Analysis: Should I buy Ethereum, Chainlink or Zap?

As with all types of trading, timing is crucial when it comes to maximizing your returns in the crypto market. Many investors are still betting big on Bitcoin, as they believe it has plenty of upside potential despite it reaching an all-time high of almost $64,000 last month.

Ethereum is another increasing popular cryptocurrency among investors, with many selling some or all of their Bitcoin to invest in Ether as they believe it has more potential to appreciate over the coming months and years.

Another much smaller altcoin that is worth considering is ZAP; it’s currently trading around the $0.13 mark, and it arguably has much greater potential than BTC, ETH and Chainlink (LINK), as we’ll discuss in this article.

ZAP technical analysis: Price steadies as market awaits breakout, ZAP/USD rally in view

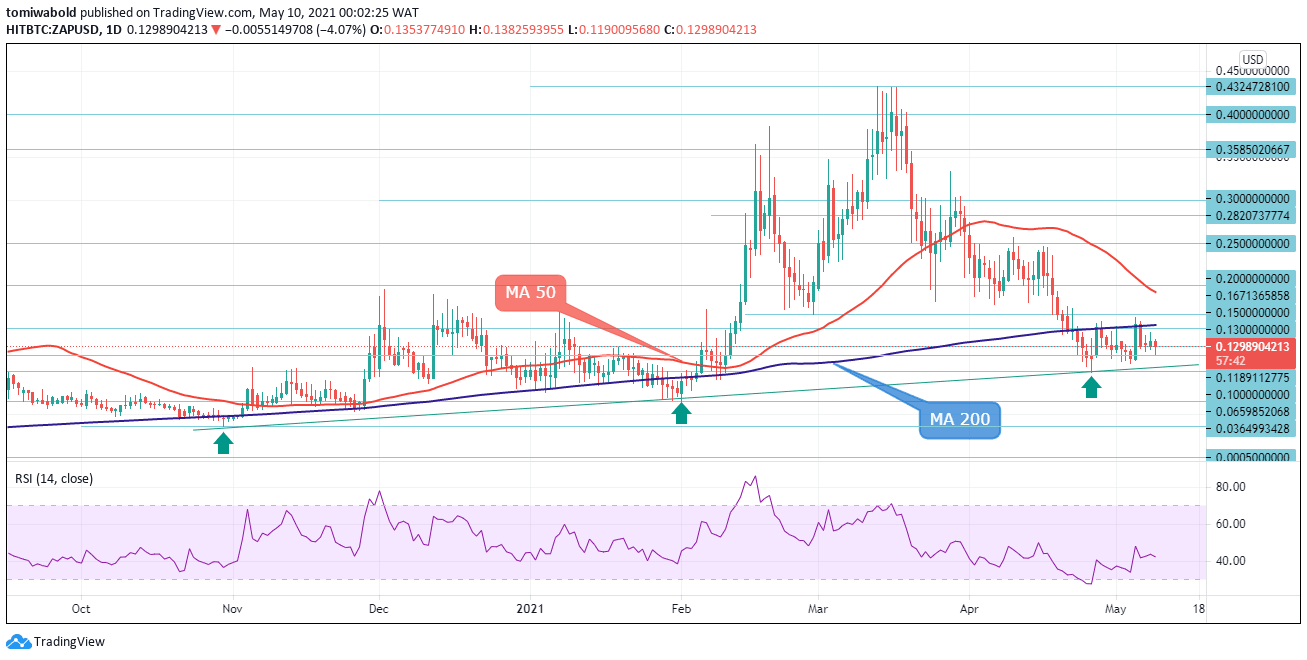

ZAP/USD Daily Chart

The ZAP market is buzzing and is poised for a strong upside correction amid a recent slide to a $0.10 low. After an impressive run on May 5 from $0.1134 to $0.1629 showed that the ZAP/USD recovery is gaining momentum by breaching the moving average (MA 200), market forces have realigned for the upcoming surge. Its price showed some broad strength on Saturday to $0.1457, and ZAP/USD fell briefly to the $0.1189 support level.

This is another indication of coming bullish pressures, as the ZAP/USD continues to range and gather momentum at a fast pace. A print above the moving average (200) barrier is certainly achievable in the short term and would provide ammunition to flip the $0.15 key zone as support. The relative strength index (RSI) is hovering within its midlines and the price steadies as the market awaits a breakout higher. A ZAP/USD rally remains in view.

With regards to ZAP’s longer term potential, given its strong use cases and similarities yet key differences to Chainlink – which is currently trading around the $49 mark – it’s not inconceivable for it to hit a similar price in the next 12-24 months and thereby deliver truly astronomical returns.

LINK price analysis: Price reaches all-time highs, signaling a bearish correction in the near term

LINK/USD Daily Chart

Chainlink (LINK) recently reached a new all-time high of $52.99, breaking through the $50.00-$45.00 consolidation zone. The technical indicators appear to be overbought, with the RSI flattening in the positive zone and the trigger line posting a bearish step in the strong bullish region below 70, indicating potential near-term downside pressures.

A downside reversal could find immediate support at the confluence area between $50.00 and $45.00, while a range slightly lower could be a critical zone for the bears. If the latter fails to stop the bearish trend, the next goal may be the $40.00 round number, which was derived from the inside swing past the moving average (MA 50).

Despite this rather bearish short-term technical analysis, many investors remain bullish on Chainlink and this token has seen capital inflows in recent months.

ETH technical analysis: Upside run nears overbought zone as price awaits correction lower

ETH/USD Daily Chart

Bulls are taking a breather on ETH/USD, following an upside run since late April which peaked at $3,984 on May 9. The overbought daily RSI and easing bullish momentum suggest a price correction could be on the horizon, before the bullish run resumes.

ETH has failed to clear the $4000 resistance level and started a downside correction, declining to lows of $3,726.

Should the market extend losses, support could be met between the $3,381 to $3,166 range and the $2,646 barrier. Slightly lower, the MA 50, which is currently at $2,374 could be a crucial line to break, while a significant leg below this area could send prices towards the $2000 psychological level. On the contrary, ETH/USD bulls may face headwinds from the $4000 psychological level ahead of the $4,500 and $5000 levels.

Several prominent crypto investors and analysts have said they believe ETH will hit $10,000 before the end of the year, and if Ethereum can continue to gather momentum and get more traction in the traditional financial markets, this target looks well within reach.

In conclusion

Ethereum is quickly becoming the crypto investment of choice, with a lot of capital flowing from Bitcoin to the world’s second-largest cryptocurrency by market cap. Chainlink is also gaining popularity, though its price may fall in the short term.

While trading at $0.13, ZAP demonstrates huge potential, as it is likely to reach a similar price to Chainlink in the future and will almost certainly experience a sharp bump in price once it is added to more exchanges with many users and good liquidity, such as the likes of Coinbase and Binance.

All three of these cryptocurrencies have plenty of potential – and holding a mixture of them is a smart strategy, though Ethereum may suffer some losses in the very short term due to market consolidation.

How to buy ETH, LINK or ZAP

Buying crypto is a fairly simple process nowadays, especially when it comes to major coins like Ethereum which are listed on virtually every crypto exchange in operation.

As for ZAP, it’s currently traded on just a handful of exchanges, with Bitrue having the most liquidity for this particular coin. However, the process remains the same, just with the addition of an extra step; you simply need to make an account with this exchange, deposit funds, purchase BTC or USDT, and then exchange this for ZAP at the market-clearing rate.

When purchasing LINK or ETH, you can immediately exchange your fiat for crypto without having to use another coin as an intermediary.

Author

Tomiwabold Olajide

FX Instructor

Tomiwabold is a forex trader and cryptocurrency analyst. A technical analyst, as well as an experienced fund manager, he has also co-authored several books on Forex trading.