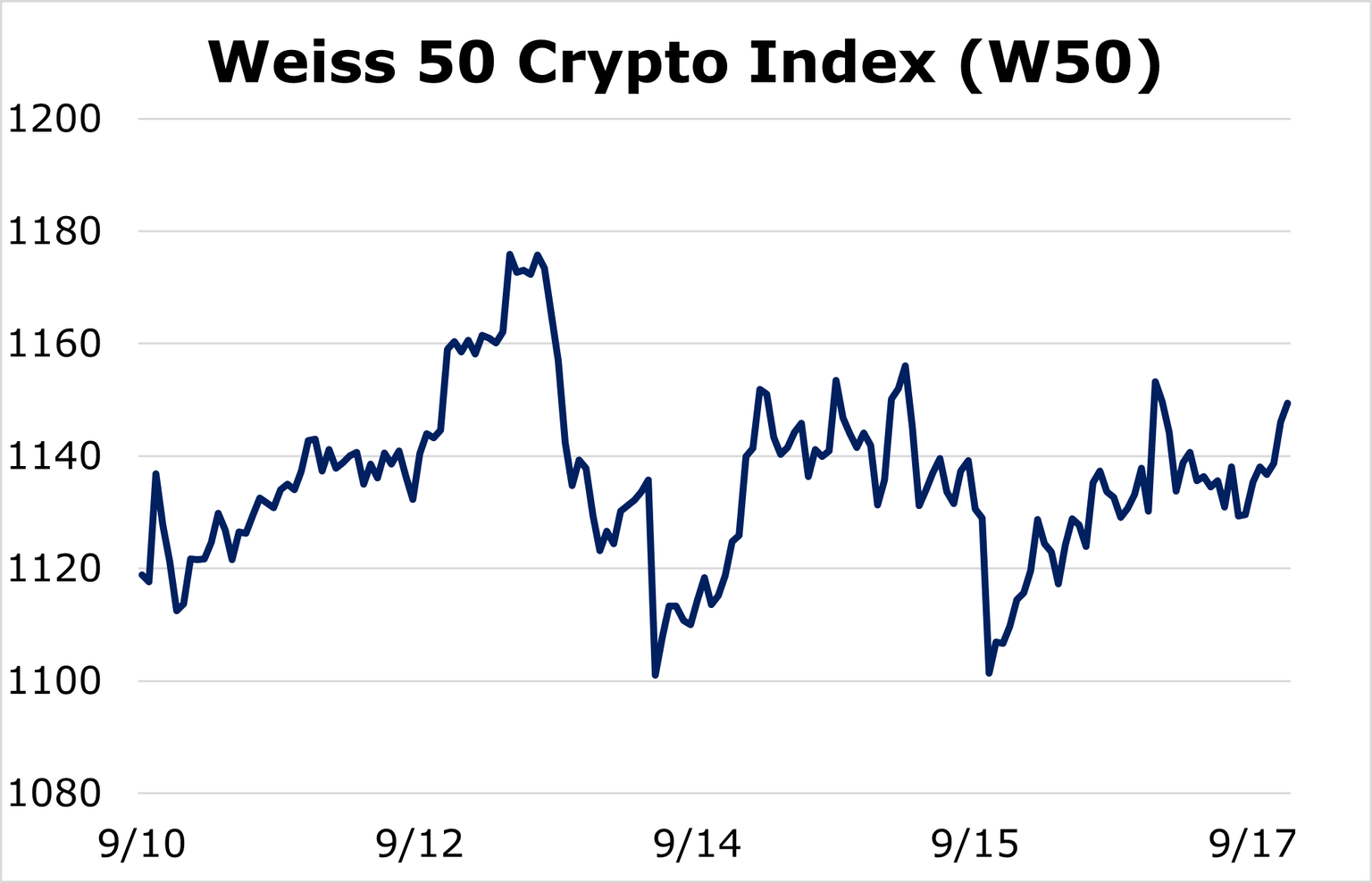

The Weiss 50 Crypto Index (W50), the broadest measure of the industry, closed the seven-day trading week ended Thursday Sept. 17, with a 2.73% gain. As the chart below shows, it was basically a “sideways” week ...

Here’s where it gets interesting.

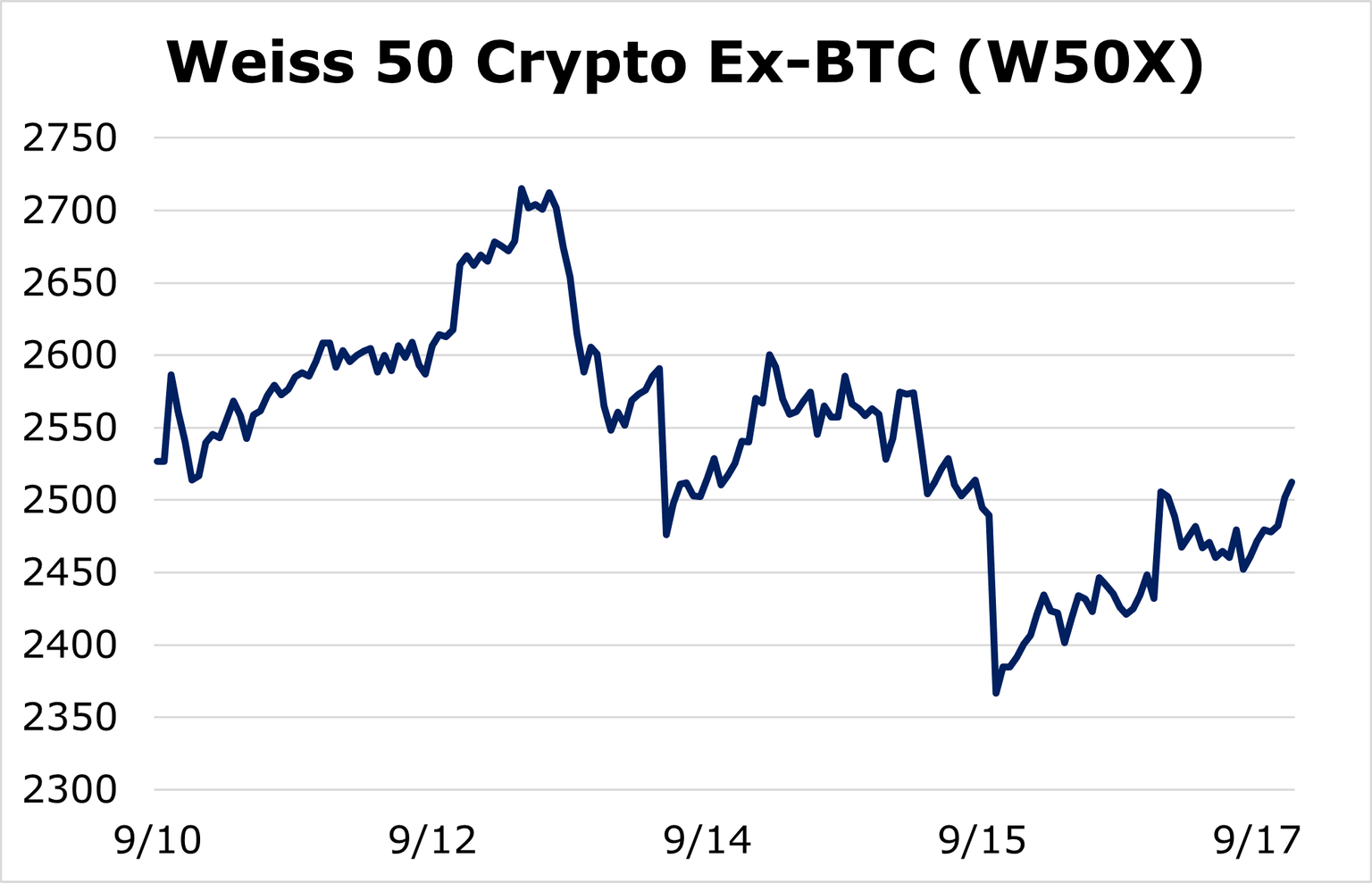

Stripping out Bitcoin (BTC, Tech/Adoption Grade “A-”) reveals a slightly more bearish week for the altcoins. The Weiss 50 Ex-BTC Crypto Index (W50X) was down 0.57%. The chart below shows a clear bearish biased compared to the W50 ...

This tells us that Bitcoin held down the fort last week, so to speak, and that altcoins were clearly weaker in the past seven days.

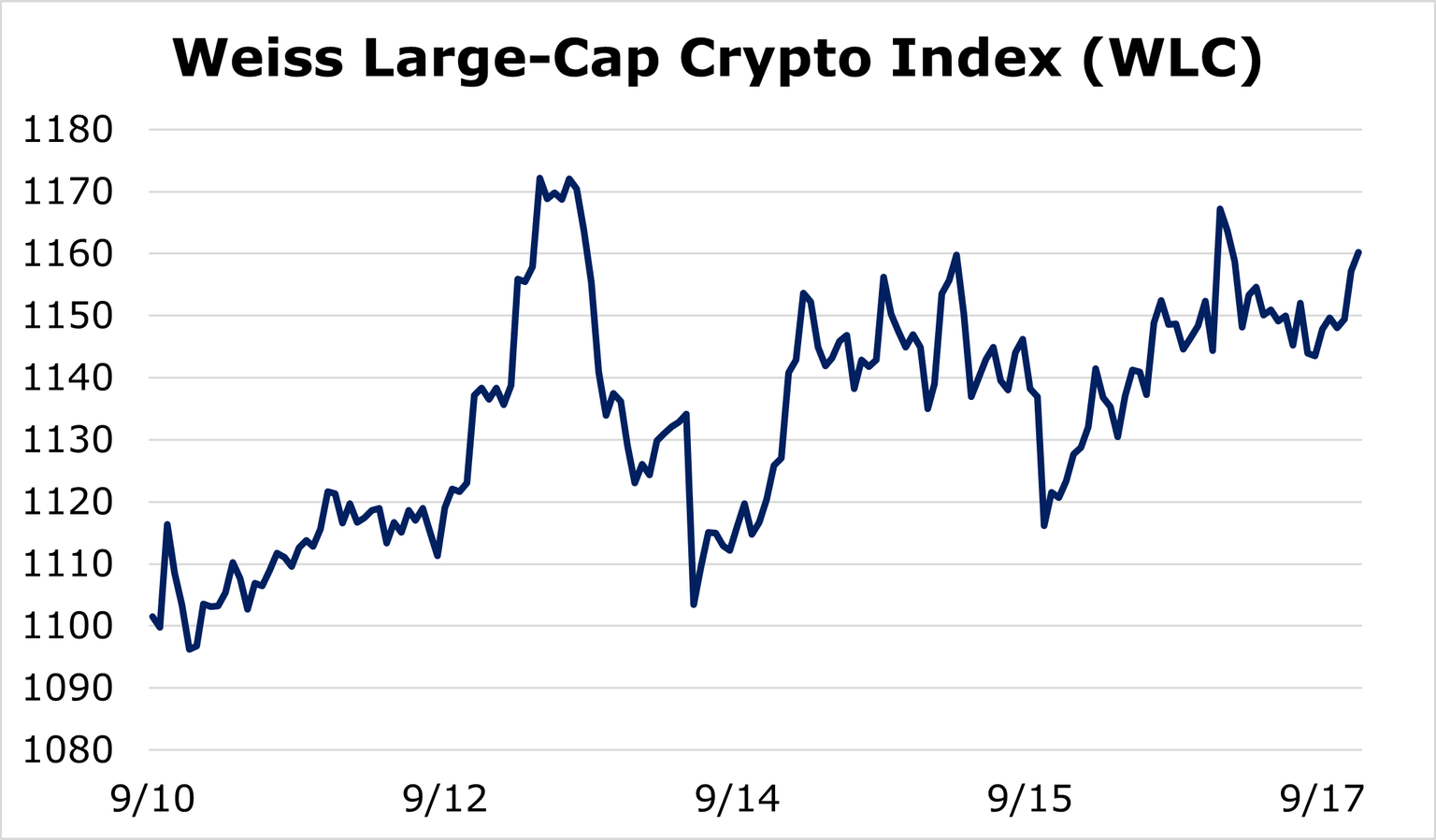

Splitting the industry by market capitalization confirms this fact.

The Weiss Large Cap Crypto Index (WLC) — which is dominated by Bitcoin — moved up 5.34% on the week. Note also that, despite some ups and downs, this index spent most of the week heading higher ...

The Weiss Mid-Cap Crypto Index (WMC) was down 1.49%. Compared to the WLC, the WMC was clearly weaker, as the chart below is clearly points downward ...

Finally, the Weiss Small-Cap Crypto Index (WSC) was the weakest of all three, shedding 9.11% for the trading week ended Thursday. Note also how the chart below is the weakest of all the subindexes ...

The takeaway this week is that, while we saw Bitcoin move higher, the altcoins had a hard time following its lead. This is in sharp contrast to the past couple months, when we generally saw the exact opposite: Altcoins were heading higher, while Bitcoin was struggling to catch up.

I’ve often noted on these reports how no crypto bull market is sustainable without Bitcoin leading the way, at least in the early stages.

As the most recognizable name in the world of crypto, Bitcoin remains the benchmark for outside investor interest in the asset class.

And it’s only when we see Bitcoin outperform the rest of the markets to the upside that we can say that new money is moving into the crypto space — a necessary pre-requisite for a long-term bull market.

I hasten to add, though, that what we’ve seen in this “reversal of fortune” is a one-off, for now. It will be interesting to see whether Bitcoin can continue to outperform its altcoin progeny over the next few weeks.

Author

Juan Villaverde

Weiss Crypto Ratings

Juan Villaverde is an econometrician and mathematician devoted to the analysis of cryptocurrencies since 2012.