XAU/USD outlook: Gold rises further on uncertainties over US trade policies, weaker Dollar

XAU/USD

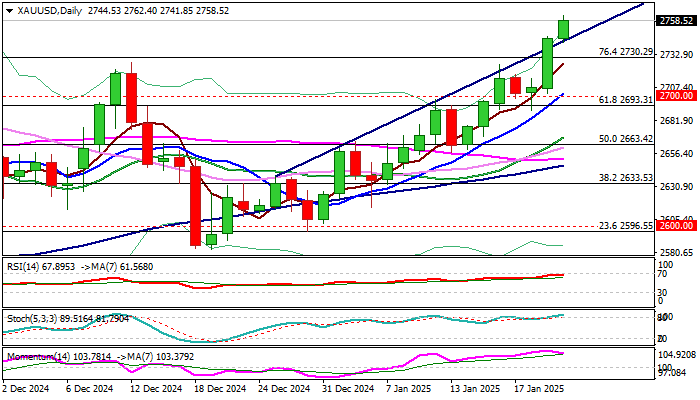

Gold price hit new multi-week high early Wednesday, in extension of Tuesday’s 1.4% advance, with near-term action being well supported by strong safe haven demand on fresh uncertainties over Trump’s trade policies that weakened dollar and wide expectations that the Fed will keep interest rates on hold in the policy meeting next week.

Bull leg above $2700 level extends into third consecutive day, as Tuesday’s close above pivotal barriers at $2721/26 (former double top) and $2730 (Fibo 76.4% of $2790/$2536) generated strong bullish signal.

Bulls eye new record high ($2790, hit in Oct 2024) and psychological $2800 barrier, but will likely consolidate before final attack.

Overbought conditions on daily chart and south-turning 14-d momentum signal that bulls already started to face headwinds.

Dips should ideally find support at $2730/20 zone (former pivotal barriers) to mark a healthy correction and offer better levels to re-enter bullish market, however, larger picture is expected to remain biased higher if deeper dips stay above $2700 zone.

Res: 2762; 2774; 2790; 2800.

Sup: 2741; 2730; 2721; 2700.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.