Altcoins signal buy after taking it ‘on the chin’ since March

Altcoins with market capitalizations under $10 billion may be gearing up to present “some opportunities” for investors as they’ve traded down since Bitcoin hit a new high earlier in 2024.

“Smaller cap crypto assets have been taking it on the chin since March high of this year,” RealVision chief crypto analyst Jamie Coutts wrote in a June 13 X post.

Bitcoin (BTC $66,898) hit an all-time high of $73,679 on March 13 — but over the past week, it slumped nearly 6% to $67,126, according to Cointelegraph Markets Pro.

“If this is a regular mid-cycle correction we are experiencing, which I believe is likely, then expect some opportunities to be had in the mid and small caps once the market settles,” Coutts added.

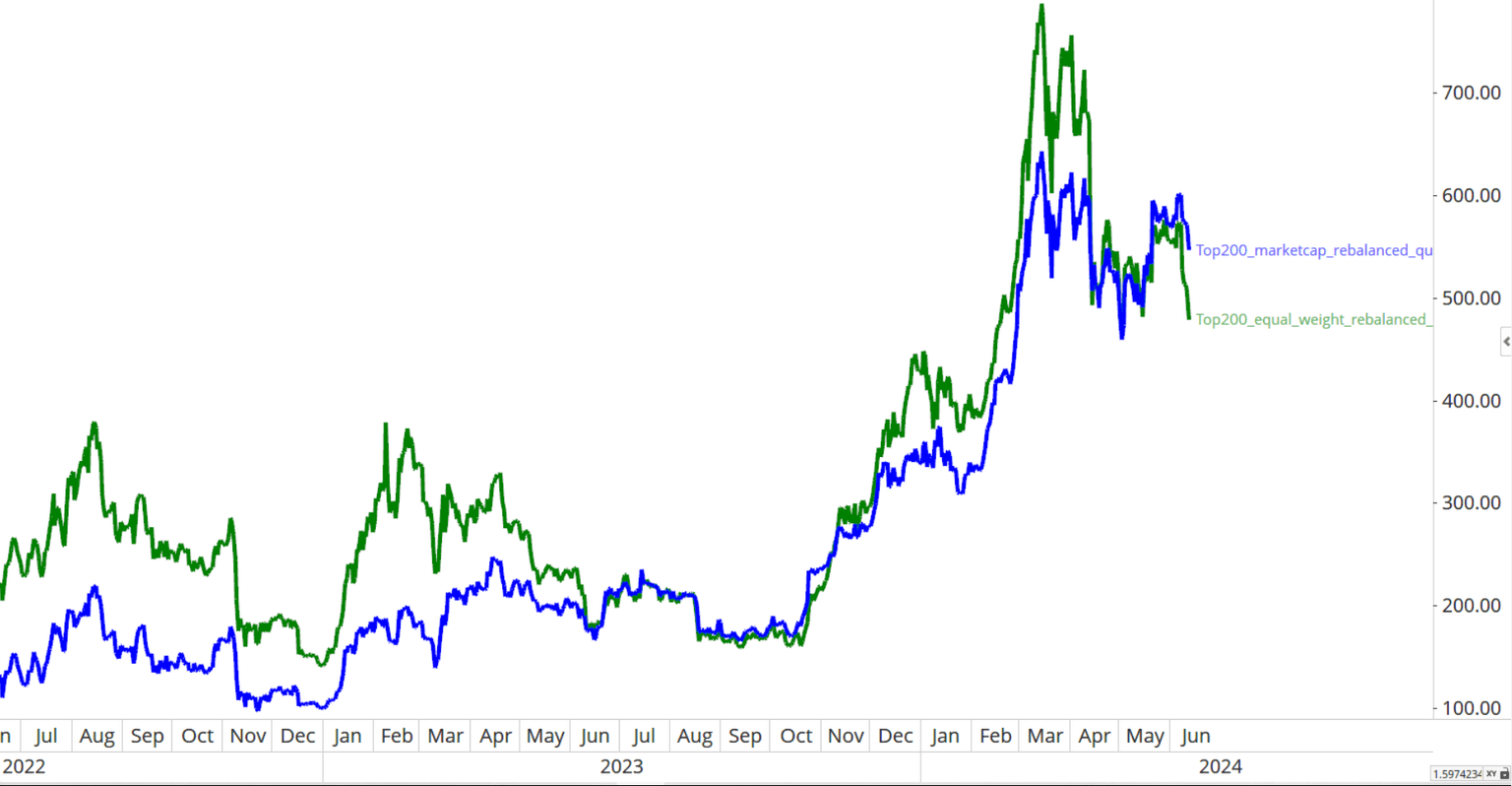

The equal weight balance fell 33% against the market cap index. Source: Jamie Coutts

Crypto tracking data from Bitformance shows that in the past three months, the top 200 equal weight index — assigning weight equally to cryptocurrencies irrespective of market cap — fell over 30% against the market cap index, where cryptocurrencies are weighted based on their market capitalization.

The fall indicates that smaller cryptocurrencies have shown weaker performance against larger cryptocurrencies that dominate the market cap index.

Meanwhile, Coutts pointed out that Bitcoin and Ether (ETH $3,516) only experienced respective declines of 11% and 5% over the same three-month period.

Bitcoin is down 6.10% over the past seven days. Source: CoinMarketCap

He added that metaverse-related tokens recorded the lowest returns within the index over the past three months, with a negative 44.13% return.

In the under $1 billion market cap category, metaverse tokens The Sandbox (SAND $0.40) and Decentraland (MANA $0.40) have both declined by over 15% in the past week, according to CoinGecko.

It comes as institutional interest beyond Bitcoin and Ether continues to grow.

On June 6, Franklin Templeton said it is exploring a new crypto fund for institutional investors to gain exposure to altcoins.

The asset manager didn’t mention which altcoins would make up the fund’s basket, but it did recently heap praise on the Solana network.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.