XAU/USD outlook: Bulls take a brief breather under new record high

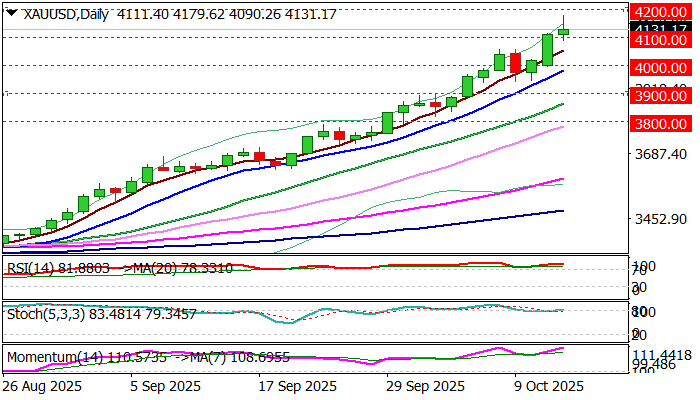

Gold broke through $4100 barrier on Tuesday and hit new record high ($4179), pressuring next round-figure resistance at $4200.

Escalation of the newest trade war between the US and China after both sides imposed special taxes on their ships, added to the cocktail of very bullish factors that drive precious metals’ prices to new record highs on a daily basis.

High market expectations for two more Fed rate cuts by the end of the year (bets exceeded 90%), very fragile geopolitical and macroeconomic situation, growing political tensions in number of the developed economies continue to underpin demand and greatly offset opposite signals from the Middle East pace agreement.

The price eased from new all-time high, but so far hold above $4100 level which reverted to initial support that keeps near term bias with bulls and point to limited corrective moves before larger bulls regain full control.

However, longer upper shadow on Tuesday’s daily candle could be seen as initial warning, which requires verification (initial signal to be expected on sustained break of £4100), as daily indicators still head north.

Look for reaction on $4100 for clearer signal, with break lower to open way for consolidation / limited correction (as long as current fundamentals do not register significant change).

Otherwise, dips contained at $4100 zone would signal positioning for fresh move into uncharted territory, with violation of $4200 to expose target at $4258 (Fibo 300% projection of the rally from $3120 (mid-May higher low).

Res: 4150; 4179; 4200; 4258

Sup: 4111; 4100; 4059; 4000

Interested in XAU/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.