Aave price recovery slows down as investors sell 100,000 AAVE in 24 hours

- Aave price noted a nearly 40% rise since June 16 before falling by more than 7% in the past day.

- Broader market bullishness led to investors buying 300,000 AAVE in a single day.

- This bullishness was short-lived as mid-term investors attempted to sell for profit but ended up bearing losses as the price fell.

AAVE price was among the highest gainers on Sunday and one of the biggest losers the very next day. The sudden switch in momentum was more than just a market cooldown as the correction was triggered by sudden selling by investors.

AAVE price rally backfires on investors

AAVE price followed the broader market cues to chart stellar gains in the last ten days, bringing the altcoin up by almost 40% to trade at $68 a day ago. However, in the past 24 hours, corrections pulled the cryptocurrency down by more than 7%, adjusting the current market price to $63.

AAVE/USD 1-day chart

This rally was in line with the rest of the market. The correction, on the other hand, was not as the AAVE price fell due to selling. As the altcoin noted a 20% increase on June 25, investors jumped to accumulate as much as they could and ended up pulling 310,000 AAVE worth $20 million off the exchanges.

This move led to investors believing another rise could be on the way, and the anticipation led to some long-time holders offloading and making profits. This sudden selling of about 100,000 AAVE worth $6.4 million resulted in a price crash as the broader market cues turned neutral.

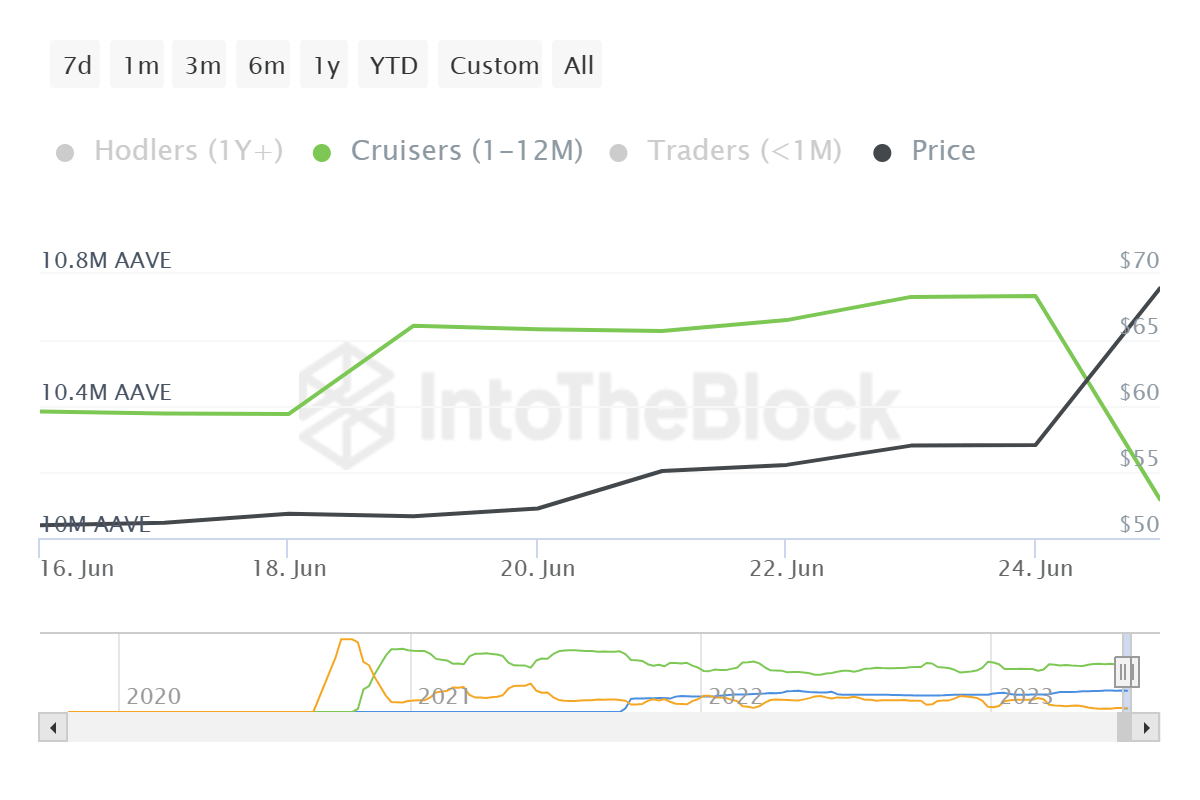

AAVE supply on exchanges

The selling observed was the decision of some potentially frustrated investors who sought to offload their holdings and recover their losses.

This is drawn from the fact that mid-term holders’ (addresses holding assets for more than a month and less than a year) supply declined by 600,000 AAVE. Most of this was picked up by short-term investors (holding supply for less than a month), but the impact was still felt by the market.

AAVE supply distribution

The correction arrived early, and the selling contributed to further bearishness bringing the AAVE price down by 7%. The ensuing selling brought losses upon the investors, which led to more than 810,000 AAVE being moved around at a far lesser value.

AAVE network realized losses

Thus by the looks of it, AAVE investors are likely to hold until signs of gains arrive again and stay for an extended period of time before they choose to make profits again.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B02.40.33%2C%252027%2520Jun%2C%25202023%5D-638234156673217414.png&w=1536&q=95)

%2520%5B02.40.30%2C%252027%2520Jun%2C%25202023%5D-638234157131243523.png&w=1536&q=95)