WTI: Renewed optimism over global demand recovery lifts oil price towards multi-week highs

WTI oil rose on Monday, retracing the largest part of Friday’s fall and shifting near-term focus higher again, after bulls were impacted by rising demand fears over surge in India’s coronavirus cases and higher oil supply.

Fresh optimism over a strong demand rebound in the biggest oil consumers, such as the United States and China, offset negative signals and lifted oil prices.

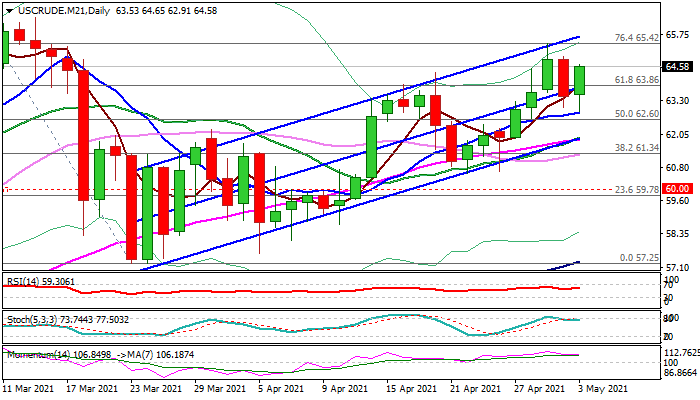

Fresh advance pushed the price in the upper side of the bull-channel from $57.25 (Mar 23/24 lows) and countered negative signal from Friday’s bearish engulfing candle.

Bulls eye Friday’s high ($64.93) and more significant Fibo barrier at $65.42 (76.4% of $67.95/$57.25), break of which would signal bullish acceleration above the upper boundary of bull-channel.

Positive daily studies underpin the action, along with monthly bullish engulfing and repeated close above monthly cloud top ($59.54).

Weekly crude stocks reports on Tuesday and Friday are eyed for fresh signals.

Res: 64.93; 65.42; 66.00; 66.38

Sup: 63.86; 63.06; 62.91; 62.60

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.