XAU/USD outlook: Gold benefits from weaker dollar after US inflation data

Gold

Spot gold edged higher on Friday and probed above $1900 barrier, inflated by weaker dollar after signals that rising US inflation, which made a biggest annual increase almost 13 years, was insufficient to push Fed to start changing its stance over ultra-loose monetary policy.

The US central bank expected to signal a strategy of a gradual reduction of its massive bond-buying program probably in August or September policy meeting, but is unlikely to act until early 2022 that leaves a plenty of space for the yellow metal to rise.

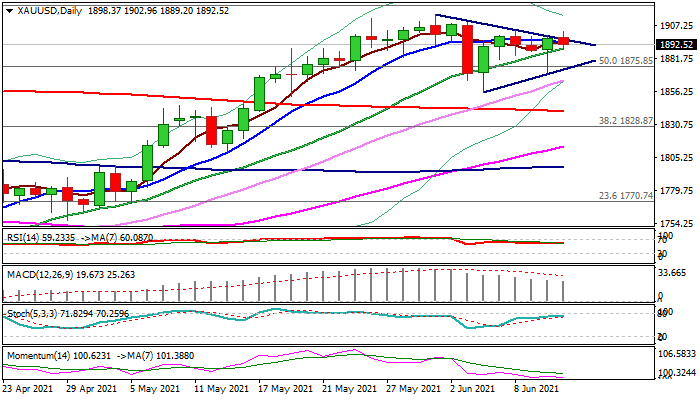

Fresh attempts higher need a clear break of $1900 zone (bear-trendline off $1916, June 1high/Fibo 76.4% of $1916/$1855 bear-leg) to complete bullish wedge pattern on daily chart and signal an end of $$1916/$1855 corrective phase.

Bullish daily studies underpin the action which looks for clear break of $1900 zone to focus next key barrier at $1922 (Fibo 61.8% of $2074/$1676 pullback), with break here to signal reversal of the downtrend from $2074 all-time high).

Caution of overbought weekly stochastic which signals prolonged consolidation.

Initial support lays at $1889 (rising 20DMA/session low), with near-term bulls expected to remain in play while the price action holds above the lower wedge pattern boundary ($1874).

Res: 1903; 1916; 1922; 1928.

Sup: 1889; 1885; 1874; 1864.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.