WTI oil outlook: Oil price stabilizes above $40 following Thursday's wide-range action

WTI OIL

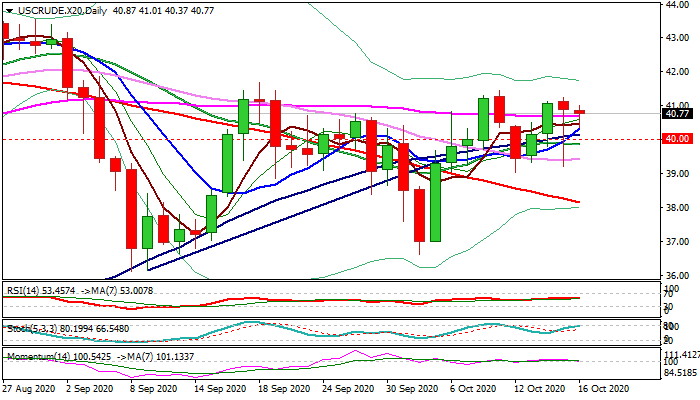

WTI oil price is standing well above $40 mark on Friday morning, following Thursday’s bumpy ride within nearly $2 range.

Oil fell sharply on Thursday, declining daily high at $41.26 to the lowest of the day at $39.66, on growing fears that new restrictive measures on spike in Covid-19 cases in Europe and the United States could significantly reduce demand in these regions.

Stronger dollar on renewed risk aversion, added to negative tone.

Oil price bounced strongly during the US session on Thursday and regained $41 handle after EIA report showed sharp drop in crude inventories due to closure of offshore production on hurricane.

Thursday’s action ended in red but with very long tail on daily candle that suggest the downside is for now protected, however, conflicting daily studies (weakening momentum vs moving averages in bullish setup) lack clearer direction signal.

The weekly action is shaped in tight Doji candle that adds to indecision signals.

Psychological $40 level (reinforced by the top of thickening daily cloud) marks pivotal support, with repeated weekly close above here needed to keep positive near-term bias.

Lift above six-week range top ($41.69) would further improve the outlook and expose key barrier at $43.75 (top of post-pandemic recovery phase).

Conversely, weekly close below $40 would weaken the tone and keep oi price within larger $36.11/$41.69 range.

Res: 41.01; 41.26; 41.69; 41.95

Sup: 40.70; 40.37; 40.00; 39.87

Interested in WTI OIL technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.