Avalanche Price Forecast: AVAX eyes breakout rally amid Bitwise ETF filing, DEX volume surge

- Avalanche edges lower on Tuesday, facing headwinds at the $30 level.

- Bitwise filed an S-1 form with the SEC for an AVAX ETF on Monday.

- The on-chain data suggest increased activity over the Avalanche ecosystem.

Avalanche (AVAX) price edges lower by 1% at press time on Tuesday, extending the struggle near the $30 mark. Bitwise is preparing to launch for the AVAX Exchange Traded Fund (ETF) with the S-1 form filed with the US Securities and Exchange Commission (SEC), tilting the scales bullish. The on-chain data and technical outlook indicate that optimism is heightened, supporting the chances of a potential breakout rally.

Bitwise files for AVAX ETF

Bitwise submits an S-1 filing to the SEC on Monday, aiming to expand its crypto-focused ETF portfolio with an Avalanche ETF. With this filing, Bitwise joins the race for the AVAX ETF with VanEck, 21Shares, and Grayscale. The altcoin fund could tap into the rising demand among US investors, fueling a potential uptrend similar to Bitcoin and Ethereum.

Activity rises across the Avalanche ecosystem

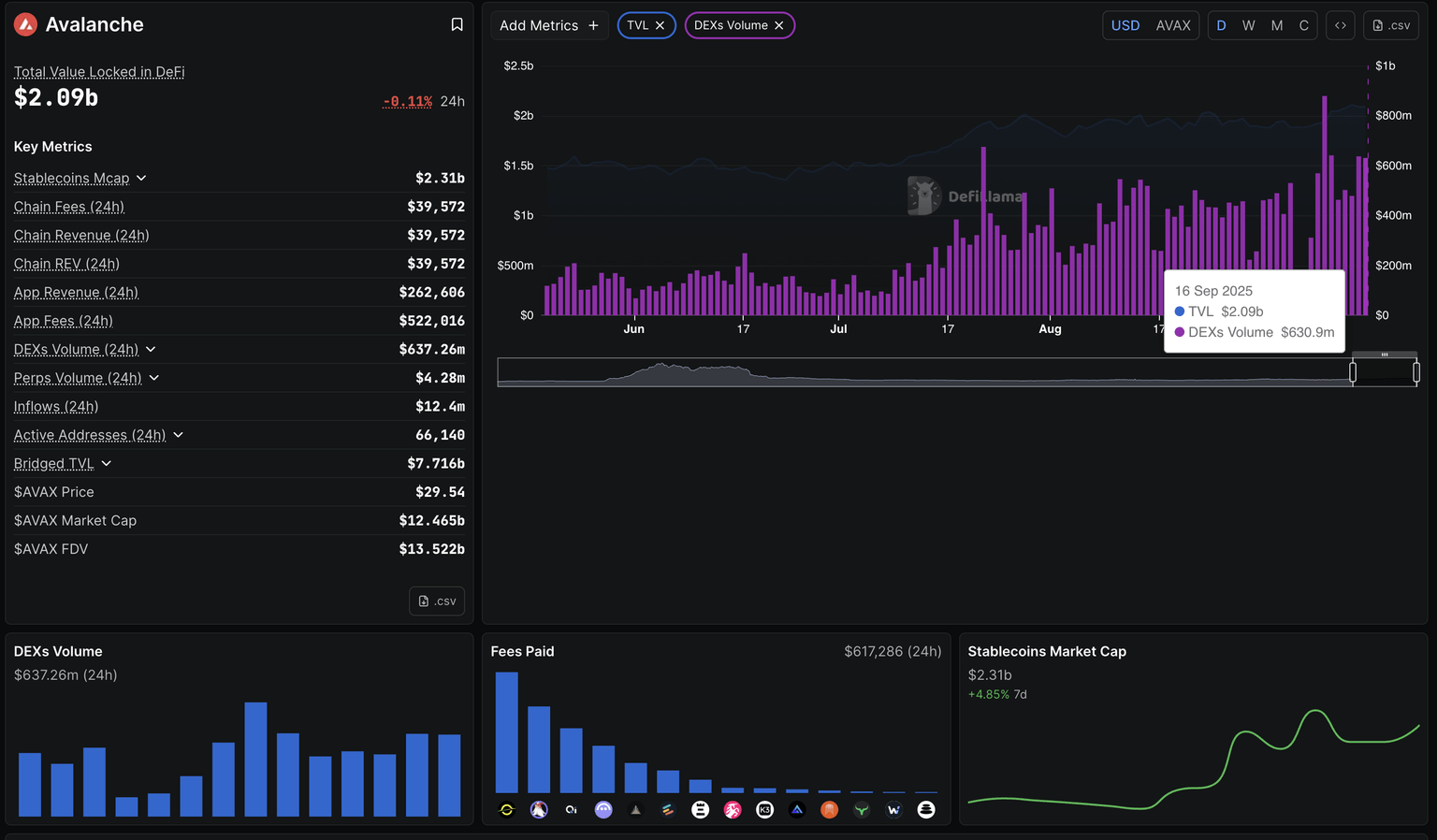

DeFiLlama data shows that the Total Value Locked (TVL) on the Avalanche ecosystem stands at $2.09 billion, up from $1.925 billion in the last week. This increase in digital assets allocated over the network suggests that the user activity has significantly increased.

Adding to the increased activity, the Decentralized Exchange (DEX) volume sustains over $2 billion for the eighth consecutive week alongside a near 5% rise in Stablecoin market capitalization to $2.31 billion. This rise in liquidity and activity over the Avalanche ecosystem could translate into heightened demand for its token, AVAX.

Avalanche DeFi metrics. Source: DeFiLlama

Avalanche eyes $30 breakout to extend gains

Avalanche struggles to mark a decisive close above the $30.37 mark, which aligns with the 38.2% Fibonacci retracement level, drawn from the $55.79 high on December 4 to the $14.66 low on April 7. The investors’ mood remains largely unaffected by the Bitwise Avalanche ETF S-1 filing as the intraday pullback deepens.

If AVAX surfaces above the $30.37 level, it could extend the rally to the 50% retracement level at $35.22.

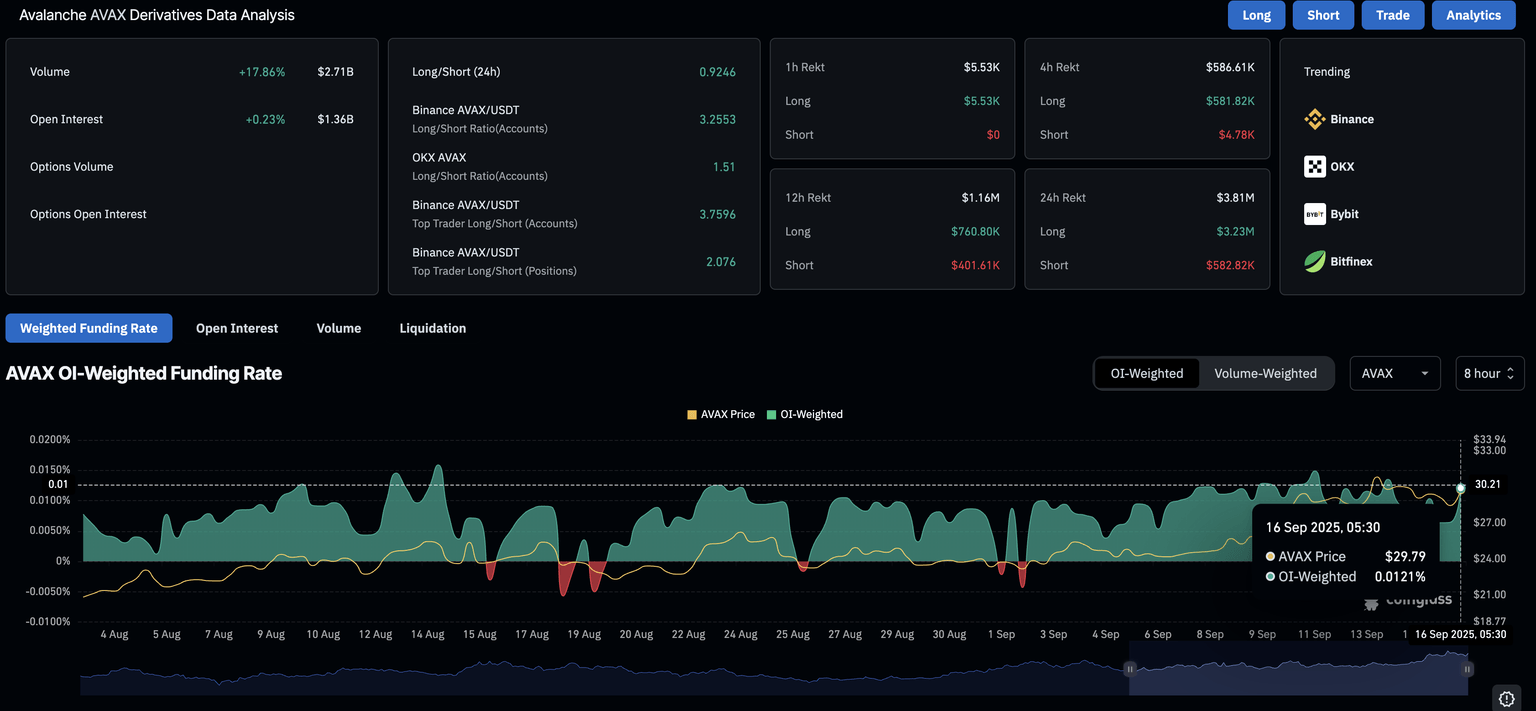

Still, the CoinGlass data shows a minor increase in AVAX Open Interest (OI) reaching $1.36 billion, suggesting increased capital inflows as investors anticipate further gains.

Adding to the optimism, the OI-weighted funding rate jumps to 0.0121%, from 0.0064% on Monday. This indicates a rise in buying activity as bulls pay the premium to balance the swap and spot prices.

AVAX Open Interest. Source: CoinGlass

The Relative Strength Index (RSI) reverts from the overbought zone to 64 on the daily chart, suggesting that the buying pressure is cooling off. Still, the RSI holding above the halfway line indicates a bullish tilt.

Additionally, the Moving Average Convergence Divergence (MACD) floats above its signal line, indicating a bullish trend in motion.

AVAX/USDT daily price chart.

Looking down, if the pullback intensifies, AVAX could test the 50-day Exponential Moving Average (EMA) at $25.13.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.