XAU/USD outlook: Gold regains traction on Fed's dovish shift /growing uncertainty

Gold

Gold keeps firm tone on Thursday and rose further, in extension on Wednesday’s post-Fed 1.5% rally.

The metal shined after dovish shift from the US policymakers deflated dollar, while growing uncertainty over the simmering crisis in banking sectors and estimations of its negative impact, additionally boosted gold’s safe-haven appeal.

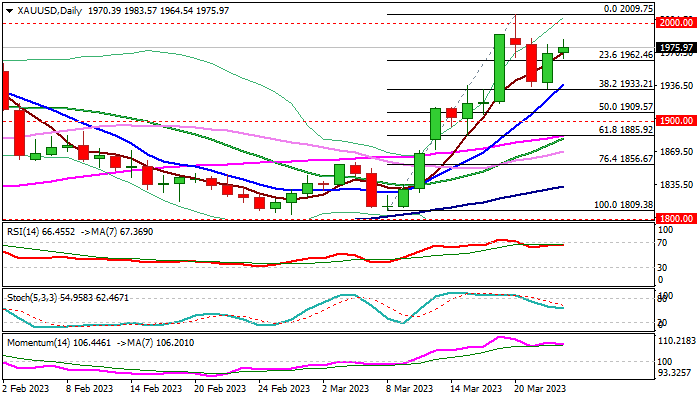

Wednesday’s strong bounce left the double-bottom at $1935/$1934, just above significant support at $1933 (Fibo 38.2% of $1809/$2009 / rising 10DMA) pointing to a healthy correction and shifting near-term focus higher.

Overall bullish daily techs support the action, but evident weakening of bullish momentum warns possible headwinds at key $2000 resistance zone (psychological / 2023 high at $2009), which may keep the price in extended range.

However, near-term bulls are expected to hold grip as long as the price action stays above strong $1993 support, with persisting uncertainty to keep fueling demand.

Bullish scenario requires firm break of $2000/$2009 barriers to open way for retest of record highs at $2070/$2074 (Mar 2022 / Aug 2020 peaks, respectively).

The metal is on track for strong monthly gains in March (the biggest monthly rally since July 2020) which adds to bullish outlook and favors scenario of prolonged consolidation preceding fresh acceleration higher.

Only loss of $1993 support would weaken near-term structure and risk deeper pullback on signs of false break above $2000, which would also signal a bull-trap.

Res: 1985; 2000; 2009; 2018.

Sup: 1959; 1933; 1918; 1909.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.