Yen under sustained pressure, igniting intervention fears

The USD/JPY pair is trading firmly around 156.56 on Monday, keeping the Japanese yen in a deeply weak position. Markets remain on high alert as they assess a chorus of verbal interventions from Japanese officials aimed at stemming the decline of the national currency.

The warnings intensified on Sunday when Takuji Aida, an adviser to Prime Minister Sanae Takaichi, stated that Tokyo is prepared to intervene directly in the currency market if the yen's weakness begins to inflict significant harm on the economy.

This follows similar expressions of concern from Bank of Japan Governor Kazuo Ueda and Finance Minister Satsuki Katayama last week. Their comments have significantly heightened expectations of potential market intervention, with many analysts identifying the 160.00 level as a critical line in the sand, recalling that this zone prompted official action during previous episodes of yen weakness.

The yen's sell-off, which drove it to a ten-month low last week, was initially triggered by the new cabinet's substantial stimulus package. The plan raised alarms over Japan's fiscal health, while the administration's continued insistence on ultra-loose monetary policy has provided a fundamental backdrop for further currency depreciation.

Technical analysis: USD/JPY

Four-hour chart

On the H4 chart, USD/JPY completed its first downward impulse to 156.19 and is now forming a consolidation range around 156.55. An upward breakout from this range is expected to trigger a corrective rally towards 157.15. Following this correction, we anticipate the resumption of the bearish move, initiating a new downward impulse with an initial target at 154.00. A break below this level would open the path for a deeper correction towards 153.30. This scenario is technically supported by the MACD indicator. Its signal line is above zero but is pointing decisively downward, suggesting that while the pair is correcting from overbought conditions, the underlying momentum is shifting bearish.

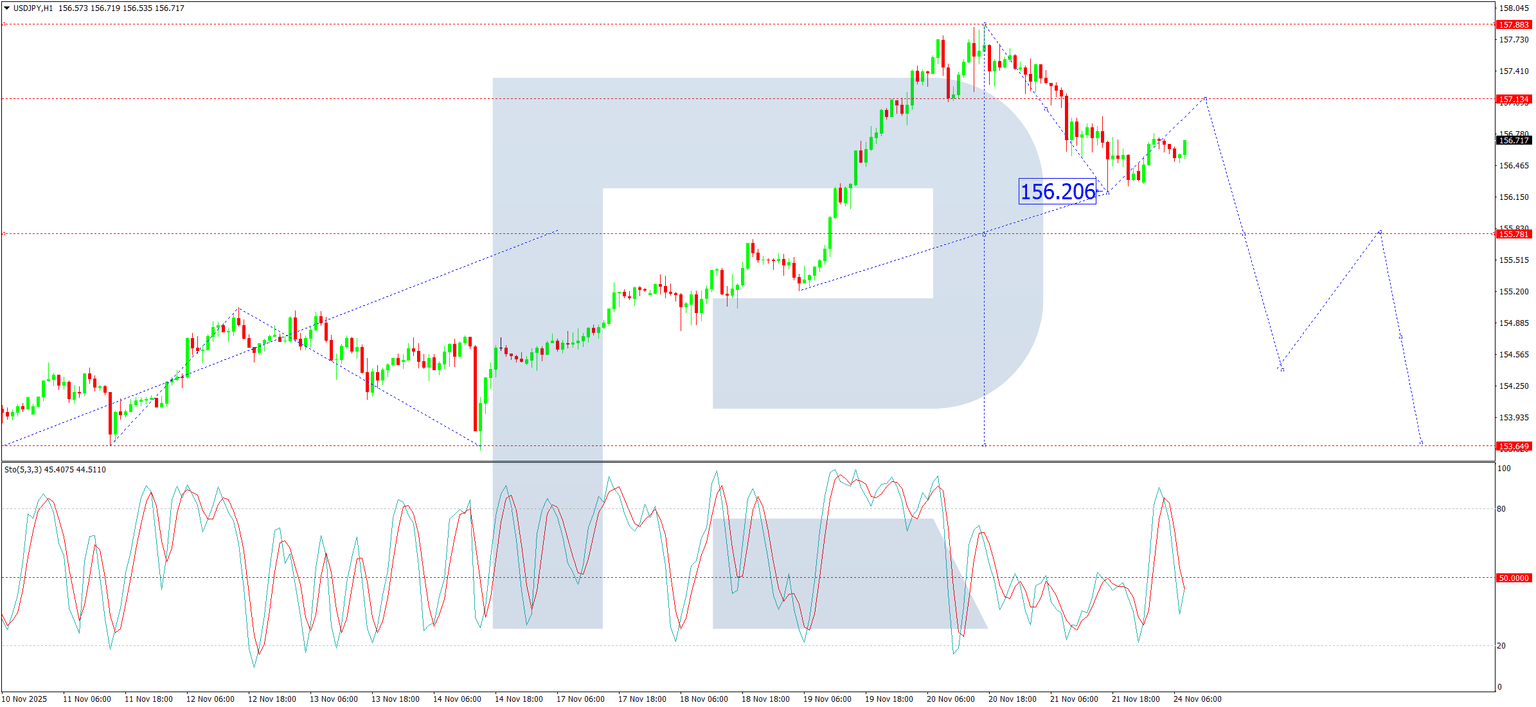

One-hour chart

On the H1 chart, the pair completed a downward wave to 156.20. We are now observing a corrective phase for this move, with an initial target set at 157.13. Upon completion of this upward correction, we expect the next leg of the downtrend to develop, targeting 154.44. The Stochastic oscillator confirms this near-term view. Its signal line is above 50 and rising towards 80, indicating that short-term buying pressure is driving the correction before the larger bearish trend reasserts itself.

Conclusion

The yen remains caught between fundamental pressures from domestic policy and escalating verbal intervention from authorities. Technically, the USD/JPY pair is completing a corrective bounce within a newly established short-term downtrend. While a rise towards 157.15 is likely in the near term, this should be viewed as a corrective move within a broader bearish structure that targets a decline towards 154.00 and potentially 153.30. All eyes remain on the 160.00 level, widely viewed as the threshold for potential official intervention.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.