Women love Gold; And not just jewelry

Women love gold!

The popularity of gold jewelry makes this pretty apparent. But that’s not the full extent of women’s love affair with the yellow metal. American women also tend to prefer gold as an investment.

A recent survey by the World Gold Council reveals that women in the U.S. are less likely than men to have bought stocks in the last 12 months, but they are nearly as likely as men to have purchased gold in the past year. And we’re not just talking about gold jewelry.

Unsurprisingly, women were more likely to have bought fine gold jewelry in the last year, with about 28 percent reporting a purchase compared to about 19 percent of men.

The number of men and women who said they bought investment gold, excluding jewelry, was almost equal, with about 23 percent of men and 22 percent of women reporting a purchase.

One might note that, given the major rally in the gold price last year, the number of people generally investing in gold is rather low.

Interestingly, females were slightly more likely to report buying gold bars or coins in the last year (15 percent) than men (14 percent).

Investment in gold ETFs was dead even, with around 14 percent of both men and women reporting a purchase.

When combining all forms of gold, including fine jewelry, 36 percent of women reported at least one purchase compared to 28 percent of men.

Women were less likely to have invested in stocks or cryptocurrencies.

Oddly, while men are less likely to invest in gold than women, they tend to have more conviction about gold’s positive investment attributes.

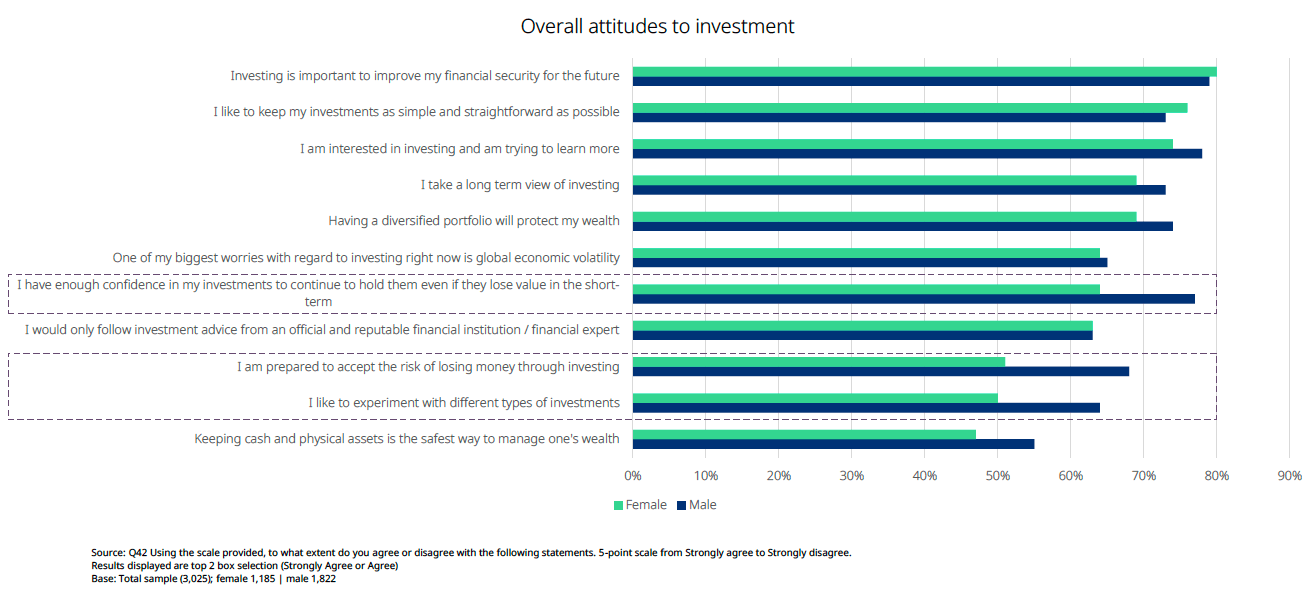

Looking at investment philosophies, men and women unsurprisingly report different priorities. Women are most concerned about investing for financial security, while men tend to prioritize building wealth and maintaining a diversified portfolio.

Women gravitate toward simple, straightforward investments and are far more risk-averse than men. Males are more likely to experiment with different investments, and they express a higher willingness to lose money.

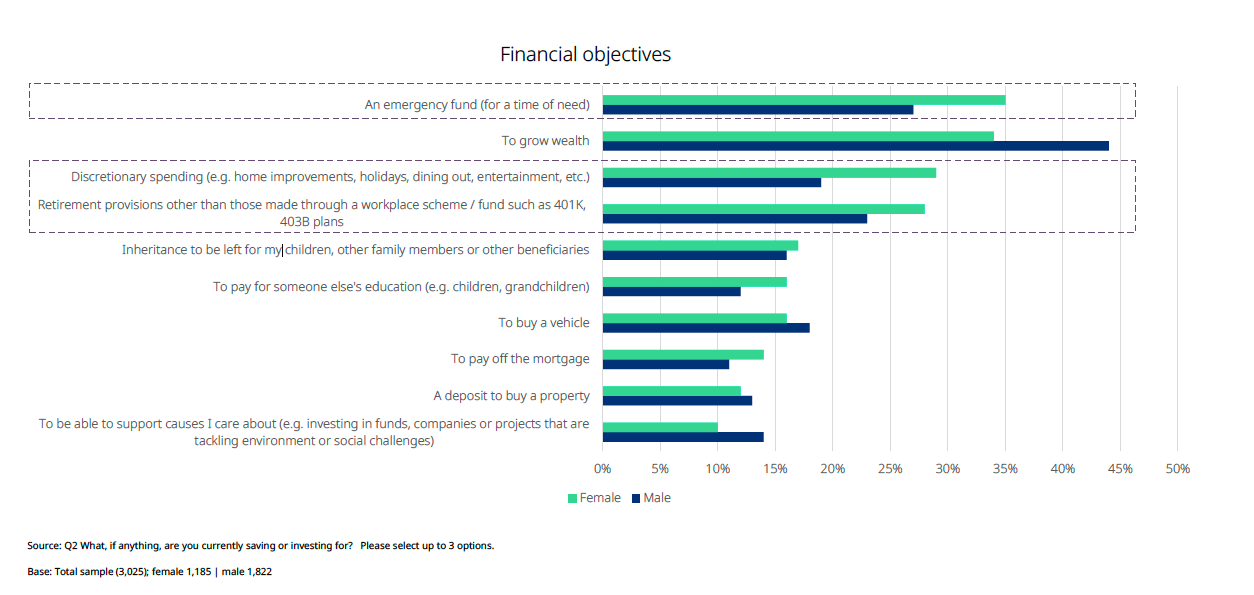

The primary financial goal for women is to have an emergency fund, followed by growing wealth. Men ranked growing wealth as their number one priority.

Men and women expressed similar views on why they hold gold, with most saying it helps stabilize their portfolios. They also view gold as separate from their other investments.

The World Gold Council surveyed 3,025 people aged 18-65 in the U.S. (Female: 1,185; Male: 1,822). Respondents had to have made an investment from a defined product list within the last year.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

To receive free commentary and analysis on the gold and silver markets, click here to be added to the Money Metals news service.

Author

Mike Maharrey

Money Metals Exchange

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.