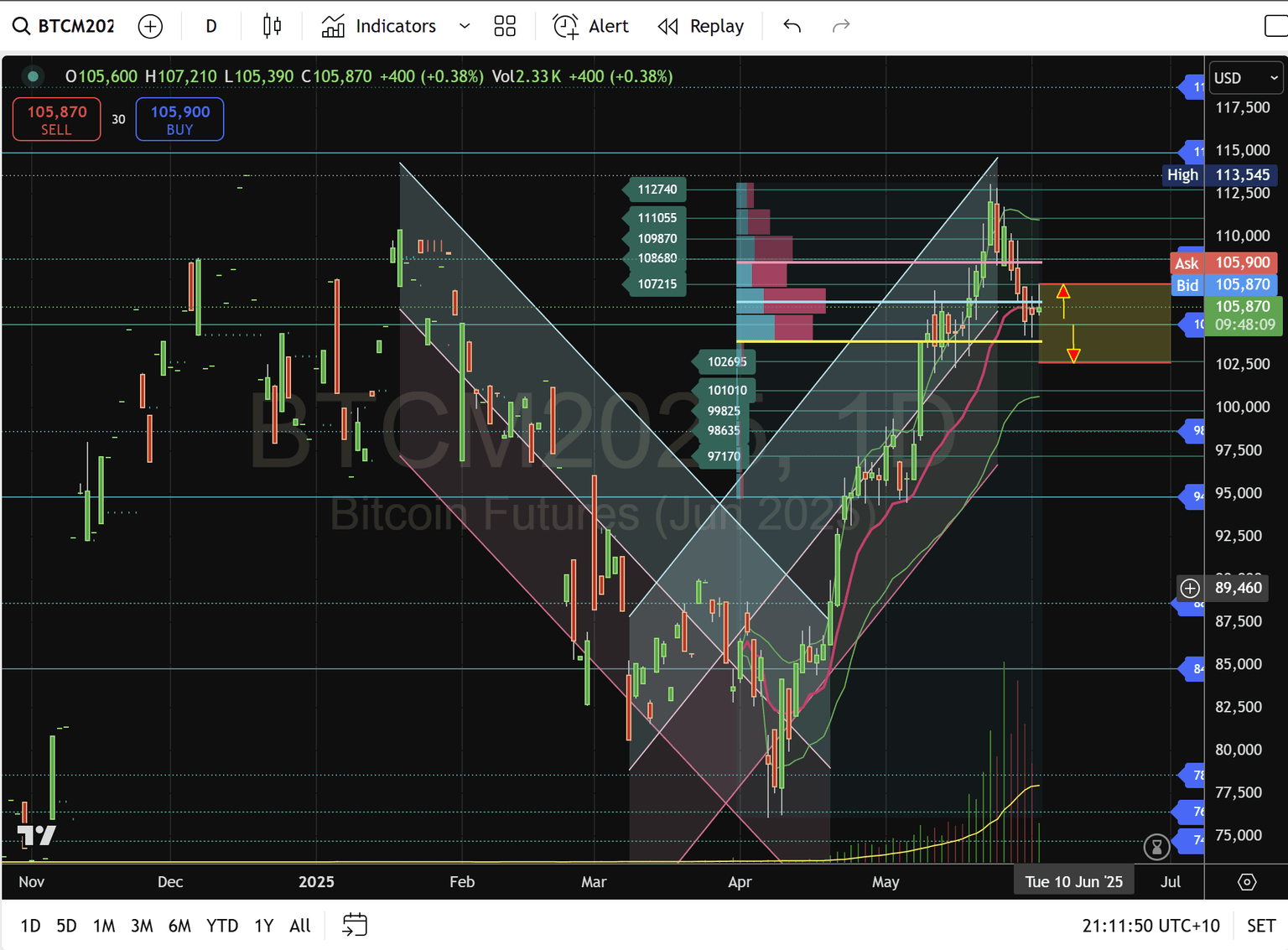

Bitcoin futures at a crossroads: Must clear 106,200 (POC) and 107,215 to reignite rally

June 2025 BTC Futures hinges on defending 104,845; reclaiming the light-blue POC at 106,200 and then 107,215 unlocks a run toward the pink VAH around 108,680 and prior high at 112,740, while a break below 104,845 risks deeper pullbacks.

Key pivot zones and volume profile

-

Central Pivot ("Line in the Sand") – 104,845 (Yellow Line):

-

After pulling back from the 112,740 resistance, Bitcoin bounced off its daily Value Area Low (VAL, highlighted in yellow) and the central pivot at 104,845. Holding above 104,845 remains crucial—this level divides bullish control from renewed bearish pressure.

-

Point of Control (POC, Light Blue Line at ~106,200):

-

The POC at 106,200 marks the highest-volume price node on the volume profile. Currently, BTC trades just below this POC. If bulls are to reestablish control, they must first push price back above 106,200. Failing to reclaim the POC keeps sellers in the driver's seat and increases the odds of retesting 104,845 or lower.

-

Immediate resistance – 107,215

-

Just above the POC sits 107,215, the breakout trigger from the last rally. Today's daily candle was rejected at 107,215. Only a sustained break above both 106,200 and 107,215 will confirm that demand is accelerating.

-

Volume Area High (VAH, Pink Line around ~109,870):

-

The VAH at approximately 108,680 represents the upper boundary of the 70% volume area. A clean break above 108,680 would confirm buyers are absorbing supply, clearing the way for targets at 109870, 111,055 and 112,740.

-

VWAP Middle Line (Red):

-

The VWAP (red middle line) currently sits between 105,500 – 106,000. As long as BTC remains above VWAP, the intraday bias favours buyers. A daily close below VWAP shifts momentum toward sellers.

Bullish scenario: Reclaim 106,200 – 107,215 – 108,680

-

Step 1 – Recapture the POC at 106,200:

-

Trigger: A 4-hour (or daily) close above 106,200 on above-average volume. This signals institutions re-entering.

-

Why it matters: The POC is the highest-volume node, and reclaiming it suggests that price acceptance is shifting upward. Failure here will likely keep BTC consolidating or push it back toward 104,845.

-

-

Step 2 – Break above 107,215:

-

Trigger: Sustained closes above 107,215 (with supportive volume).

-

Why it matters: 107,215 served as the breakout point on the last rally. Clearing this confirms a fresh bid. Once above, watch for short-covering and new long entries targeting the VAH.

-

-

Step 3 – Conquer the VAH at ~108,680 (Pink Line):

- Trigger: A daily close above 108,680 on expanding volume.

-

Why it matters: The VAH marks the upper boundary of the value area. A clean break here validates that bulls are absorbing leftover supply from the previous consolidation.

-

Targets beyond VAH:

-

109,870 (next volume‐profile node)

-

111,055 - 112740 (prior swing high and major supply zone)

-

-

Bullish confirmation:

-

VWAP Support: Price must remain above the VWAP red line. A reversion below VWAP weakens the bullish edge.

-

Higher Highs & Higher Lows: Daily/4-hour lows must hold above 104,845, and highs must clear 107,215 and eventually 108,680.

-

Volume Expansion: A noticeable pickup in traded volume around 106,200 confirms institutional participation.

-

Bearish scenario: Breakdown below 104,845

- Immediate downside Objective – Revisit 104,845 (Central Pivot):

- Trigger: A 4-hour (or daily) close below 104,845 on rising volume.

- Why it matters: Losing the "line in the sand" shifts the short-term control to sellers.

- Next support – 102,695: Although the chart's POC has shifted to 106,200, the volume profile's secondary node lies near 102,695. A failure below 104,845 likely drags price toward 102,695.

- Secondary support ladder:

- 102,695 (Secondary volume profile node): Holding this level is key to preventing a deeper drop in value.

- 101,010 – 99,825: This range was prior congestion/support in March. Breaching it invites acceleration to 98,635, the volume node from late April.

- 98,635 & Lower: Once under 98,635, watch 94,800

- Bearish confirmation:

- VWAP rejection: If BTC cannot reclaim VWAP and it flips to resistance, sellers dominate.

- Lower highs & lower lows: A series of daily candles failing at 104,845 and new lows under 102,695 confirm a downtrend.

- Rising down-volume: Noticeably larger volume on declines through each support level confirms institutional selling pressure.

Current price action and trading implications

-

Range-bound between 104,845 – 107,215:

-

Bitcoin is consolidating. Bulls are defending 104,845; bears remain active near 107,215. The POC at 106,200 now sits between these two levels, acting as short-term resistance.

-

VWAP as mid-range magnet:

-

The red VWAP line (approx. 105,500 – 106,000) is currently the intraday balance. Sustained closes above VWAP support a bullish tilt; sustained closes below signal further choppiness or potential breakdown.

-

Daily candlestick rejection:

-

Today's daily candle was turned back at 107,215, indicating overhead selling. If bulls cannot clear 106,200 on a 4-hour basis soon, expect another test of 104,845.

-

Volatility expectations:

-

A decisive break below 104,845 on expanding volume likely pushes BTC toward 102,695. Conversely, a strong push above 106,200 and 107,215, accompanied by volume, should accelerate a rally into 108,680 (VAH) and beyond.

Trade strategy and risk management

-

Bullish Entry (POC & 107,215 Break):

-

Entry trigger: 4-hour (or daily) candle closing above 106,200 with volume above the 20-period moving average, followed by a subsequent close above 107,215.

-

Stop loss: Place stop just below VWAP (around 105,000). A reversion below VWAP signals the bullish thesis is invalid.

-

Profit targets:

-

107,215 – 108,680 (first barrier; scale-out partial).

-

109,870 (second target; scale-down).

-

111,055 – 112,740 (final target range).

-

-

-

Bearish entry (break below 104,845):

-

Entry trigger: 4-hour (or daily) candle closing below 104,845 on increasing volume.

-

Stop loss: Just above VWAP (around 106,500).

-

Profit tTargets:

-

102,695 (secondary volume‐profile node; scale-out).

-

101,010 – 99,825 (next support range).

-

98,635 – 97,170 (final target area).

-

-

Conclusion

Bitcoin's June 2025 futures contract sits on a knife-edge. The 104,845 pivot (yellow VAL) remains the "line in the sand," backed up by the light-blue POC at 106,200. As long as bulls defend 104,845, they can attempt to reclaim the POC. Only a sustained break above 106,200 → 107,215 will confirm that demand is returning, opening the door for a run toward the pink VAH at 108,680 and, ultimately 112,740. Conversely, a failure below 104,845 risks a swift drop into 102,695 and possibly into the low-100,000 region or below. Traders should watch how price interacts with the VWAP, POC, and VAH—clear breakouts or breakdowns at these levels offer the most favourable risk-reward setups.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.