Bitcoin, Ethereum prices rally as US CPI inflation falls to 4.9%

- Bitcoin climbed above the $28,000 level and Ethereum inched closer to $1,900 in response to US Consumer Price Index data release.

- The US Bureau of Labor Statistics reported that inflation declined to 4.9% in April, against the market expectations of 5%.

- Technical expert behind tedtalksmacro has set a bullish target of $29,000 for BTC price.

Bitcoin price eyes the $29,000 target as US Consumer Price Index (CPI) came in at 4.9%, below market participant’s expectations of 5%. The largest asset by market capitalization rallied in response to the data release by the US Bureau of Labor Statistics (BLS).

Also read: Breaking: US CPI inflation data declines to 4.9% in April vs. 5% expected

Bitcoin price climbs above $28,000 with this macro catalyst

Bitcoin was trading sideways below the $28,000 level for nearly a week, in the absence of a catalyst. The US CPI release fueled Bitcoin’s breakout past $28,000, the asset is now climbing closer to resistance at $29,000.

The US CPI is considered a well-known indicator of inflation and change in prices paid by urban consumers over time. The CPI’s decline of 4.9% on a yearly basis in April 2023 was below market expectations of 5%, while CPI and Core CPI increased by 0.4%, matching the market analysts’ estimates.

BTC/USD 15-minute price chart

As seen in the price chart above, Bitcoin is currently in an uptrend and the asset hit a peak of $28,327 in response to the US CPI release for April 2023. BTC price experienced a pullback, however it has sustained above the $28,000 level, making it key support for Bitcoin.

With a US CPI release of 4.9%, technical experts at Tedtalksmacro have set a bullish target of $29,000 for Bitcoin.

CPI gameplan for #Bitcoin

— tedtalksmacro (@tedtalksmacro) May 10, 2023

Above 5.5% --> $25,000 (4% probability)

5.3% to 5.5%--> $26,500 (25% probability)

5.0% to 5.2% --> $28,500 (50% probability)

4.7% to 4.9% --> $29,000 (20% probability)

4.5% or lower --> $30,000+ (1% probability)

*Probabilities according to JPMorgan

In the case of Ethereum, the altcoin wiped out its losses since May 7, climbing past the $1,880 level in a bullish knee-jerk reaction by ETH traders.

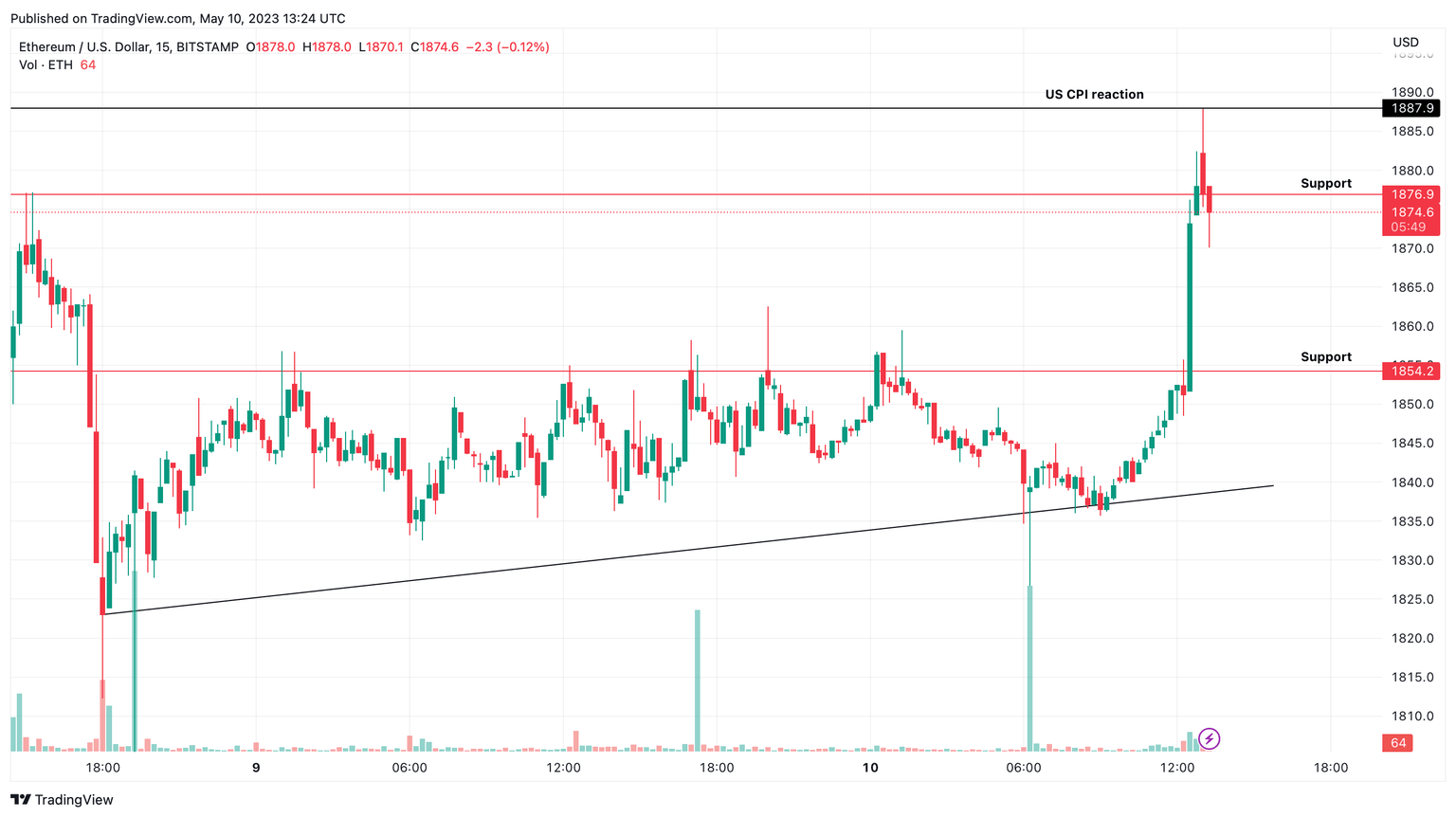

ETH/USD 15-minute price chart

Ethereum price climbed past $1,887, erasing losses since Monday, followed by a moderate pullback to support at $1,876. As long as Ethereum price sustains above the $1,850 level, the upward trend is intact. A decisive close below the trendline could invalidate the bullish thesis for Ethereum.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.