Arbitrum price could double with ease as AI partnership with Skynet sparks $23M inflows

- Arbitrum price rose 12% on Wednesday, mirroring the broader crypto market recovery.

- ARB gains accelerated after Skynet confirmed the launch of an AI-optimized Layer 3 blockchain on Arbitrum Orbit.

- Within hours, Arbitrum open interest increased 22%, adding $23 million to hit $113 million.

- ARB is forming a falling wedge technical pattern, highlighting $2.8 as a viable long-term price target.

Arbitrum price rose 10% on Wednesday, as Bitcoin led the market recovery on news that President Trump could roll back tariffs imposed on Canada and Mexico this week. Derivative trending signals show traders reacting positively to Arbitrum’s latest Skynet partnership. Could this drive ARB into a 600% rally?

Why is the Arbitrum price going higher ?

Arbitrum (ARB) posted gains exceeding the broader market average on Wednesday as two critical market events formed bullish catalysts.

Firstly, speculations that Trump could ease the 25% tariffs imposed on Mexico and Canada lifted investors sentiment across global financial markets.

Secondly, the Skynet team confirmed the launch of an AI-optimized Layer 3 blockchain on Arbitrum Orbit.

Arbitrum (ARB) Price Action | March 5

According to the team’s announcement, Skynet needed a blockchain that could do what no L2 or existing rollup could handle—process AI-driven microtransactions at an extreme scale while keeping fees predictable and low.

Skynet’s blockchain is designed for a future where every human can own a swarm of AI agents, each with its own identity, while ensuring user privacy and security. — This is the infrastructure that will power the AI-driven economy.” — Vishnu Korde, Founder, Skynet.

Positive reactions to these two vital news events lifted Arbitrum into a 12% rally.

As depicted above, ARB price rose from $0.38 to hit $0.42 at press time, outperforming the likes of ETH, SOL, and XRP, which were all restricted to single digit gains on the day.

$23 million capital inflows from ARB speculative traders could spark more gains

The dual impact of Trump’s tariff rollback plans and Arbitrum’s AI partnership with Skynet saw ARB rally 12% on Wednesday.

However, derivatives data suggests that the uptrend may continue as capital floods into speculative markets.

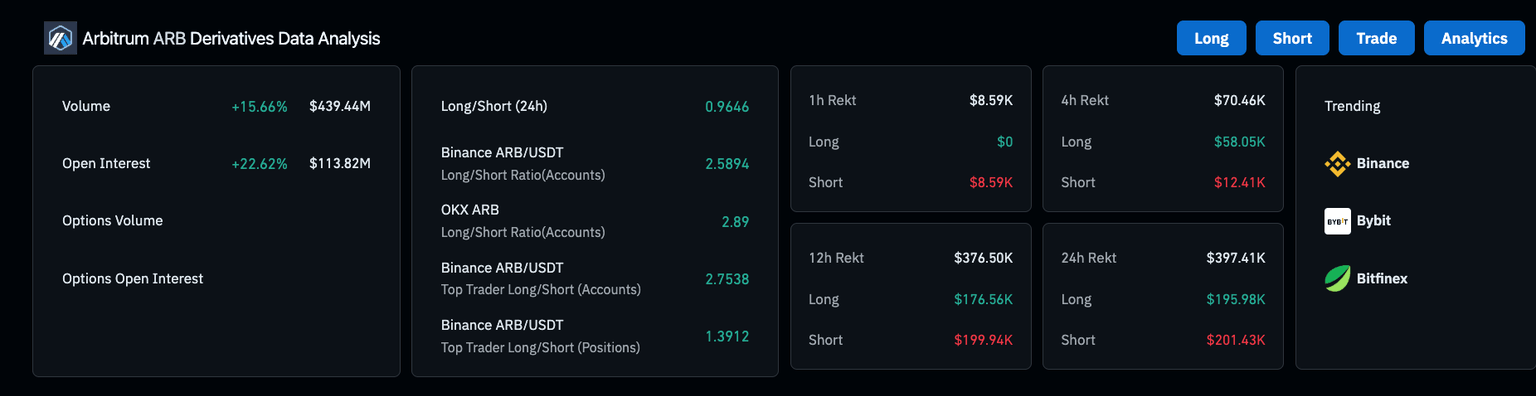

Within hours, Arbitrum’s open interest surged by 22.62%, adding $23 million to push the total to $113.82 million.

This increase exceeded the 15.66% rise in trading volume, which reached $439.44 million.

Arbitrum Derivatives trading metrics, March 5 | Source: Coinglass

Open interest growth outpacing trading volumes suggests traders are committing to leveraged positions rather than simply rotating capital, a bullish signal indicating strong conviction in ARB’s price momentum.

Additional data supports this optimistic outlook.

The Binance ARB/USDT long-short ratio among accounts stands at 2.5894, while OKX traders are even more bullish at 2.89.

Top traders on Binance also reflect a strong leaning toward longs, with a 2.7538 long-short ratio.

While liquidation events are moderate, with $376.50K wiped out in 12 hours, the split between long and short liquidations remains balanced, preventing a cascade of forced selling.

These figures suggest that traders are positioning for more upside, increasing the likelihood of sustained gains for ARB.

Arbitrum price forecast: Falling Wedge pattern hints AI integration could spark 600% gains

Arbitrum (ARB) is showing early signs of a bullish reversal as the price breaks out of a falling wedge formation.

The breakout above $0.42 signals a potential upside continuation, with the falling wedge structure hinting at a long-term price target of $2.80.

This bullish technical pattern is often characterized by declining resistance and converging support, creating a setup for explosive breakouts.

Volume analysis supports the bullish thesis, with volume delta flipping positive at 17.9 million, marking the strongest buying pressure in weeks.

The recent surge in trading volume suggests fresh demand, reinforcing the breakout’s credibility.

While the 600% breakout towards $2.8 remains unlikely in the near-term, rising trading volume signals a potential retest of the $0.50 psychological resistance in the coming trading sessions.

The MACD indicator is also turning bullish, with the MACD line (blue) attempting to cross above the signal line (orange).

A confirmed crossover would indicate a shift in trend strength, providing further confluence for a sustained recovery.

However, if the MACD breakout attempt fails, a pullback toward $0.38 remains possible.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.