0x Price Prediction: ZRX flashes buy signal, aiming for $0.50

- ZRX is ready to recover from the recent sell-off.

- The bulls may reach $0.50 with no hassle.

0x is an open-source protocol that supports the peer-to-peer exchange of tokens on the Ethereum blockchain. The users of the protocol can stake its native token ZRX to earn rewards in ETH. Currently, ZRX is the 51st-largest digital asset with the current market capitalization of $319 million and an average daily trading volume of $48 million, in line with the current values. The token is most actively traded on Coinbase Pro and Binance.

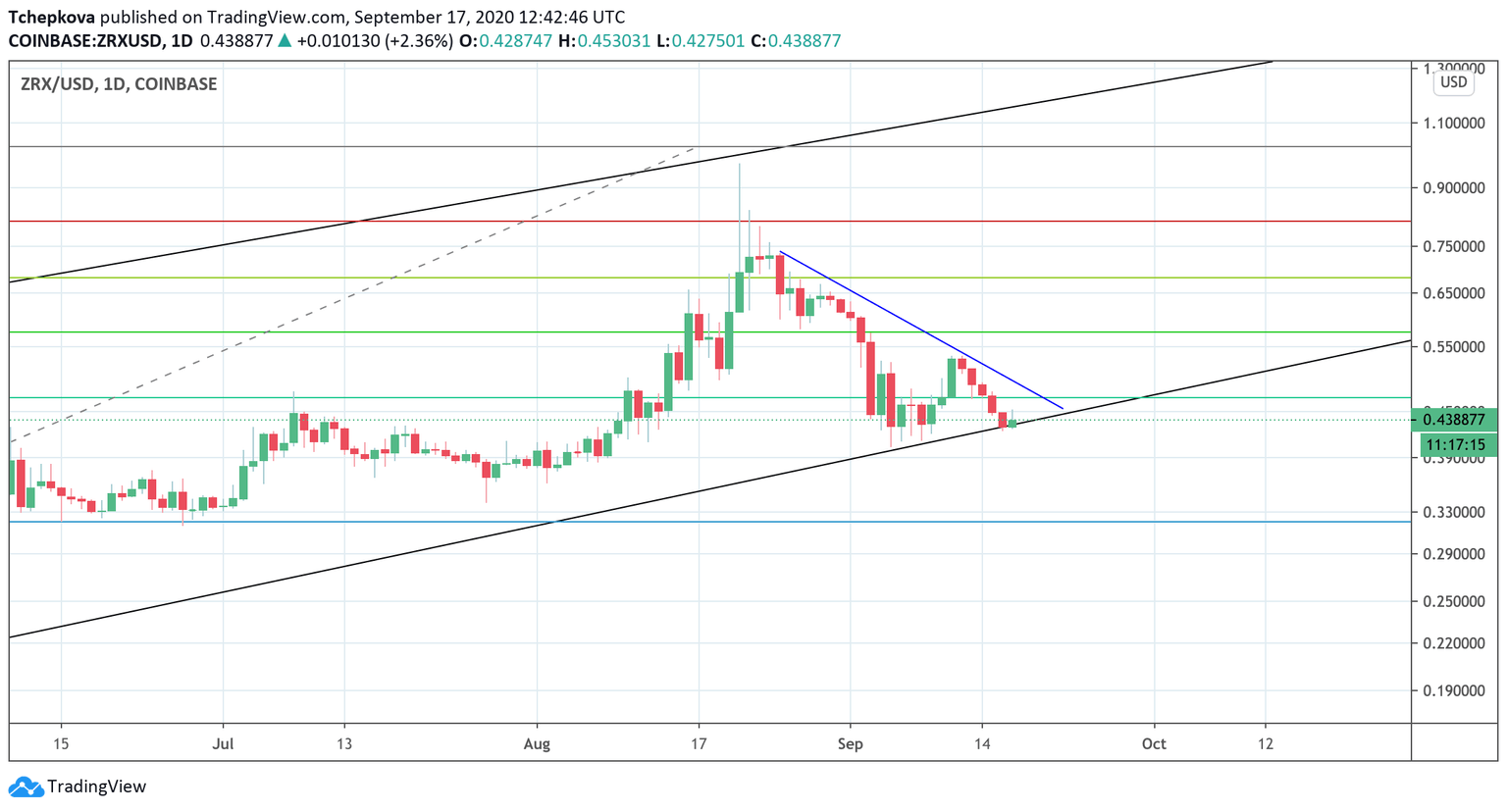

ZRX/USD: The technical picture

ZRX/USD bottomed at $0.138 on March 13, as the global cryptocurrency market was hit by COVID-19 consequences and massive anti-risk sentiments across the board. On August 17, the token topped at $0.97 before the downside correction pushed it back to $0.40. At the time of writing, the ZRX/USD is changing hands at $0.44, mostly unchanged in the last 24 hours. Despite the retreat from the recent highs, the token is still yielding nearly 170% of annual return on investments.

ZRX/USD daily chart

On a daily chart, the price broke a sequence of five bearish days in a row and reversed from the long-term channel support (currently at $0.42). The price tested this barrier on numerous occasions recently but failed to engineer a decisive breakthrough. If the history is repeated, the price may extend the recovery towards the initial resistance created by the short-term downside trendline that coincides with the psychological $0.50. Once it is out of the way, the upside is likely to gain traction with the next focus on $0.575 (50% Fibo for the upside move from March lows).

On the downside, a sustainable move below $0.42 will invalidate the immediate bullish outlook and bring $0.40 in focus. If it is broken, the sell-off may continue all the way down it $0.32 (78% Fibo for the above-mentioned move).

XRX market positioning

Source: Intotheblock

0x market positioning data confirms the bullish outlook as we have no solid supply walls all the way up to $0.50. At the same time, nearly 5 million addresses with 92 million ZRX tokens stand ready to defend their breakeven point in the range of $0.42-$0.40. This impressive army of potential buyers has the power to stop the sell-off and trigger a sharp recovery towards the above-mentioned bullish target.

At the same time, the holders' distribution data shows that 0x whales are buying tokens as the number of wallets holding over 1 million coins increased from 36 on September 8 to 40 on September 15. As the chart below shows, the price tends to go along with the whales' activity, meaning that the current divergence between the price and the holders' distribution metrics is likely to result in bullish momentum.

0x holders distribution

Source: Santiment

To conclude, 0x (ZRX) may use the channel support as a jumping-off ground for a healthy recovery with the first aim at $0.50 and $0.57. The market positioning data confirms the bullish outlook, as there are no significant supply areas along the line. On the other hand, a sustainable move below $0.42-$0.40 will invalidate the bullish setup and open up the way to $0.32.

Author

Tanya Abrosimova

Independent Analyst

%20%5B15.47.38%2C%2017%20Sep%2C%202020%5D-637359441124776283.png&w=1536&q=95)