Avalanche Price Prediction: Can Nasdaq’s latest ETF filing drive AVAX to $30?

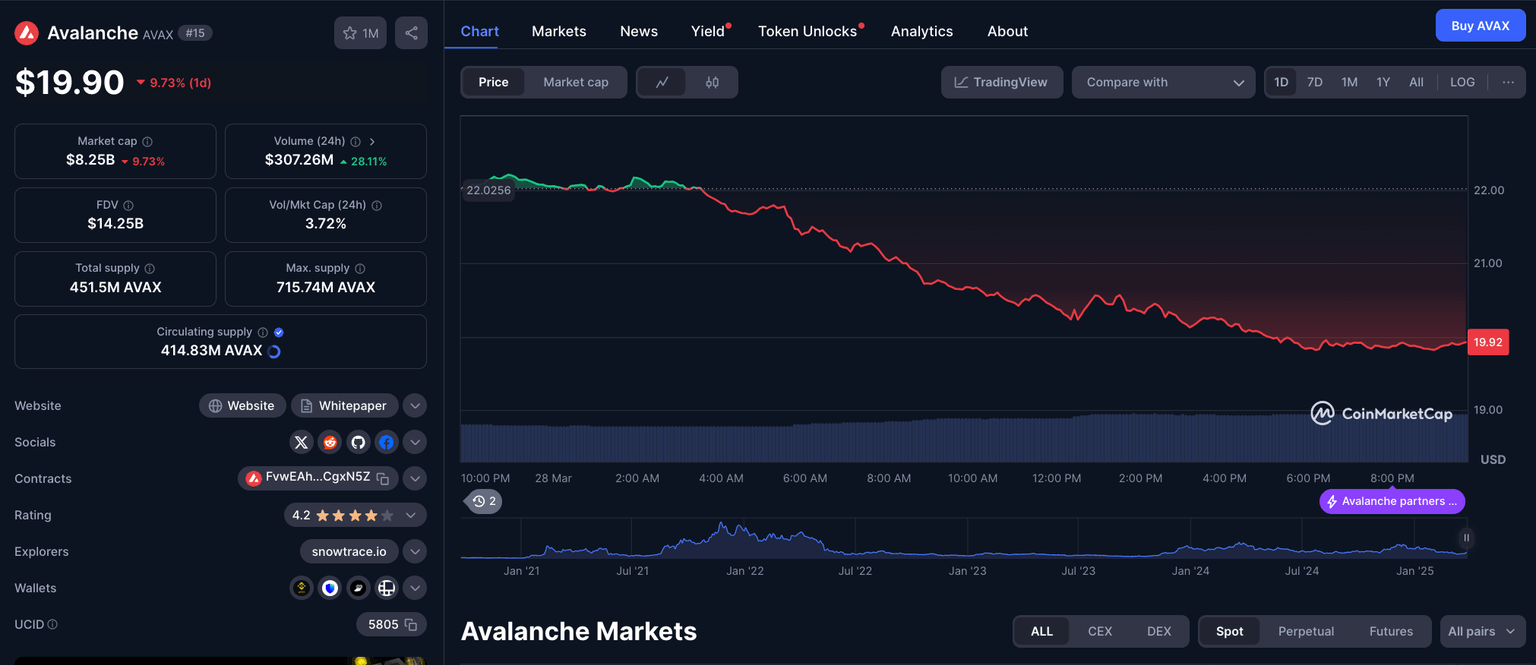

- Avalanche price fell toward the $20 support on Friday, down 8% in the last 24 hours.

- Nasdaq filed to list Canary Capital’s AVAX spot ETF, subject to US SEC approval.

- Bullish traders are weighing a potential rebound as AVAX's current support level aligns with the 50-day SMA.

AVAX finds crucial support at $20 amid market uncertainty

Avalanche (AVAX) has been under selling pressure in recent days, falling to the $20 support level on Friday, down 8% over the past 24 hours. The decline comes amid broader market uncertainty, with risk sentiment affecting the cryptocurrency sector.

Despite the downturn, AVAX’s resilience at the $20 mark suggests strong investor interest at this level.

Recent market events have contributed to the volatility, with macroeconomic concerns, regulatory developments, and liquidity shifts playing a role in crypto price movements.

While Bitcoin and Ethereum have also faced pullbacks, AVAX’s declining trading volume as price approached the $20 level suggests bulls could attempt to form a local bottom.

Nasdaq’s filing fuels institutional interest in Avalanche

In a significant development for Avalanche, Nasdaq has filed to list Canary Capital’s AVAX spot ETF, a move that could pave the way for greater institutional adoption.

The filing, which is currently subject to approval by the US Securities and Exchange Commission (SEC), represents a growing appetite for regulated investment vehicles that provide exposure to AVAX.

The proposed AVAX spot ETF follows the increasing trend of traditional financial institutions recognizing digital assets as a legitimate asset class.

If approved, this ETF would allow institutional investors to gain exposure to Avalanche without the need to directly hold or manage AVAX tokens.

This could lead to a surge in demand, similar to what has been observed with Bitcoin and Ethereum-based ETFs.

Market analysts suggest that the ETF listing could be a game-changer for Avalanche, potentially driving prices higher as institutional capital enters the ecosystem.

The timing of this development is particularly crucial, as it aligns with a broader push for crypto ETFs across major financial markets.

While short-term volatility remains a concern, the Nasdaq filing signals institutional confidence in Avalanche’s long-term potential.

AVAX price forecast: Losing $20 support could present buying opportunity

AVAX price is teetering near the $20 support level, a crucial support that could dictate its next major move.

The 12-hour chart reveals a notable 8.40% decline, with AVAX currently trading at $20.17.

The red candlesticks confirm bearish momentum, while the 50-day SMA at $19.74 serves as the immediate support.

If this level fails, the next logical downside target sits near $18, where a stronger demand zone could spark a rebound.

AVAX price forecast

However, the Moving Average Convergence Divergence (MACD) indicator suggests a complex picture.

While it remains in positive territory, the MACD line (blue) is showing signs of rolling over, nearing a bearish crossover with the signal line (orange).

A confirmed cross would amplify selling pressure, potentially invalidating near-term bullish expectations.

Conversely, if bulls defend $20 and push AVAX above the 21.99 SMA, a relief rally toward $23 could unfold.

Volume analysis, with 828,220 AVAX traded, indicates heightened market activity. A decisive move in either direction hinges on whether AVAX holds above key support or succumbs to bearish pressure, presenting a strategic entry point for traders.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.