Binance Coin Price Prediction: BNB crashes 22%, but uptrend remains intact

- In the past 12 hours, Binance Coin price plummeted by 22% down to $116.

- BNB bulls bought the dip pushing the digital asset back up by 10%.

- The entire cryptocurrency market has suffered a brief crash losing $50 billion in market capitalization.

Earlier today, the entire cryptocurrency market experienced a brief crash and lost around $50 billion in market capitalization. However, the bulls quickly bought the dip. BNB hit a new all-time high at $148 and fell towards $116 before a recovery bounce to $126.

Binance Coin price aims for $150 despite pullback

Although this was a significant 22% correction, it should be considered healthy given the magnitude of the previous rally towards $148. There are several crucial on-chain metrics in favor of BNB.

BNB Holders Distribution chart

The number of whales holding between 10,000 and 100,000 BNB coins ($1,300,000 and $13,000,000) has increased by 10 in the past week. Similarly, smaller holders with 1,000 to 10,000 BNB have also been joining the network in the past week from 656 on February 3 to 667 currently.

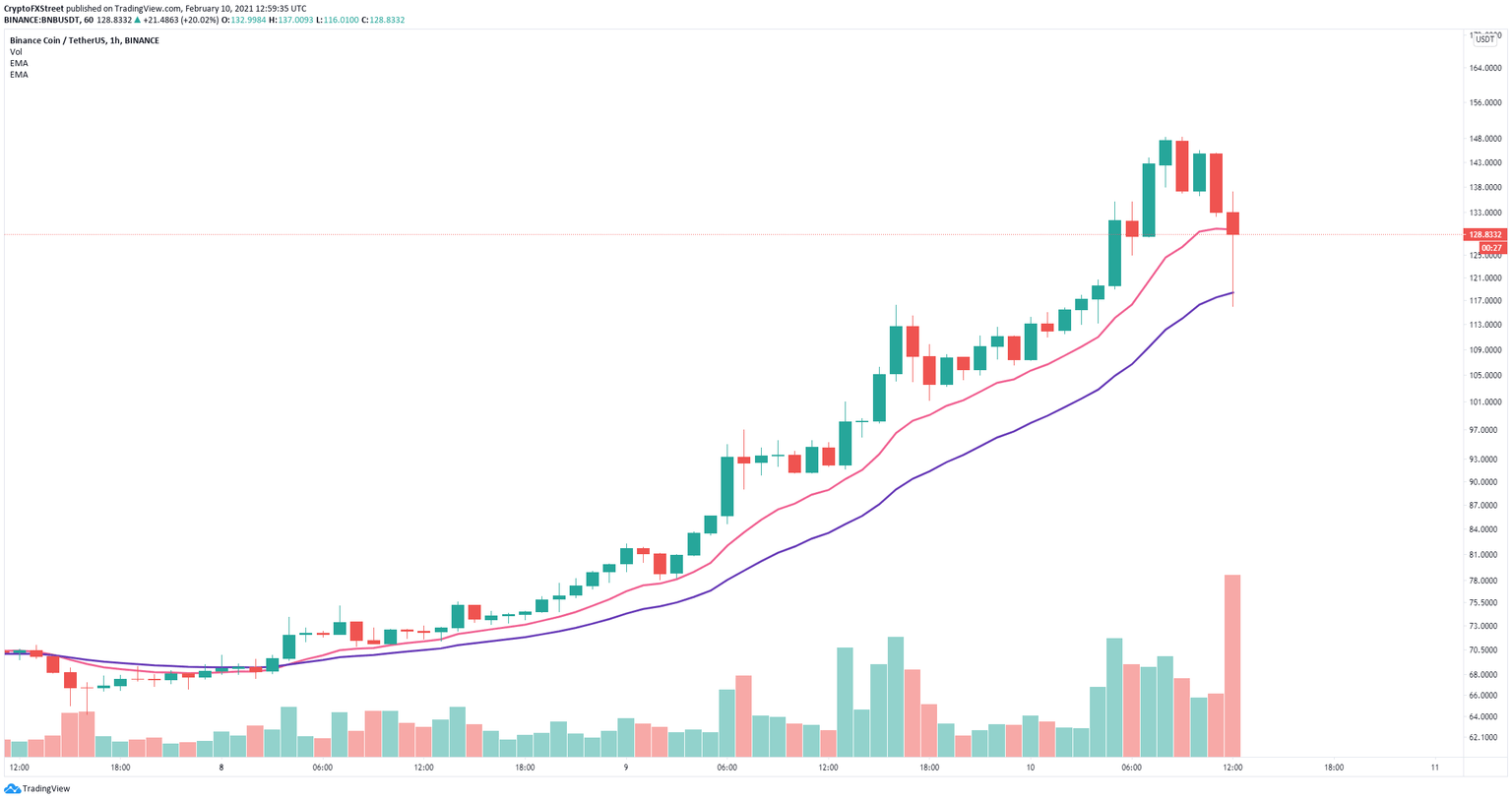

BNB/USD 1-hour chart

On the 1-hour chart, BNB bulls defended the 26-EMA support level located at $118 and are trying to push Binance Coin price above the 12-EMA at $130. If they succeed, BNB can quickly jump to its all-time high at $148 and eye up a breakout towards $150.

BNB/USD 1-hour chart

However, bears have managed to push Binance Coin price below an ascending parallel channel on the 1-hour chart. The bounce could simply be a re-test of the previous support level and transform into a continuation move towards $110.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.57.39%2C%252010%2520Feb%2C%25202021%5D-637485590252987520.png&w=1536&q=95)