Alpha Finance Lab (ALPHA) rallies 50% as project fundamentals improve

ALPHA price turned bullish shortly after the project introduced staking, simplified farming options and a launchpad for new blockchain projects.

Bitcoin (BTC) price continues to trade in a predictable range which has given traders confidence in trading altcoins and DeFi tokens. This translated to a 110% rally in the price of Alpha Finance Lab (ALPHA) over the past four days.

Data from Cointelegraph Markets Pro and TradingView shows that since hitting a low of $0.30 on June 22, the price of ALPHA has rallied 196% to a monthly high at $0.89 on July 6 as its 24-hour volume spiked 433% to $293 million.

ALPHA/USDT 4-hour chart. Source: TradingView

Reasons for the building momentum for ALPHA include protocol improvements to Alpha Homora V2, the launch of the Alpha Launchpad and an attractive price per earnings ratio (P/E) when compared to competing platforms.

Protocol upgrades promote interoperability

The biggest upgrade for the Alpha Finance Lab protocol came back on February 1 with the launch of Alpha Homora V2 which brought a new level of interoperability to the project by allowing users to conduct leveraged yield farming on Curve, Balancer, SushiSwap and Uniswap.

Excitement for the launch was followed by ALPA price hitting an all-time high at $2.95 on Feb. 6 but the Iron Bank exploit on Feb. 13 drained $37 million from the Alpha Homora protocol and pulled the price back below $1.

Following the hack, integrations with Binance Smart Chain, ALPHA staking and the launch of AlphaX, a “non-orderbook perpetual swap trading product” that allows leveraged long and short positions helped to boost the altcoin's price.

Alpha Homora V2 also includes a basic farming mode designed to simplify the process and the recently unveiled Alpha Launchpad claims to be "the first and only DeFi incubator program created by builders for builders."

The release of the Launchpad was covered in a recent report from Delphi Digital, which called its launch a potential “dark horse catalyst for Alpha” that has likely not yet been priced into the market.

Delphi Digital said,

Alpha’s launchpad will potentially accrue more value to token holders as they will receive a portion of cashflows from new protocols that are incubated by the Alpha Finance Lab ecosystem.”

Revenue from fees makes an attractive value proposition

One of the more notable features of the ALPHA protocol is its fee structure, which takes 20% of all borrow interest in V2 and 10% of the borrow interest in V1 to pay out stakers.

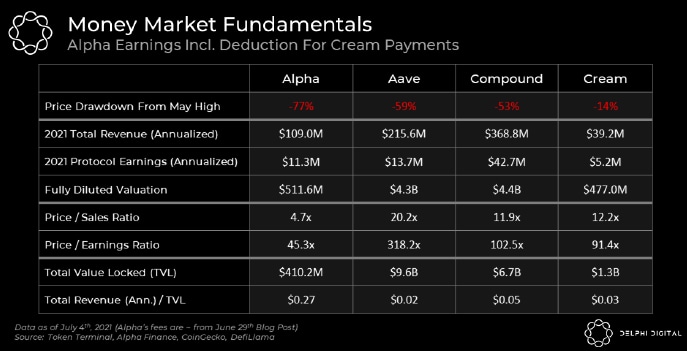

A recent report from Delphi Digital highlighted the protocol's fee structure and calculated that the V2 annualized protocol earnings are projected to be $6.53 million, meaning that “Alpha trades at a relatively cheap P/E ratio compared to its peer group.”

ALPHA money market fundamentals. Source: Delphi Digital

As shown above, the fees generated per dollar of total value locked which is significantly higher when compared to competing platforms.

Delphi Digital said,

From a capital efficiency standpoint, Alpha is in a league of its own, with the amount of fees it generates per $ of TVL at $0.27. For context, the runner up for this metric is Compound at $0.05.

Alpha Finance Labs alsoestimates that the annualized fee revenue for the project across all platforms is projected to be roughly $15.28 million.

Number of ALPHA staked since its launch. Source: Twitter

When this figure is combined with the continued increase in the number of ALPHA tokens being staked on the network, the bullish case for Alpha Finance Lab is further strengthened as DeFi becomes part of the mainstream conversation.

According to Rekt Capital, a pseudonymous crypto Twitter analyst, ALPHA price is looking over-extended in the short-term.

$ALPHA / #BTC - #alpha #Alphafinance

— Rekt Capital (@rektcapital) July 6, 2021

ALPHA has enjoyed a phenomenal run up this week

But it has reached a pivotal resistance area (red)

I'd only expect further upside upon turning red into support as that could unlock an additional +40% rally towards the orange area#Crypto pic.twitter.com/RZlrB4Nk8W

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.