ARB holders' skepticism impedes Arbitrum price recovery, could result in 18% decline

- Arbitrum price could decline further if ARB falls through the support line at $1.068.

- The lack of sustained recovery and incentive has led to the altcoin losing traction among investors.

- On the DeFi front, the L2 chain has also been losing investment, with the total value locked declining to $2.38 billion in the last two weeks.

Arbitrum price has noted a disappointing series of candlesticks, with the altcoin trending downwards with each passing day. As the layer-2 chain's native token continues to lose ground, it is also losing its investors' confidence, evident in the overall network changes.

Arbitrum price needs to recover soon

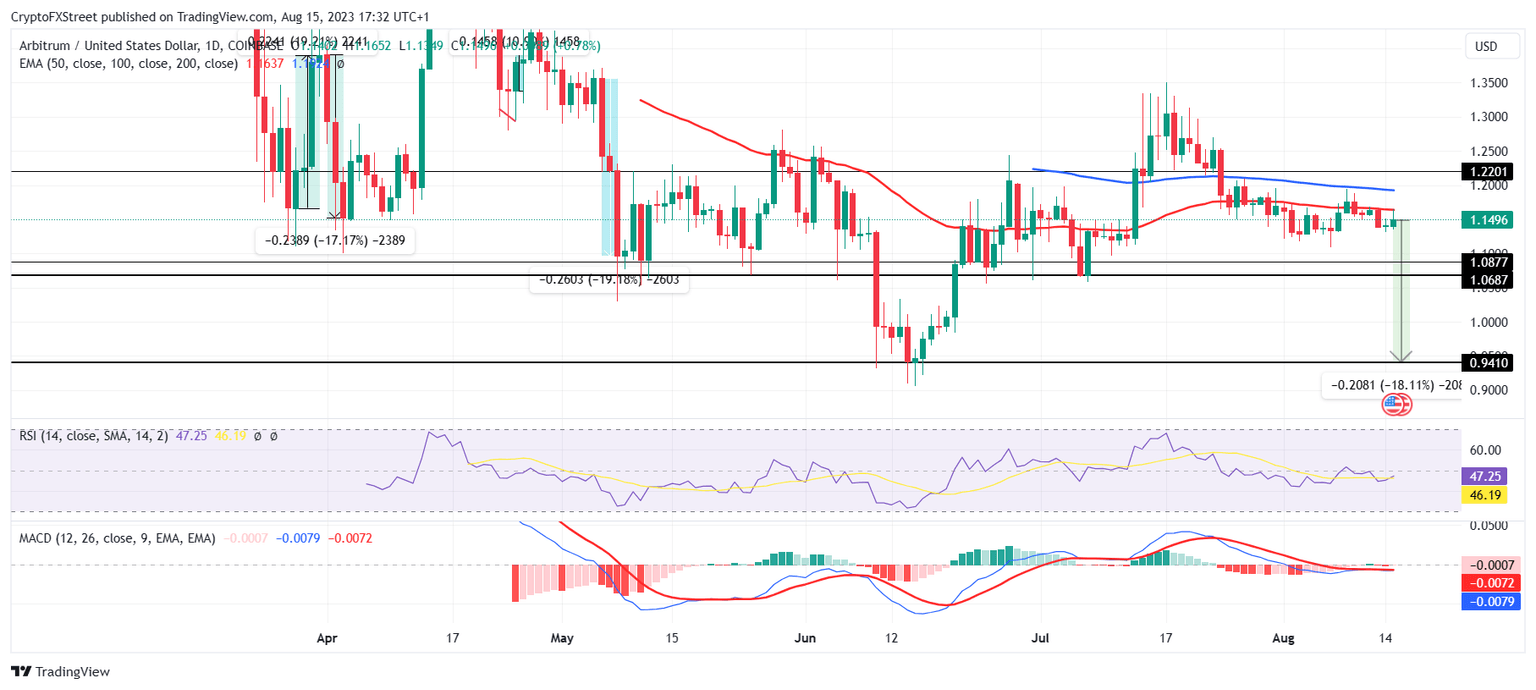

Arbitrum price trading at $1.14 fell under the 50-day Exponential Moving Average (EMA) at the beginning of August. Since then, the potential for recovery has been waning, with the price indicators building a bearish momentum.

The Relative Strength Index (RSI) is sitting below the neutral line of 50.0, and as it lingers there, a rally is unlikely. Additionally, the Moving Average Convergence Divergence (MACD) indicator also favoring a bearish crossover as the signal line (red) continues to dominate the MACD line (blue).

ARB/USD 1-day chart

But beyond technical indicators, the investors have created a bearish environment for the altcoin. Over the past few weeks, the slow recovery has discouraged new investors from joining the network, resulting in the network strength taking a hit.

The metric measures the rate at which addresses are formed on the chain to provide a consensus on whether the project is gaining or losing traction. And in the case of Arbitrum, it is the latter at the moment. As long as the price keeps sliding lower, new investors will refrain from joining Arbitrum, resulting in a decline in ARB.

Arbitrum network strength

But beyond the investors, the protocols running on the Ethereum L2 solution have also been losing the money invested in them. The total value locked (TVL) on the Decentralized Finance (DeFi) network has declined by over 6% in the last two weeks, falling to $2.38 billion. While it is still among the top five biggest chains in the world, it has close to 13% of the total TVL in the past 30 days.

Arbitrum DeFi TVL

Thus, if the bearish woes emerge stronger, it could lead to Arbitrum price declining and testing the support levels at $1.08 and $1.06. Breaking below the latter would push the price to June lows of $0.94, resulting in an 18% crash.

However, if the cryptocurrency breaches the 50-day EMA and tests the $1.22 resistance as support, it could rally to recover the recent losses.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B22.02.39%2C%252015%2520Aug%2C%25202023%5D-638277268947209787.png&w=1536&q=95)