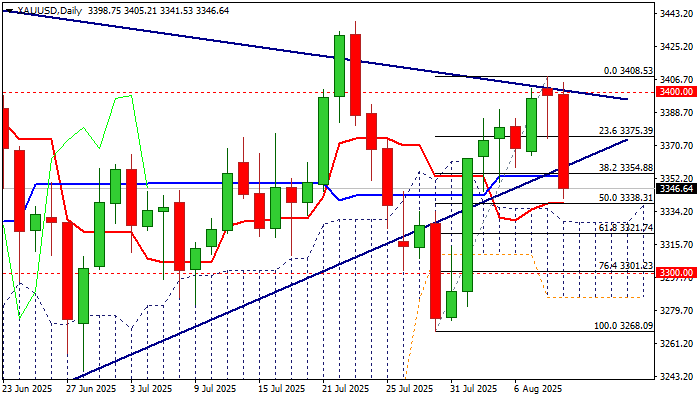

XAU/USD outlook: Drop below triangle support line weakens near term structure

XAU/USD

Gold remains firmly in red (down 1.2% until early US trading on Monday), as traders collected profits after repeated rejection at pivotal $3400 resistance zone (psychological / upper boundary of daily triangle pattern).

Fresh weakness broke below the triangle’s lower boundary ($3360) shifting near term focus lower, with close below triangle support line to validate bearish signal.

Gold price was dragged lower by strong fall of gold futures, which spiked to new record high on Friday (spot did not follow) on signals that Trump’s administration had imposed import tariffs on 1kg gold bars, although the White House is still to issue an executive order to clarify its stance on tariffs that eased an upside pressure.

Markets also await more information about potential Trump – Putin meeting, as well as Tuesday’s release of US July inflation report, which will provide more details for the US central bank about monetary policy path in coming months.

Technical picture has weakened on daily chart (14-d momentum is heading deep into negative territory / Stochastic reversed from overbought zone) that opens the way for test of immediate support at $3338 (daily Tenkan-sen / 50% retracement of $3268/$3408 upleg) and more significant supports at $3328 / 21(daily Ichimoku cloud top / Fibo 61.8% retracement).

Res: 3354; 3360; 3375; 3400.

Sup: 3338; 3328; 3321; 3300.

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.