Aave Price Analysis: DeFi token poised to retest the recent high once $67 is cleared

- Aave has been one of the best-performing tokens out of top-50.

- The further recovery is limited by the technical resistance on approach to $67.

Aave (LEND) is the 32nd digital asset with a current market capitalization of $778 million. The native token of the decentralized lending protocol bottomed at $48.84 on Thursday amid the global sell-off on the cryptocurrency market and recovered to $65.6 by the time of writing. The coin has gained over 21% in the past 24 hours; however, it is still down 15% on a week-to-week basis.

Aave is a pioneer of the DeFi lending industry. The platform allows users to lend and borrow digital assets. Currently, it is the fourth-largest DeFi protocol with over $1.2 billion locked as collateral.

Aave retains bullish potential

Aave bottomed at $24.64 on November 5 and has been gaining ground ever since. The token's bullish trend was driven by the overall sentiment improvement in the DeFi industry and the cryptocurrency market. The price had recovered over 90% from the sell-off and hit $84.71 on November 20 before another bearish correction started.

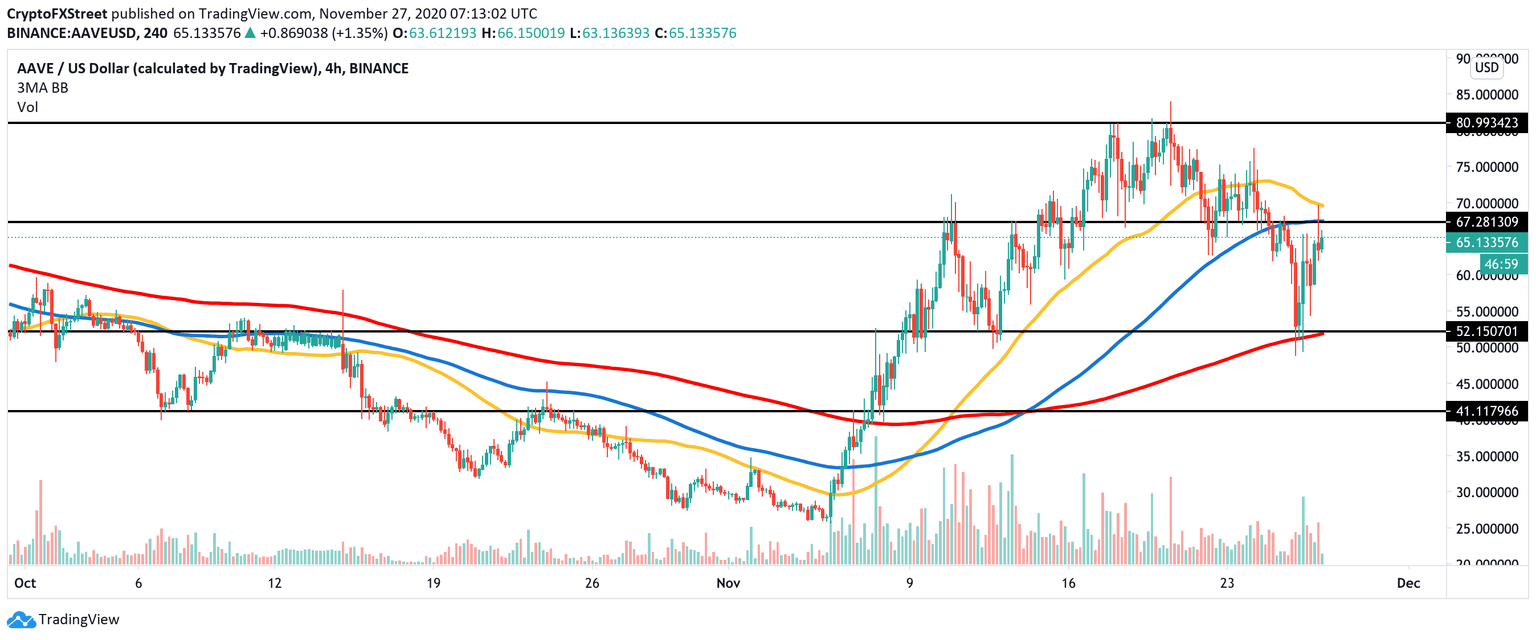

From the technical point of view, the recovery is capped by 4-hour EMA100 at $67. This barrier may slow down the upside momentum and initiate a consolidation cycle before another bullish wave. Once it is out of the way, the upside is likely to gain traction with the next focus on $80, followed by the recent high of $84.

AAVE/USD, 4-hour chart

On the downside, the price is supported by 4-hour EMA200 at $52. This area stopped the downside move twice since the beginning of November and now may be regarded as a strong barrier with the potential to limit the bearish momentum.

On-chain metrics confirm the bullish scenario

Meanwhile, the In/Out of the Money Around Price data confirms a strong wall on the approach to the $52 area. Over 250 addresses purchased over 3 million coins between $56 and $54. If it gives way, the increased selling pressure may push the price towards $41.

AAVE's In/Out of the Money Around Price data

The way to the north is a bit less cluttered with the resistance areas. The IOMAP cohorts show that there is an insignificant barrier around $64 with 560 addresses holding only 560,000 coins.

Author

Tanya Abrosimova

Independent Analyst

%2520-637420583090299852.png&w=1536&q=95)