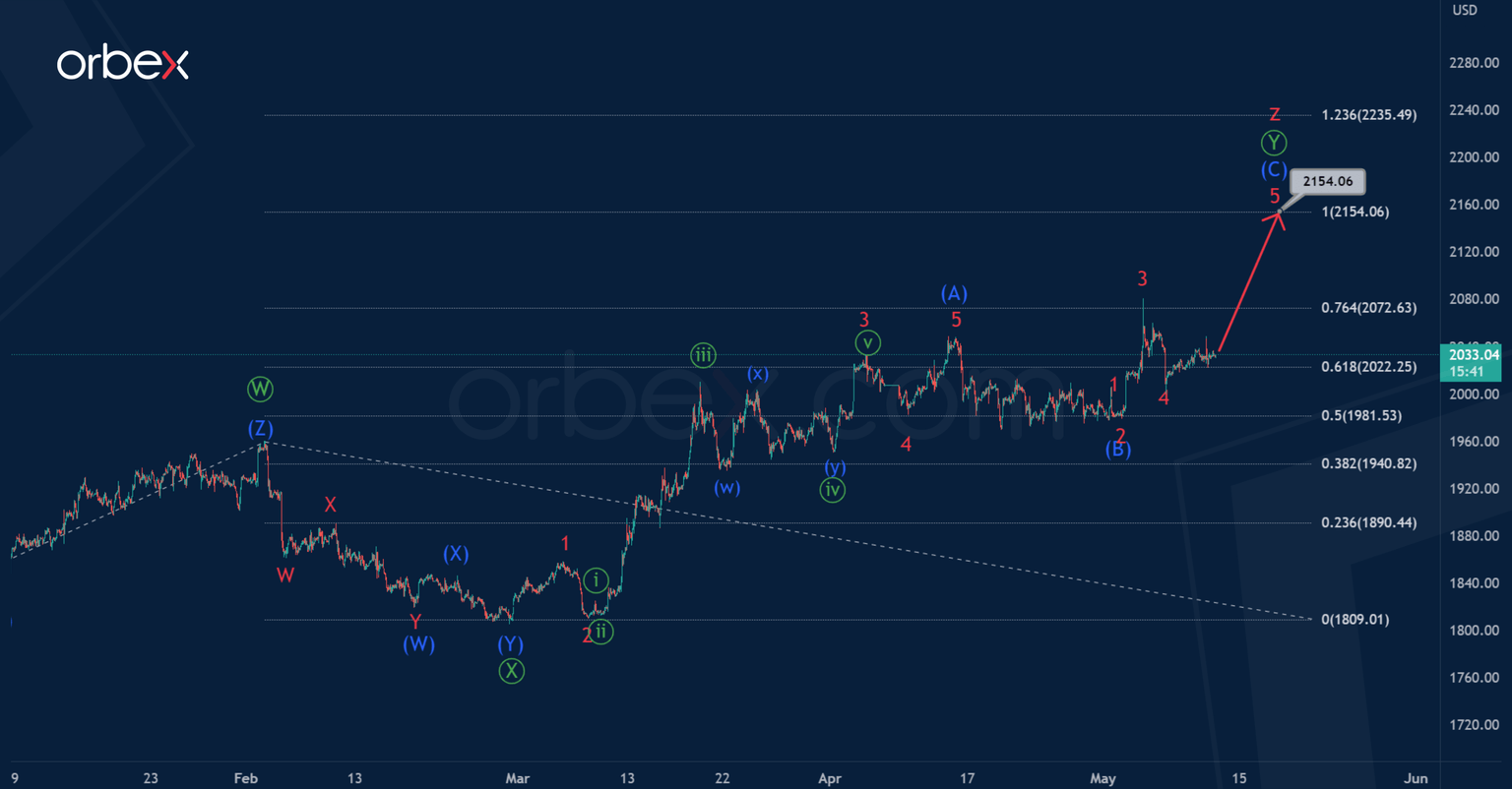

XAU/USD: The final impulse continues to build in a bullish zigzag

In the long term, XAUUSD forms a primary double zigzag, it consists of three main sub-waves Ⓦ-Ⓧ-Ⓨ.

Apparently, the primary sub-waves Ⓦ-Ⓧ have already been formed, and the third sub-wave Ⓨ is under development.

It is assumed that Ⓨ will acquire a standard zigzag shape. Intermediate waves (A) and (B), impulse and correction, are finished. It is likely that in the near future the price will continue to rise in the intermediate impulse (C).

Gold may rise to 2154.06. At that level, primary wave Ⓨ will be at 100% of wave Ⓦ.

According to the alternative, the impulse wave (A) has recently ended, with a long minor correction 4 having a horizontal structure.

At the moment, we can expect a decline in the price and the development of an intermediate correction (B). It is still difficult to determine which correction model wave (B) will take.

However, it is possible to determine the approximate final of wave (B). At 1910.39, the correction (B) will be at 61.8% of impulse (A). Thus, we can expect a drop to the specified level.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.