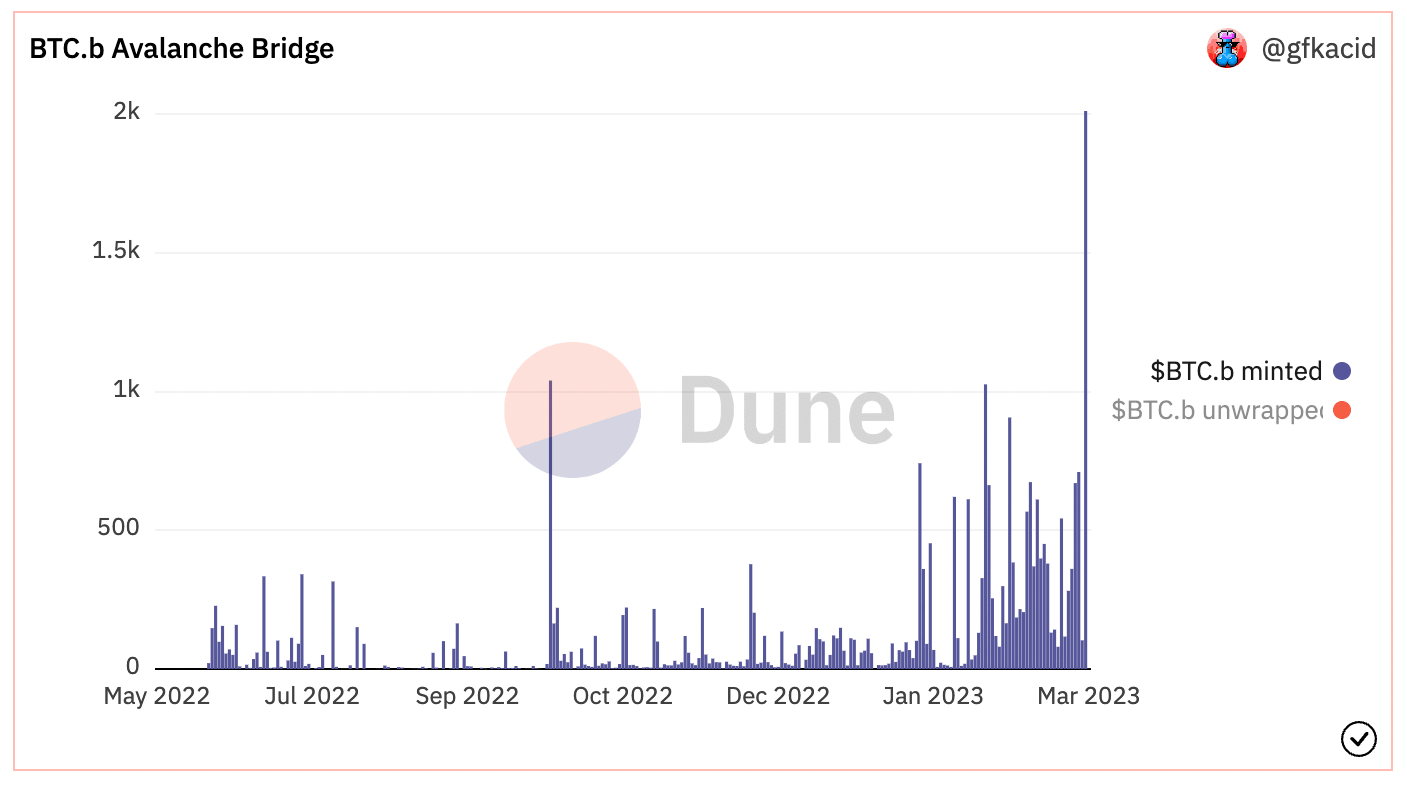

Bitcoin-bridged to Avalanche reaches record daily mint of over 2k BTC

Interest in bridging bitcoin (BTC) to the Avalanche smart contract blockchain (BTC.b) continues to swell as the supply of wrapped Bitcoin (wBTC), the largest wrapped version of bitcoin on Ethereum, dwindles.

On Thursday, over 2,000 BTC ($44 million) was ported to Avalanche, the largest single-day BTC.b mint on record, according to data sourced from pseudonymous analyst 0xAcid's dashboard on Dune Analytics. That has lifted the total circulating supply of BTC.b to 8,572.

According to 0xAcid, half of the bitcoin minted on Thursday has been moved to BENQI Finance. BENQI Finance is an Avalanche-based decentralized finance protocol, which allows users to lend, borrow and earn additional yields from digital assets.

In June 2022, Avalanche added support for bitcoin on its cross-chain bridge, allowing BTC holders to deploy their coins in the Avalanche-based decentralized finance (DeFi) ecosystem to generate extra yield. BTC.b has seen impressive growth since then, surpassing the number of coins held in the Lightning Network.

A crypto bridge is a tool that facilitates interactions between the two economically and technologically separate blockchains. Bridges became a target of hackers last year, accounting for about 70% of the total exploits in the crypto industry last year, according to forensics firm Chainalysis.

(Dune Analytics)

The record BTC.b mint comes as the WBTC supply fell by 15% to 153,164 in February, reaching the lowest since March 2021. Apparently, bankrupt crypto lender Celsius, a well-known WBTC holder, redeemed a large amount of WBTC, causing a sharp drop in the token's supply.

WBTC, issued by Bitgo, is an ERC-20 token based on the Ethereum network with its price pegged 1: with bitcoin. The token's supply peaked at 285,000 in April last year and has been falling ever since.

The Avalanche community considers BTC.b a better option than WBTC, considering Avalanche offers users the ability to mint and redeem BTC.b anytime with the bridge in a non-custodial browser extension Core, eliminating the need for intermediaries. It provides more control to users, unlike WBTC, which relies on merchants to initiate the process of minting and burning.

According to Emperor Osmo, an anonymous writer for Cosmos-based automated market maker Osmosis, the investors in AVAX, the native token of Avalanche, are yet to take notice of BTC's growing use in DeFI, as evidenced by BTC.b's rising supply.

"Over $200M of BTC has been bridged to Avalanche [to date]. The BTC DeFi narrative is definitely not priced in for AVAX," Osmo tweeted early Friday.

At press time, AVAX traded nearly 6% lower on the day, near $16, the lowest since Jan. 20. The cryptocurrency has seen a 50% appreciation in its market value this year, per CoinDesk data.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.