WTI oil outlook: Oil prices come under fresh pressure on growing fears of Omicron impact

WTI oil

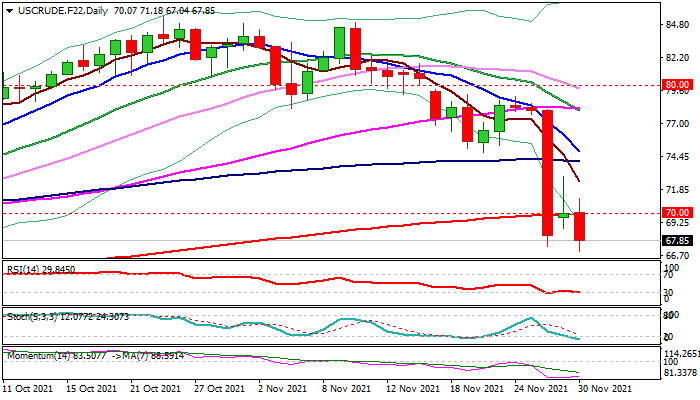

WTI oil price dipped again on Tuesday, following a short-lived recovery of last Friday’s 12.5% drop, coming under fresh pressure on doubts on the efficacy of Covid-19 vaccines against new Omicron variant of the virus.

Fresh weakness posted new marginally lower three-month low ($67.04), boosting near-term bearish stance after repeated failure to sustain bounce above pivotal $70 barrier (psychological / 200DMA).

Growing concerns that Omicron variant may slow global economic activity and hurt demand for energy, would keep oil prices under increased pressure, but lower oil prices may deflate surging inflation and allow central banks to keep ultra-low interest rates for some more time.

Bears cracked Fibo support at $67.35 (76.4% of $61.83/$85.39 upleg), with firm break lower to open way for extension towards $61.80 (Aug 15 trough / top of ascending weekly Ichimoku cloud).

Res: 68.84; 70.00; 71.18; 71.63.

Sup: 67.35; 66.91; 65.02; 64.00.

Interested in WTI technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.