Bitcoin is not money even if it costs nearly $9,000 - Ray Dalio

- The founder of Bridgewater Associates does not recommend investing in Bitcoin.

- BTC/USD has been oscillating in a tight range recently.

Bitcoin (BTC) has settled below $8,700 after a short-lived move to $8,791 during early Asian hours. The first digital coin has stayed mostly unchanged both on a day-to-day basis and since the beginning of Wednesday as the market has entered a range-bound phase after sharp movements at the end of the previous week.

Ray Dalio criticized Bitcoin at Davos

The founder of Bridgewater Associates Ray Dalio praised gold and criticized Bitcoin while speaking at the World Economic Forum in Davos, Switerzland, CNBC reported.

According to the guru of investments, the first cryptocurrency is too speculative to serve as money.

“There’s two purposes of money, a medium of exchange and a store hold of wealth, and bitcoin is not effective in either of those cases now,” he said.

Dalio also urged investors to ditch cash as they are worthless as an. investment instrument.

“Cash is trash. Get out of cash. There’s still a lot of money in cash,” he added.

According to Dalio, gold is the best choice for long-term investors. He believes that the precious metal should be included in investment portfolios for diversification purposes.

Notably, the same opinion is shared by another prominent gold bug Peter Schiff, who recently confessed that he had lost keys to his Bitcoin wallet.

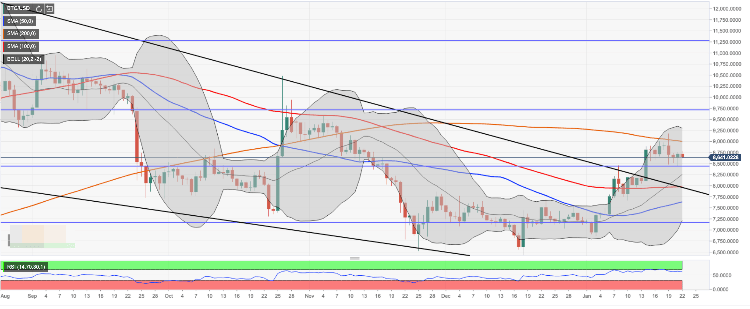

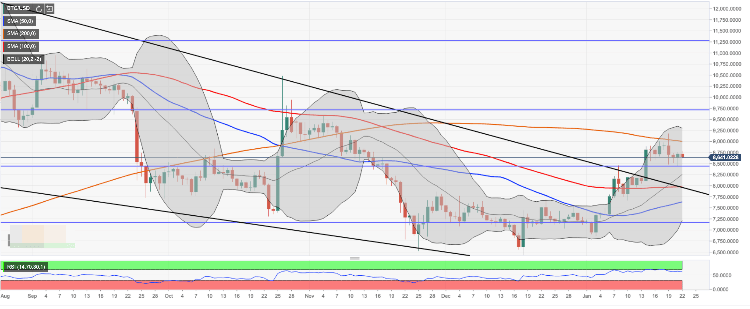

BTTC/USD: technical picture

BTC/USD has been moving inside the range limited by SMA200 daily ($9,000) on the upside and 50% Fibo retracement for the upside move from December 2018 low to July 2019 high ($8,500). The coin is set to continue its directionless oscillations until one of those barriers are broken.

If bears have an upper hand, the sell-off may be extended towards the next critical support at $8,000. This area is reinforced by the broken upper boundary of the wedge formation and SMA100 daily. Moreover, it served as a lower boundary of a consolidation range since the beginning of January. A sustainable move below this hurdle will open up the way towards SMA50 daily at $7,600.

On the upside, a strong move above $9,000 will open up the way towards the recent high of $9,184 and allow for a further recovery towards $9,300. This resistance is created by the upper line of the daily Bollinger Band and followed by 38.2% Fibo retracement for the upside move from December 2018 low to July 2019 high at $9,750.

BTC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst