XAU/USD outlook: Gold extends weakness as dollar rises ahead of Fed

Gold

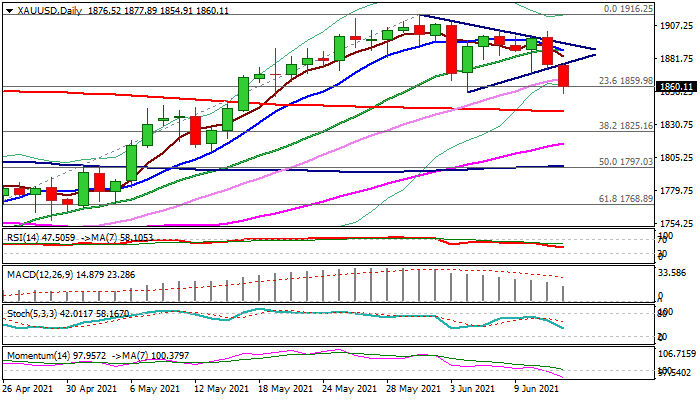

Spot gold accelerated further down, losing 1% in Asia / early Europe trading on Monday and adding to Friday’s 1.1% drop.

Stronger dollar keeps the metal under pressure as investors turn focus to Fed’s policy meeting later this week.

The market sees recent spikes in inflation as temporary action that reduced demand for the yellow metal, used as a hedge against inflation, but slight optimism that the policymakers may start talks about tapering and possibly hint changes in the monetary policy due to improved economic conditions, could further inflate the greenback.

Fresh bears cracked important support at $1855 (June 4 trough), break of which would complete a failure swing pattern on daily chart and signal further weakness.

Extension of pullback from $1916 (June 1 peak) would face pivotal supports at $1840 (200DMA) and $1825 (Fibo 38.2% of $1677/$1916 upleg) with break here to confirm reversal.

Rising bearish momentum and south-heading RSI / stochastic on daily chart, support near-term action. Upticks need to hold below $1877 (bull-trendline off $1855 higher low) to keep fresh bears in play.

Res: 1866; 1877; 1883; 1888.

Sup: 1855; 1840; 1825; 1815.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.