ADA bearish momentum hits Covid-19 crash levels as Cardano price descends to $0.22

- Cardano price fall reduced the value of the altcoin by more than 27% last week.

- The chances of recovery are more likely than ever as ADA has seemingly bottomed out.

- Whales, too, are opting to pull back until then, as their volumes have slipped by 30% in two weeks.

Cardano price has steadied significantly after the drawdown it witnessed in the days before. The impact of the crash was severe enough to trigger fear in ADA investors. But with the market hitting the lows it is presently at, these investors might find some confidence in the fact the only way from here is up.

Cardano price set up for recovery

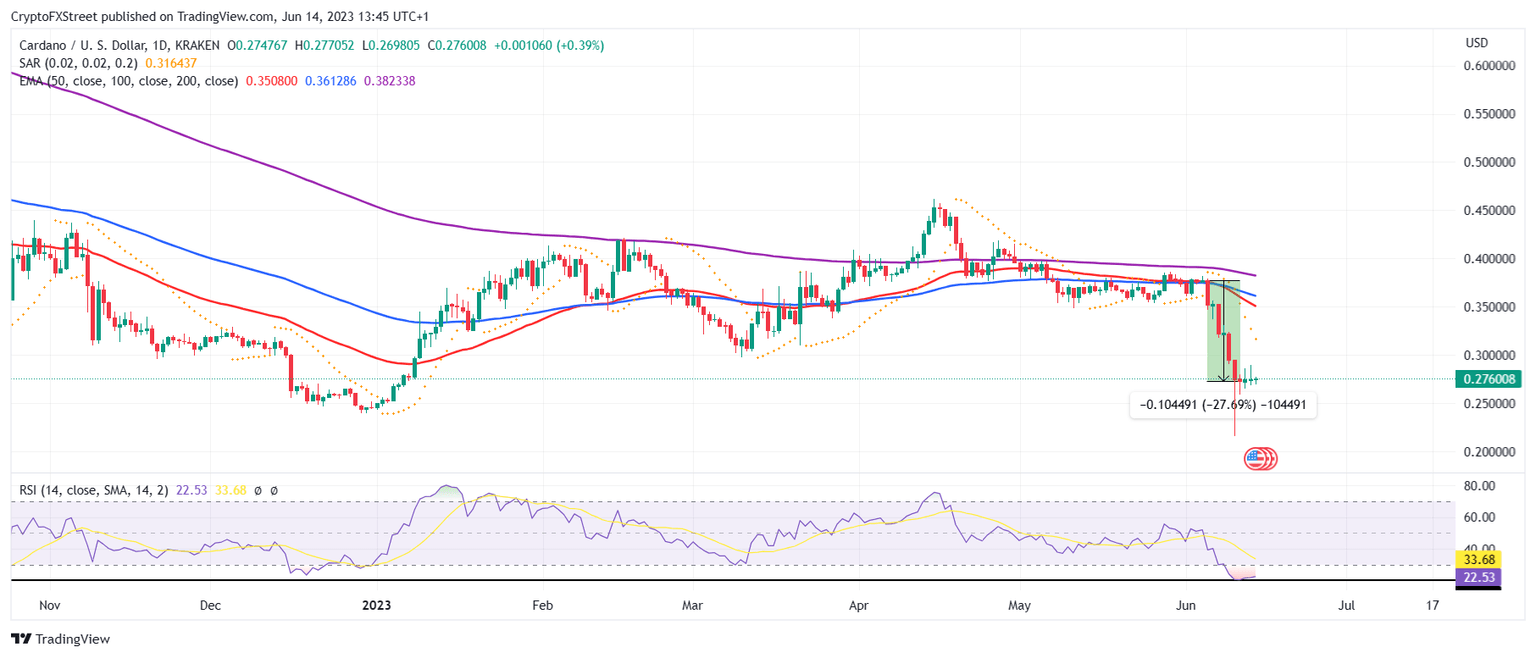

Cardano price is trading at the $0.27 area after noting a 27% decline in the span of a week starting June 5. Although the market is stable at the moment, the bearish momentum built up following the crash has led to ADA being significantly oversold.

ADA/USD 1-day chart

The Relative Strength Index (RSI) fell into the oversold zone below the 30.0 mark and hit a low of 20.53 at the cycle lows. The last time the indicator was at this level was back in March 2020, when the Covid-19 pandemic was at its peak. The crypto market suffered a major crash back then due to the terrible macroeconomic conditions, but the current crash also includes the contribution of the regulatory crackdown.

Cardano RSI

Although the market took months to recover in 2020, the conditions might improve much more quickly this time around. Indications of the same are visible in the fact that the Market Value to Realized Value (MVRV) ratio is currently at a yearly low. This metric is used to measure the profit/loss of the investors and whether or not there is room for a change in trend.

At the moment, the MVRV ratio is far into the “opportunity zone,” which historically is followed by a recovery in the price action. Usually, investors tend to accumulate at this time to book profits once the price climbs back. In the case of Cardano, the altcoin seems to have bottomed out, making a bounce the most likely scenario.

Cardano MVRV ratio

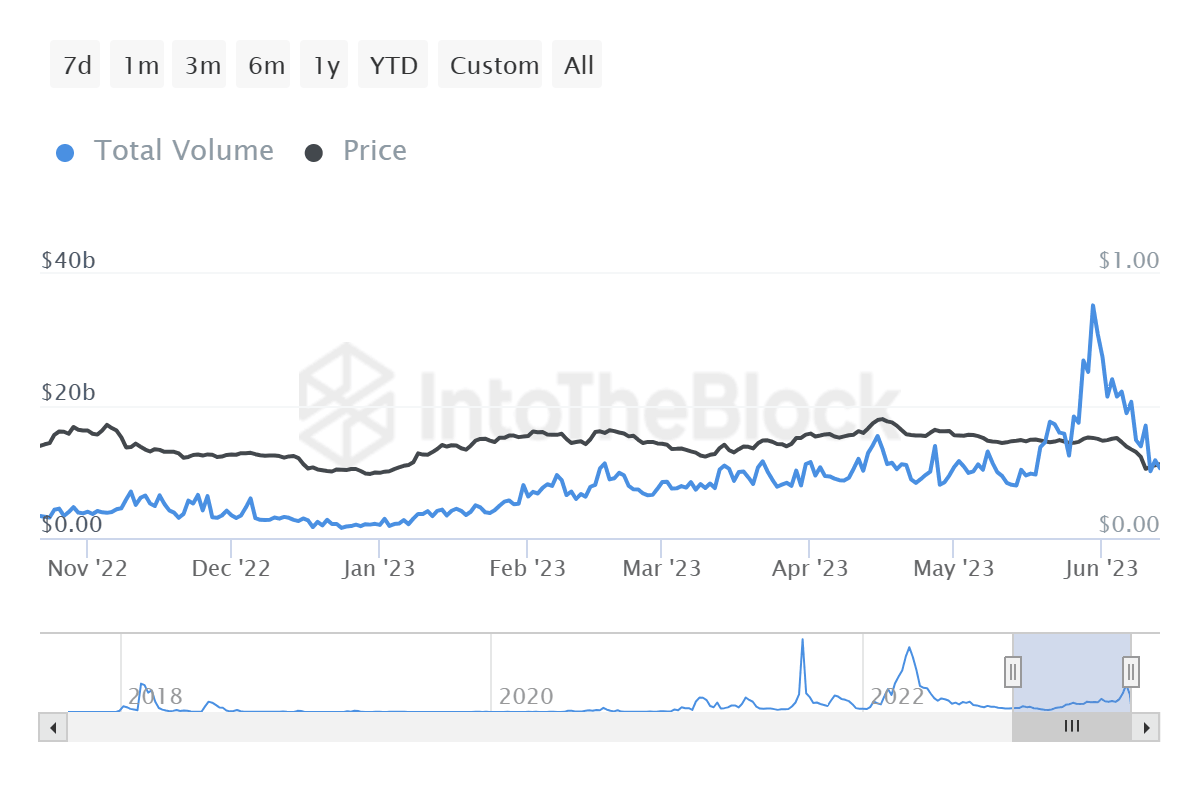

However, the price recovery may not find much support from the investors this time as ADA holders are reasonably spooked right now. Whale transaction volume, which peaked in May, has declined by nearly 30% in the last two weeks and is only expected to reduce further.

Cardano whale activity

Thus if the most important cohort of an asset steps back, not much can be expected from retail investors. Therefore, until Cardano price marks a decent recovery by climbing back above $0.35. The skepticism among investors might persist.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B18.13.39%2C%252014%2520Jun%2C%25202023%5D-638223525177272290.png&w=1536&q=95)