WTI Oil futures swing within neutral triangle [Video]

-

WTI Oil futures extend horizontal move.

-

Resistance at 73.85; support at 69.60.

![WTI Oil futures swing within neutral triangle [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Energy/Oil/offshore-drilling-for-oil-13084709_XtraLarge.jpg)

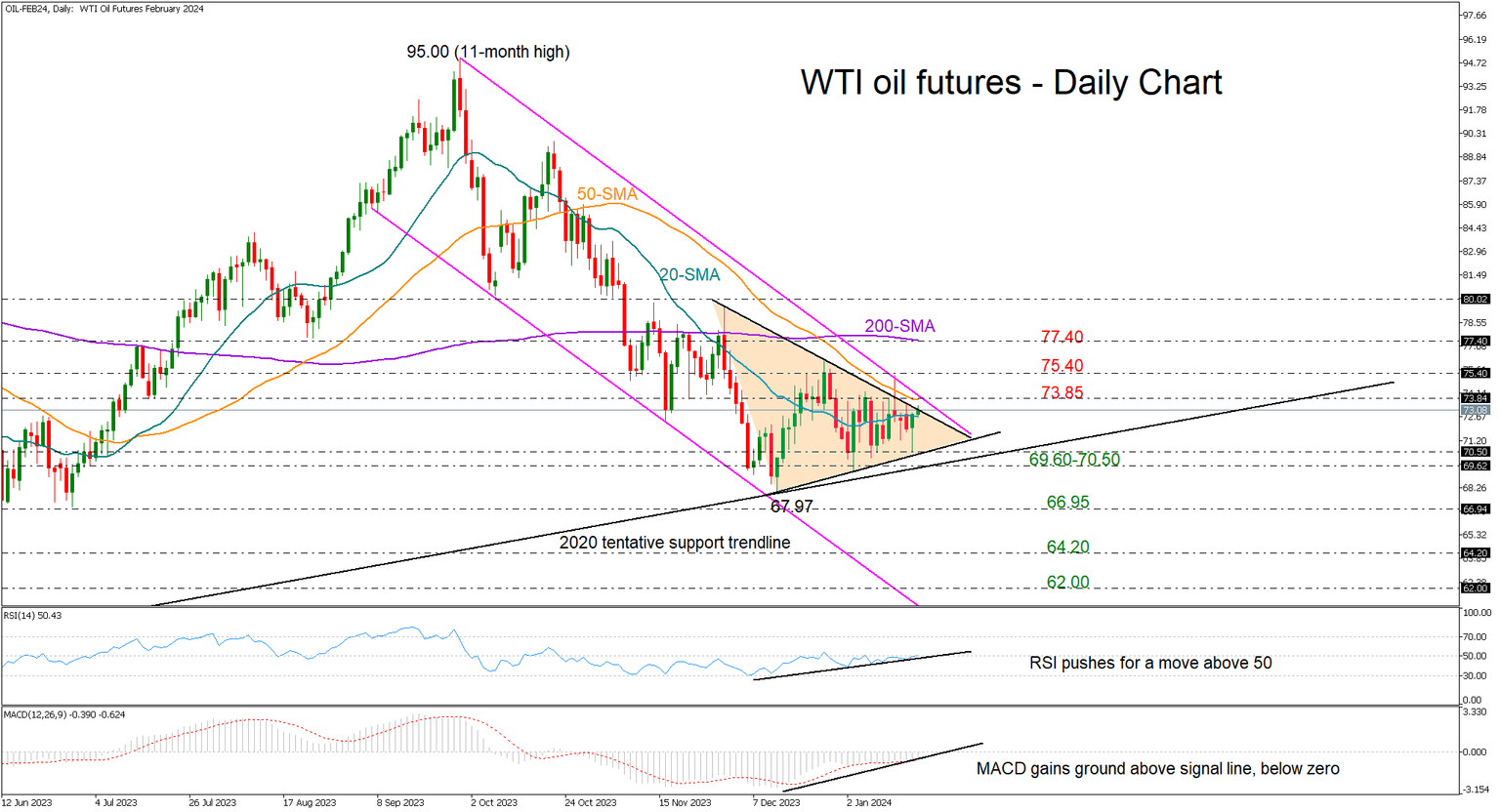

WTI oil futures (February delivery) have been in a range so far in January, printing a neutral triangle pattern at the bottom of the broad bearish channel.

Given the RSI’s continuous efforts to climb above its 50 neutral mark and the improvement in the MACD, there is a ray of hope for a bullish breakout.

Practically though, the price will have to overcome a few obstacles before the outlook shifts to the bullish side. Specifically, it will first need to climb above the upper band of the downward-sloping channel at 73.85, where the 50-day simple moving average (SMA) is positioned. Then, a close above the 75.40 constraining zone would violate the short-term neutral trajectory, opening the door for the flattening 200-day SMA at 77.40. A decisive extension above the latter would brighten the outlook, clearing the way towards the 80.00 round level.

In the event the price pulls lower, it may retest the triangle’s lower band at 70.50 and perhaps touch the tentative ascending line from the 2020 low seen at 69.60. Failure to bounce there could prompt a fast decline towards the May-June floor of 66.95. If selling forces persist, the downtrend could reach the 2023 bottom of 64.20 and then the 62.00 mark.

In brief, WTI oil futures provide no clear signals about the next move in the price as long as they fluctuate within the 69.60-73.85 region.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.