Week ahead: What are the markets watching this week?

USD to remain bid?

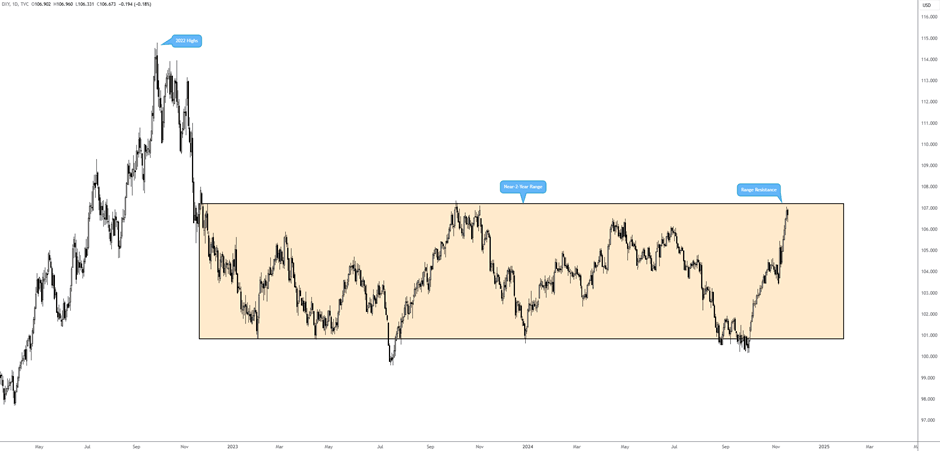

US Federal Reserve (Fed) Chairman Jerome Powell’s modestly hawkish commentary last week – ‘the economy is not sending any signals that we need to be in a hurry to lower rates’ – coupled with other Fed officials echoing a similar vibe as well as sticky inflation, prompted a dovish rate repricing. Markets assign a 60% probability of a 25 basis point (bp) cut in December, down from about 80%. This and the Trump Trade, which is still in full swing, further support US dollar (USD) buying (up 1.6% last week and on track to pencil in a second straight month in the green). From a technical standpoint, nevertheless, the FP Markets Research Team highlighted clear long-term range resistance around 107.19 on the USD Index. Although sentiment favours further outperformance in the USD, this could be a technical base worthy of this week's watchlist (see daily chart below).

The markets view the Fed as more cautious due to the possibility of an inflation spike as we enter the Trump era. Whether the Fed cuts rates next month will largely depend on upcoming data. Key events are the CPI inflation report (Consumer Price Index) scheduled for 11 December, PCE (Personal Consumption Expenditures) data at the end of this month, and the US employment situation report on 6 December.

This week’s focus, however, will be on weekly jobless claims data for the week ending 16 November on Thursday and the November flash manufacturing and services PMI estimates (Purchasing Managers’ Index) on Friday. Weekly unemployment claims are expected to have increased to 225k according to the market’s median estimate (max/min estimate range: 225-219k). For the manufacturing (services) flash PMI, markets forecast a slight uptick to 48.8 (55.2) from 48.5 (55.0) in October.

UK CPI inflation key this week

It is set to be more of an eventful week in the UK; investors will closely monitor October’s CPI inflation report on Wednesday. The majority of economists expect a pick-up in headline inflation. Economists anticipate headline YY inflation to have increased to 2.2% from 1.7% in September (max/min estimate range: 2.3-2.0%), while for YY underlying inflation (stripped of energy, alcohol, food, and tobacco prices), markets are forecasting that prices have risen to 3.2%, unchanged from September’s reading of 3.2% (max/min estimate range: 3.3-3.0%).

While September’s headline inflation reading elbowed south of the Bank of England’s (BoE) 2.0% inflation target – its first time venturing beneath this threshold since mid-2021 – ‘the job is not yet done on inflation’, to echo the words of some central bank speakers. This was emphasised in the BoE’s latest quarterly forecast update. The central bank projects YY CPI inflation at 2.7% over the next year (revised from August’s forecast of 2.4%), with peak inflation expected at 2.8% in Q3 25.

Earlier this month, you will recall that the BoE – in an 8-1 vote – reduced its Bank Rate by 25 bps and signalled more of a cautious (or gradual) approach to the pace of easing policy. Consequently, with core inflation and services inflation still elevated, and wage growth running north of inflation (which could increase on the back of the Autumn Budget’s raid on national insurance and the rise in the national minimum wage increasing employment costs), investors are pricing in 5 bps of easing for December’s meeting (essentially an 18% probability of a cut) and are not forecasting a 25 bp cut until the end of Q1 25.

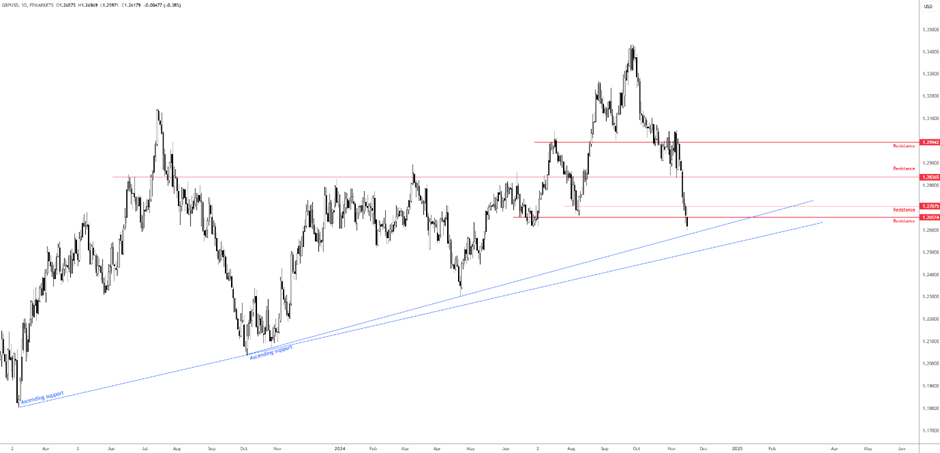

If inflation rises this week, reaching or surpassing maximum estimates (see above), this could underpin the British pound (GBP) bid as investors will likely push back interest rate expectations further into 2025. As of writing, the GBP remains firmly on the ropes versus the USD; the GBP/USD wrapped up the week lower by 2.3% and is on track to pencil in a second straight monthly loss. Technically, the currency pair is on the doorstep of two nearby daily ascending support lines, taken from lows of US$1.1803 and US$1.2070 – a location buyers could make a show from if inflation does indeed display early signs of increasing. Still, you will also note that two resistance levels are nearby at US$1.2708 and US$1.2657.

In addition to CPI inflation this week, undoubtedly the main focus, Friday welcomes retail sales data for October and November’s flash manufacturing and services PMI estimates. Retail sales are expected to have fallen -0.3% between September and October from 0.3% in the previous print (max/min estimate range between 0.3% and -0.8%). For the manufacturing (services) flash PMI, markets forecast the index to remain at 49.9 (52.0).

Canadian CPI inflation

Investors will receive the latest Canadian CPI inflation data for October on Tuesday. The Bank of Canada (BoC) reduced its overnight rate by 50 bps to 3.75%, marking a decline of 125 bps from its peak of 5.0% in a bid to bolster economic growth and keep inflation around the 2.0% mid-point of its 1-3% target band. Money market expectations are pricing in 34 bps of easing for the next policy meeting in December, meaning a 66% chance of a 25 bp cut is on the table and a 34% chance of another 50 bp cut.

It is important to remember that the BoC signalled further policy easing if inflation remains close to its target. So, although growth and job numbers will remain important for the BoC, this week’s inflation data will help determine the direction of the Canadian dollar (CAD). Markets expect headline inflation to have increased by 1.9% YY after cooling to 1.6% in September, its lowest rate since early 2021 (max/min estimate range: 2.0-1.8%). The CPI Median and Trim measures are both expected to have risen by 2.4% from 2.3% and 2.4%, respectively; this would increase the average to 2.4% from 2.35% in September.

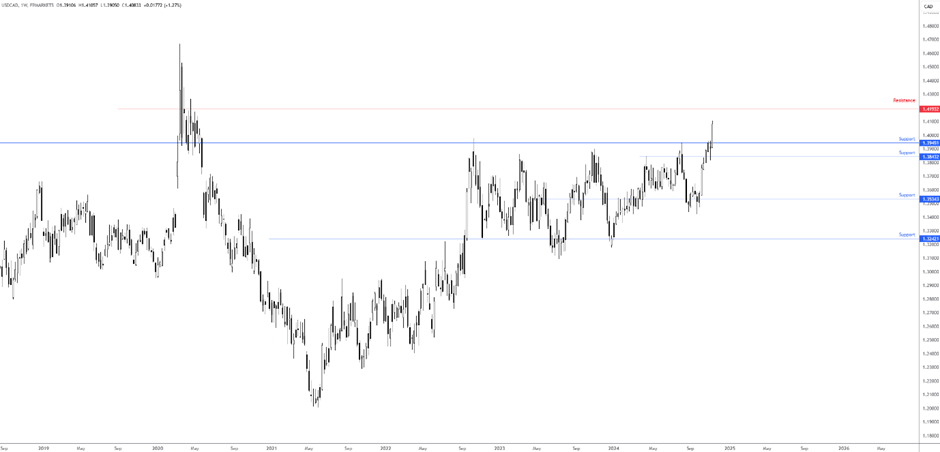

Higher-than-expected inflation data this week could lead to a bid in the Canadian dollar (CAD) as investors will likely begin pricing out another 50 bp cut. However, lower-than-expected data could show that the CAD depreciates further. Notably, the USD/CAD ended last week at 1.3%, reaching a high of C$1.4106, its highest level since May 2020. From the weekly timeframe below, you will see that following last week’s upside push through resistance at C$1.3945 (a level now marked as possible support), air space above is relatively clear until another layer of resistance from C$1.4193, indicating buyers have space to work with.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,