Analysts debate Bitcoin’s next step after today’s $45.5K retest

BTC finally hit the projected $45,000 support zone, but analysts have mixed views on whether continuation or consolidation will be the next step.

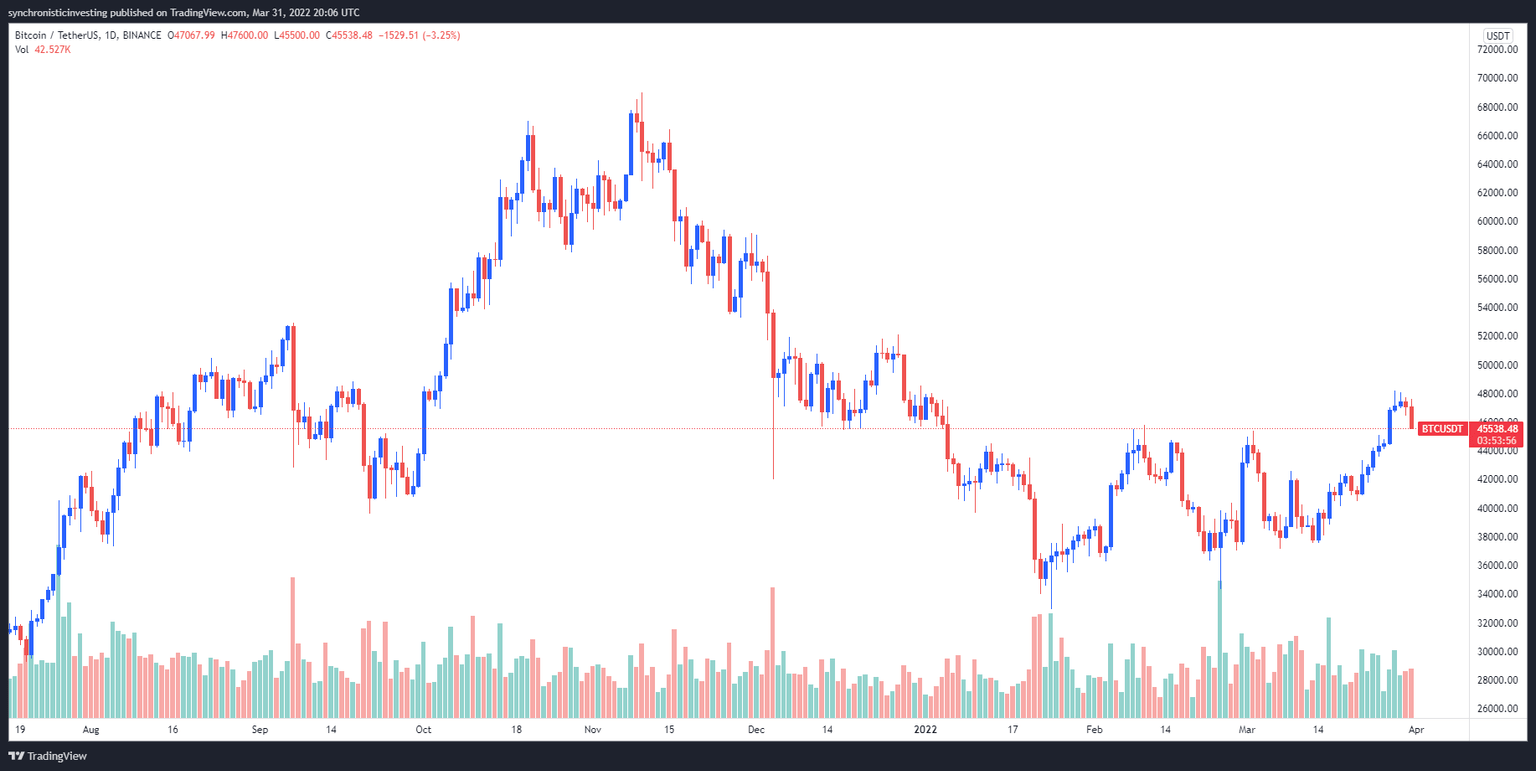

The euphoric calls for a return of the bull market may have been a bit early especially after Bitcoin (BTC) bulls failed to push the price over the $46,000 level on March 31. Even with the current pullback, analysts continue to expect a lower support retest at the $45,000 level.

Data from Cointelegraph Markets Pro and TradingView shows that today's attempt to push the price of BTC above $47,500 was soundly rejected by bears which sent the top cryptocurrency plunging to $45,500.

BTC/USDT 1-day chart. Source: TradingView

Here’s a look at what several analysts in the market are saying about the price pullback for BTC and whether or not traders should brace for further losses or prepare for another move higher.

This is just a short term correction

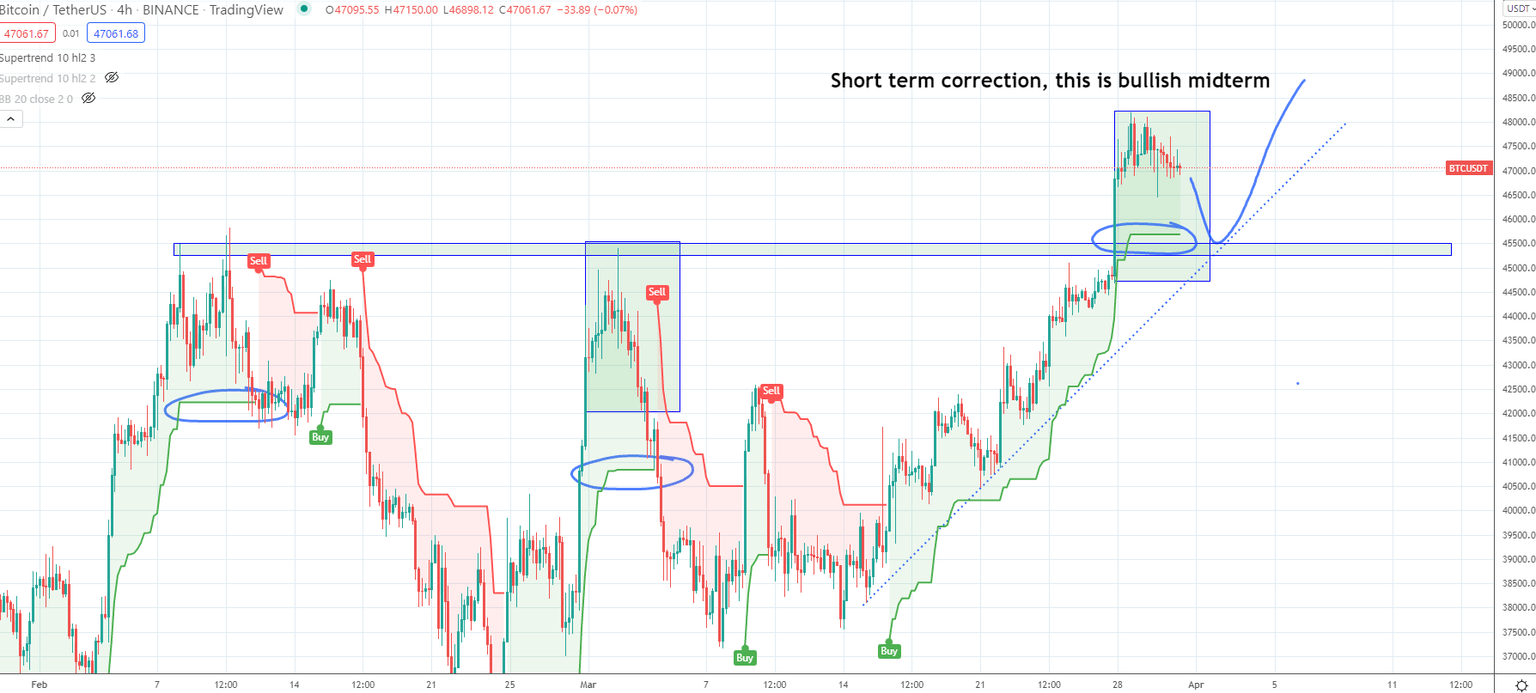

Not all traders were caught flat-footed by Thursday's move lower in Bitcoin, including market analyst and pseudonymous Twitter user ‘IncomeSharks’, who posted the following chart prior to the price drop noting that the “4h looks like it wants to correct a bit.”

BTC/USDT 4-hour chart. Source: Twitter

IncomeSharks said,

This is not me being bearish, I'm just noticing 3 reasons why a little correction makes sense. Supertrend is going flat, we probably will re-test this breakout, and we can bounce at the trend line. Good time for me to take profits.

BTC searches for support between $42,000 and $45,000

The next available levels of support to keep an eye on were discussed by market analyst and economist Caleb Franzen, who posted the following chart showing the 21-day, 55-day and 200-day exponential moving averages (EMA) for Bitcoin stating, “Sometimes it's helpful to cut out all the noise, remove price structure analysis, and just look at the exponential moving averages.”

BTC/USD 1-day chart. Source: Twitter

Franzen said,

All are potential support for Bitcoin, giving us a range of $42,000 - $45,000.

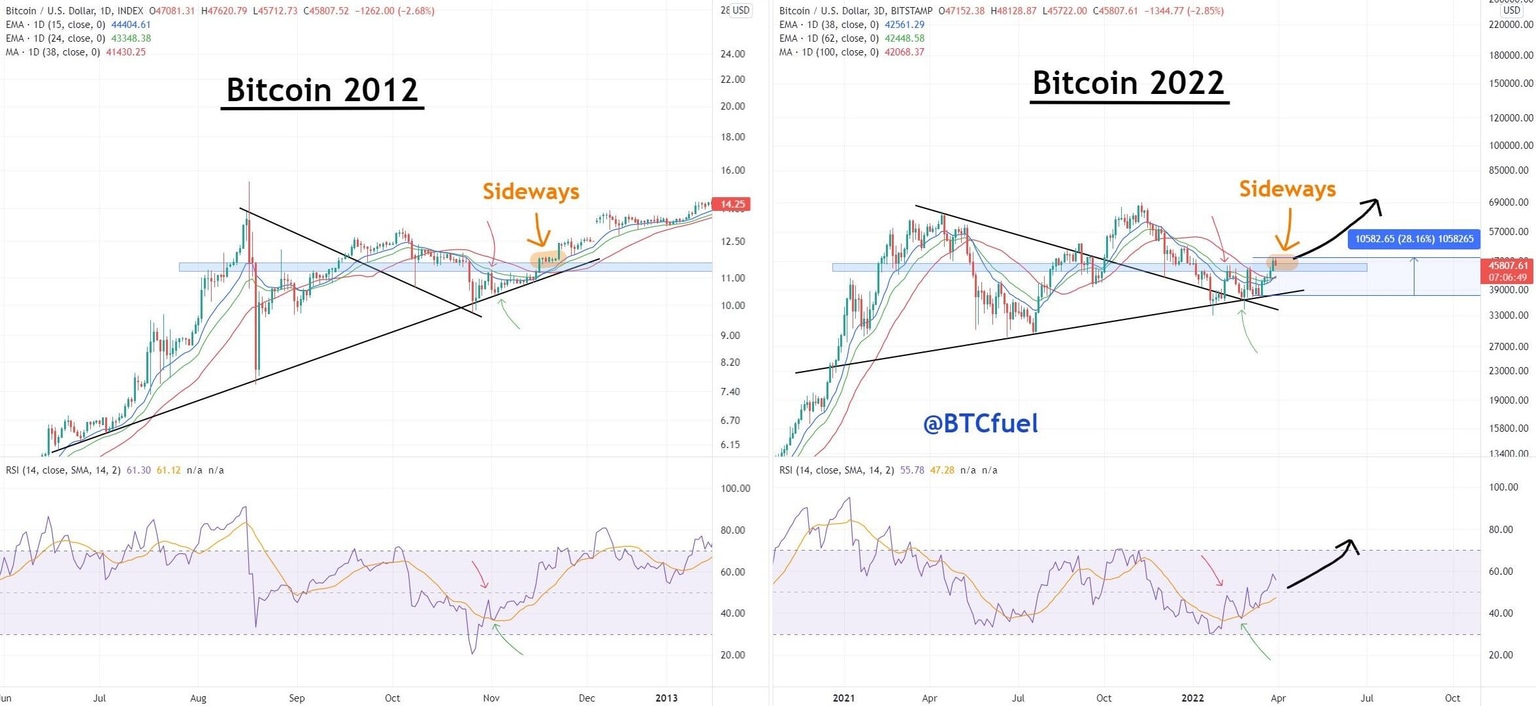

A necessary period of sideways consolidation

A more macro view on what comes next for Bitcoin was provided by analyst and pseudonymous Twitter user ‘BTCFuel’, who posted the following chart comparing the BTC price action in 2012 to its current movement and suggested that “after being up 28% in the last 2 weeks and breaking a major resistance, some sideways consolidation should be good for Bitcoin.”

BTC/USD price in 2012 vs. BTC/USD price in 2022. Source: Twitter

BTCFuel said,

In the next months, I believe that Bitcoin will move slow and steadily up like in 2012. But altcoins will go nuts.

The overall cryptocurrency market cap now stands at $2.087 trillion and Bitcoin’s dominance rate is 41.6%.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.