Bitcoin H&S pattern Completed

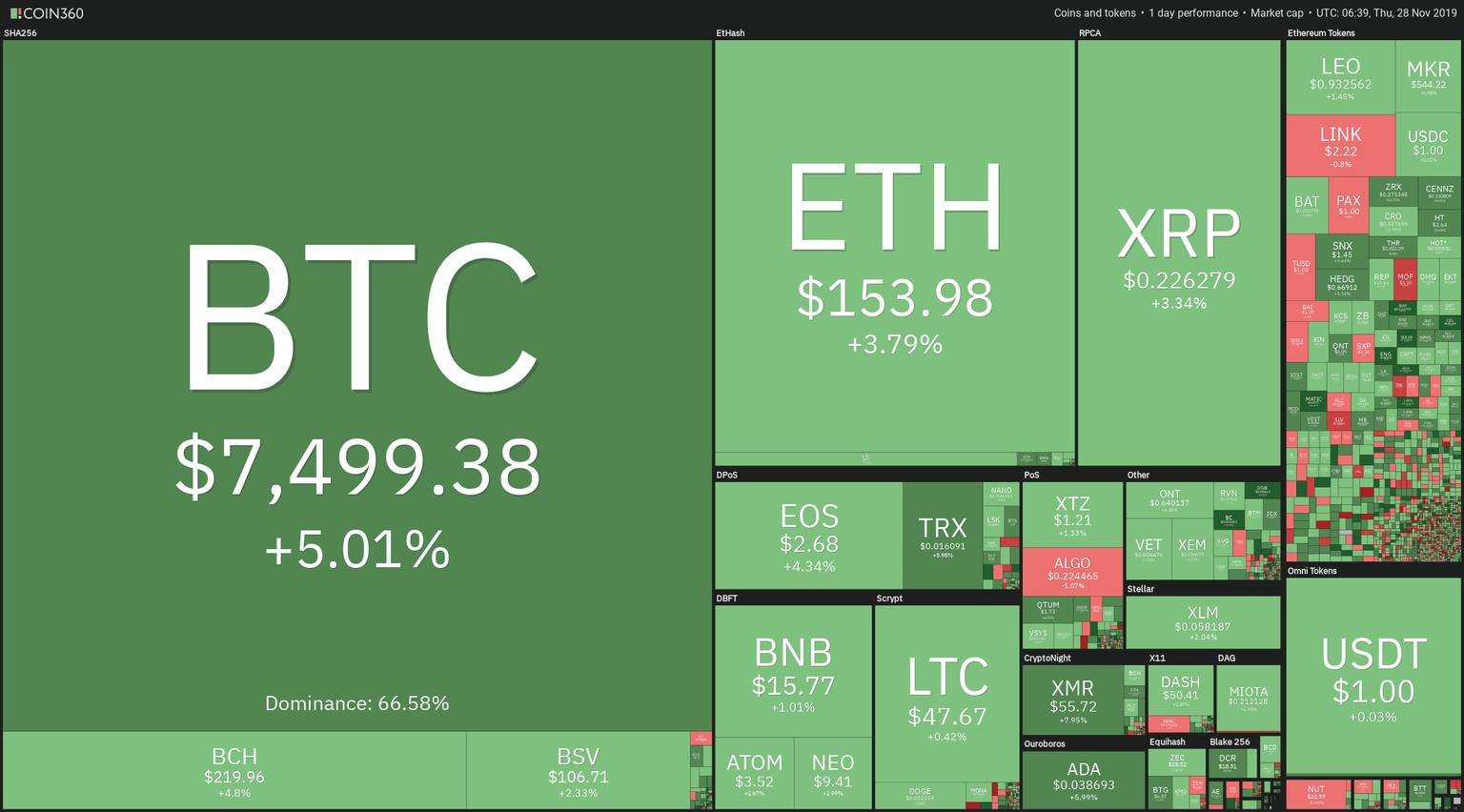

The last 24 hours were key for Bitcoin (+4.81%) and the rest of the crypto sector, as the descending momentum has been stopped. Bitcoin not only broke through a resistance level. That level was the neckline of an H&S pattern. The rest of the sector followed. Among the top capitalized cryptos XMR(+9%), Qtum ( +6.63%), ADA (+5.9%), and Tron(+5.9%) were the best performers. The Ethereum token sector moves mostly bullish, as well. ENG(+24%), SOLVE (+16%) and CEL (+16%) are among the top performers.

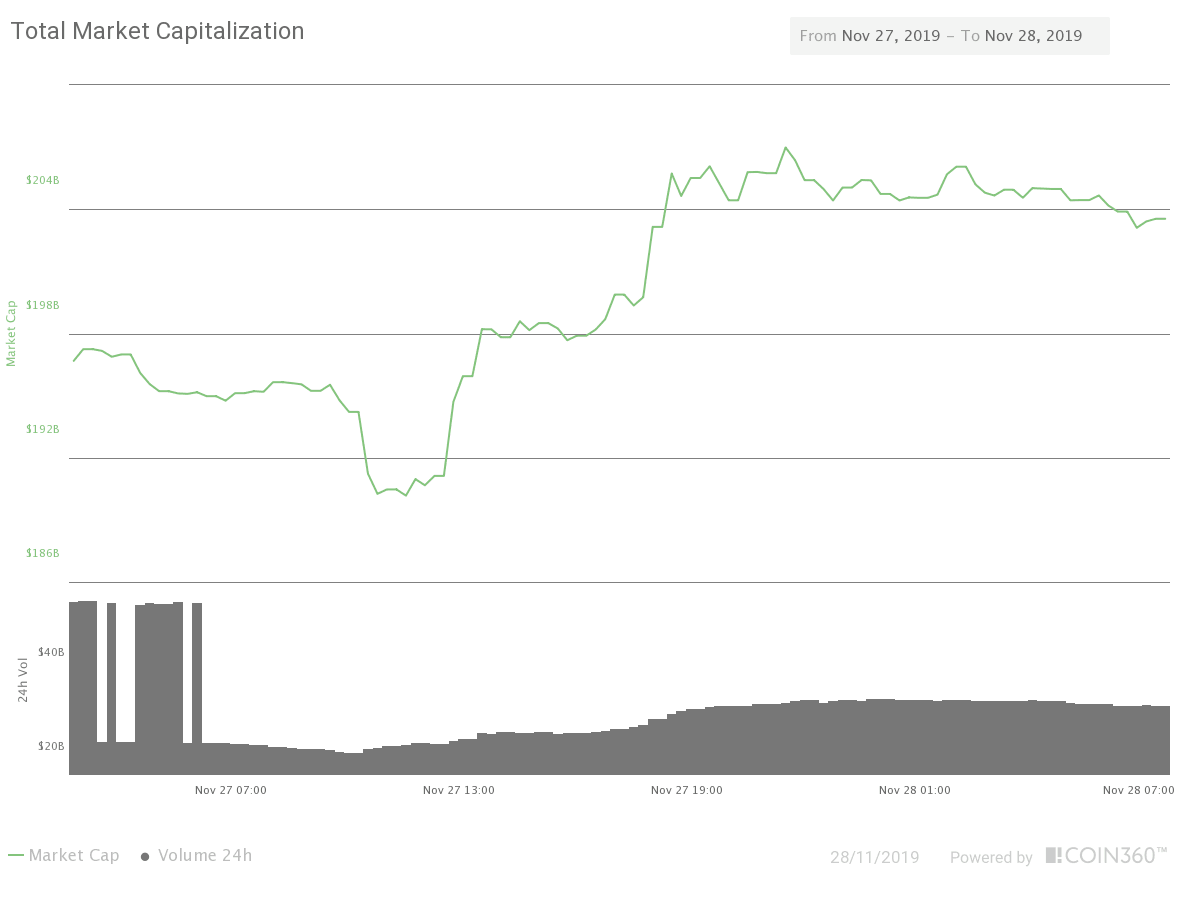

The market capitalization of the sector advanced 3.3%, to $203.540 billion, and the traded volume increased 24%, to $35 billion, while the dominance of the Bitcoin progressed to 66.59%.

Hot News

Bakkt Bitcoin futures volume soared to over $38 million yesterday, a 40% increase from its previous high. That means institutional investors were quite interested in purchasing physically- settled bitcoin futures at the current prices.

The Swiss Federal Council is passing to a proposal to its Parliament to improve the legislative body for the new blockchain technology and digital asset industry, aimed at "increasing legal certainty, removing barriers for applications based on distributed ledger technology (DLT) and reducing the risk of abuse," according to a notice of the Federal Department of Finance of the Swiss Confederation released yesterday.

Technical Analysis

Bitcoin

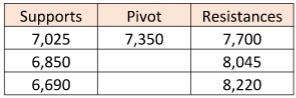

After a fake movement to the downside that went as low as $6,850, Bitcoin reversed and headed up with increasing volume to break the neckline of a very evident inverted head and shoulders pattern to make convincing close above $7,500. The price not only is moving above the +1SD Bollinger line, but the Bollinger channel has also turned upwards. Even, the MACD has crossed above the zero-line. All these are signs of a trend change, at least short-term. The next barrier to break on its way for the $8,000 level is $7,700, while $7,390 transmuted to support.

Ripple

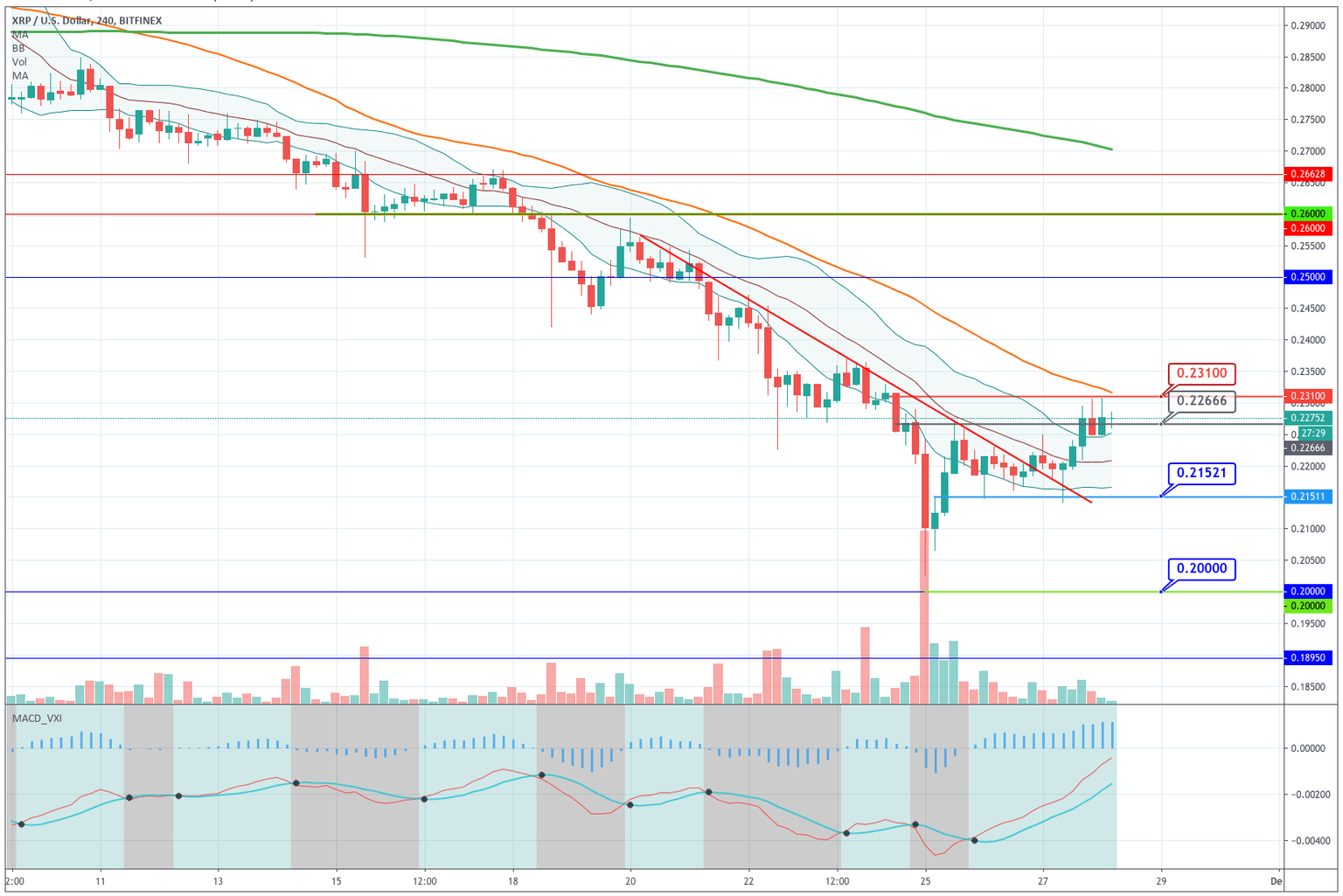

Yesterday, Ripple has followed the wave of purchases of the crypto sector, although much more timidly. Nevertheless, the action drove the price through the mid-Bollinger line and up to its +1SD line. The price broke its first resistance level at 0.22666, but it is still very close to it. Therefore, we consider it yet not consolidated as support. The next barrier to break seems to be $0.231. The Bollinger lines and MACD make us consider XRP has an upward bias currently, with a potential next target at about $0.25. As a final note, the volume shown during XRP's advances is insufficient for more advances, although liquidity could appear after the breach of the $0.231 level.

Ethereum

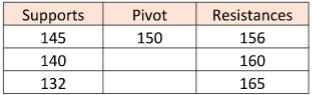

Ethereum also broke the neckline yesterday and moved above $150 with increasing volume. The price managed to move above the +1SD Bollinger line, and even turn it to the upside, both excellent news for buyers and "hodlers". The MACD signal line has crossed the zero line, as well.

The next barrier to cross is $156, and a potential short-term target is $170.

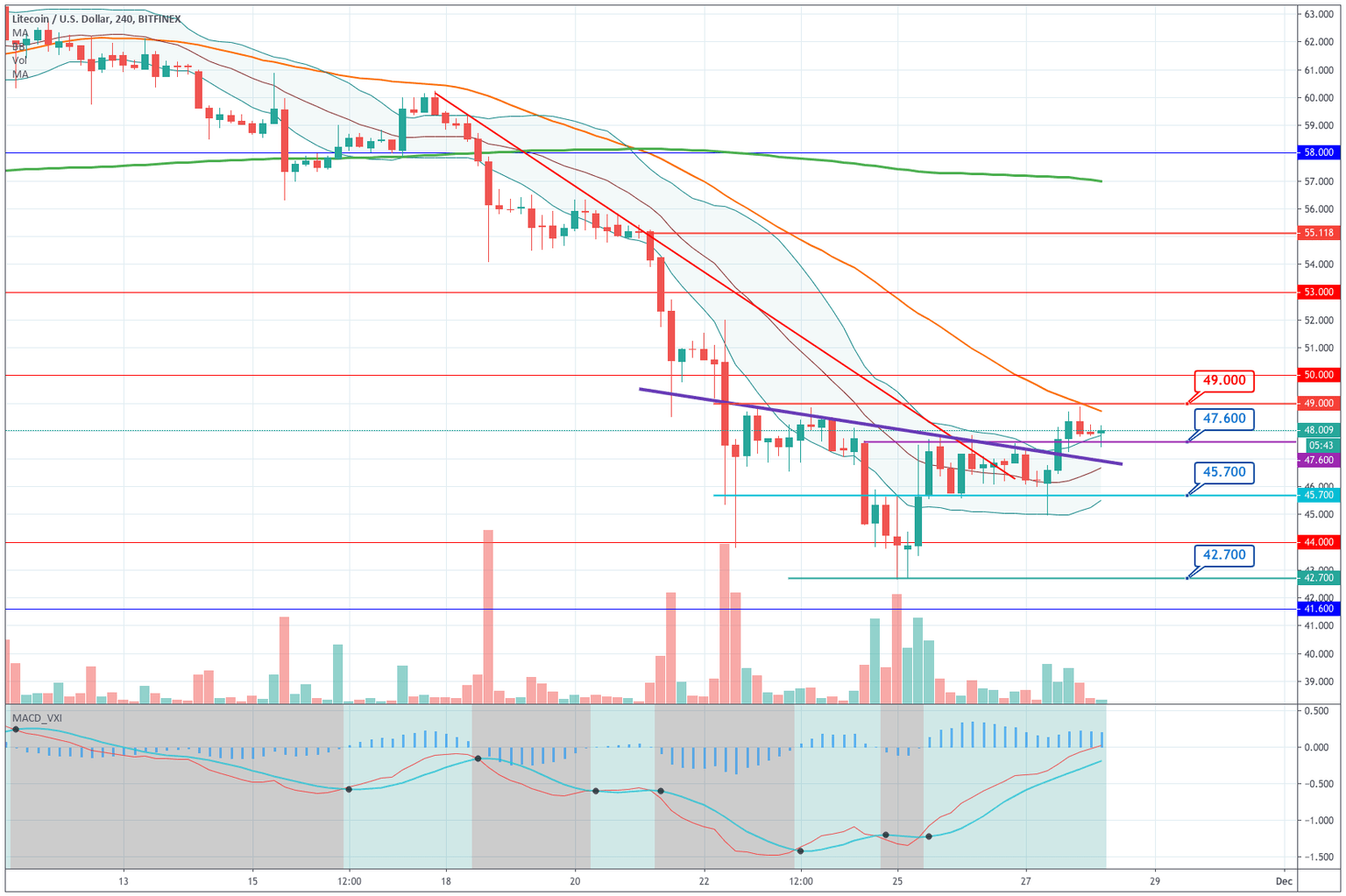

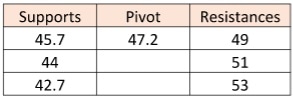

Litecoin

Litecoin made a quite similar movement to Ethereum. After a fake drop that became a hammer pattern, it broke the descending neckline and moved up to cross the $47.6 level. We could still argue that the real neckline is $49, and that may be the case, but the signs of improvement are there to see. The price moves above the +1SD Bollinger line. The Bands have turned upwards, and the MACD still up, with the signal line crossing the zero line. Anyway, on the chart, we see that the next resistance to break is $49 with potential targets at $53 and $55.

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and