Worst of both worlds: Are the risks of stagflation elevated? – Part II

Summary

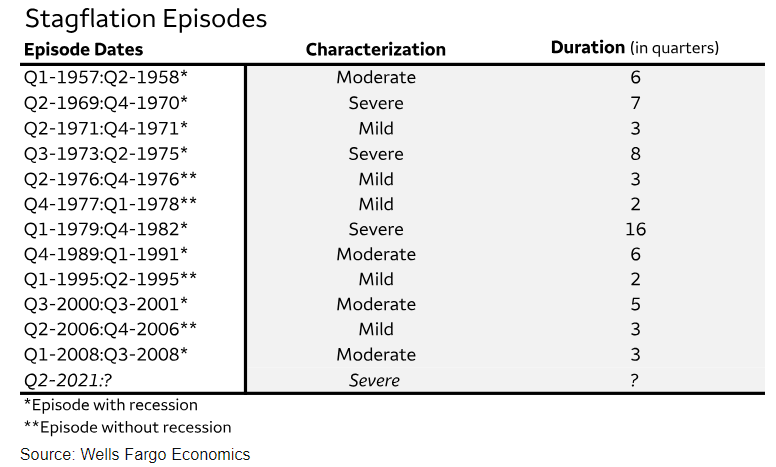

In the first installment of this series, we presented a simple framework to characterize stagflation and identified 13 instances in the United States since 1950.

Episodes vary in severity, but each posed unique challenges to monetary policymakers. In this second report, we briefly review historical instances of stagflation and their accompanying monetary policy decisions.

Six of the 13 episodes of stagflation occurred in the 1970s as oil price shocks, imbalanced fiscal and monetary policy and robust labor cost growth placed upward pressure on prices and weighed on output growth.

The episodes outside the 1970s have ranged from mild to moderate, with the exception of the post-COVID pandemic occurrence, a topic that we will turn to in the final installment of this three-report series.

Over time, historical instances of stagflation have often been met with accommodative monetary policy to support employment, despite elevated price growth.

The degree to which the accommodative policy stance exacerbated stagflation depends on the drivers of the inflationary bouts themselves and whether the economy's structure would help entrench or dilute price momentum.

External factors, such as oil price shocks, were associated with severe episodes of stagflation, but expansionary fiscal policy enacted amid a tight labor market also played a role. Those dynamics mirror the current environment, as the unemployment rate is at a decades' low and the fiscal deficit is swelling. Will the economy suffer from stagflation in the near term?

All stagflation is not created equal

We presented a simple framework to characterize stagflation in the first installment of this series. Using that framework, we identified 13 instances of stagflation in the United States since 1950 (Figure 1). Episodes vary in severity, but each posed unique challenges to monetary policymakers. In this second installment, we briefly review historical instances of stagflation and their accompanying monetary policy decisions. The distinctive experiences point to an economy whose structural drivers of growth have shifted over time, which underscores the idea that a policy enacted back in the 1970s may not have the same effect today as it did then.

Author

Wells Fargo Research Team

Wells Fargo