Week ahead – Round two of French elections, Powell testimony and US CPI [Video]

-

French parties race to block Le Pen’s RN.

-

Powell testifies before Senate Banking Committee.

-

US CPI data to shake Fed rate cut bets.

-

RBNZ to leave OCR untouched, focus on language.

![Week ahead – Round two of French elections, Powell testimony and US CPI [Video]](https://editorial.fxstreet.com/images/Macroeconomics/EconomicIndicator/Prices/CPI/consumer-price-index-gm500080630-80587217_XtraLarge.jpg)

Euro traders keep gaze locked on French election

Traders will be sitting on the edge of their seats on Sunday, in anticipation of Monday’s open and what market impact the second round of the French election will have.

The far-right National Rally (RN) led the first round last Sunday, but the left-wing New Popular Front (NFP) was not far behind. The outcome also revealed that RN and its allies took first place in 296 out of 577 constituencies, which could translate in absolute majority in the second round.

However, left-wing and centrist parties formed an alliance and decided to withdraw their candidates in electorates where there is a three-way runoff, in an attempt to increase their chances of stopping RN from running the government.

The outcome of the European parliamentary elections revealed that the rise of Eurosceptic parties is a negative development for the euro, thus the coordinated attempt to halt Le Pen’s march is seen as positive.

However, even if the left-wing alliance secures victory and the euro opens with a gap on Monday, uncertainty will not vanish as investors may still be eager to find out whether this could lead to a stable government.

There is also the chance of having a hung parliament, where a minority government will struggle to pass legislation. This could lead to prolonged political paralysis given that no elections can take place for at least 12 months, but if the minority government is led by RN, it may not be that bad for the euro, as the other parties may do whatever it takes to block their Eurosceptic agenda.

Increasing Fed rate cut bets to dent the US Dollar

In the US, Fed Chair Powell will testify on the economic outlook and recent monetary policy actions before the Senate Banking Committee. The Fed Chief will present a prepared statement and then the committee will conduct a Q&A session.

This week, at the ECB forum on central banking in Sintra, Powell said that they are getting back on “the disinflationary path,” adding though that they want to be more confident about inflation’s return towards their 2% target before they start loosening policy.

His comments were interpreted as corroborating the market narrative that two quarter-point rate reductions may be warranted this year, despite the Fed’s own dot plot pointing to just one. What’s more, following the disappointing ISM PMIs for June, the probability of the first reduction to be delivered in September has risen to 80%.

Although Powell is unlikely to deviate much from what he said in Portugal, the Q&A session may include more targeted questions that result in more clarity regarding the Fed’s plans.

Nonetheless, even if he insists that there is no urgency to press the rate cut button, whether the market pricing will drastically change could depend more on the outcome of the US CPI data on Thursday.

Taking into account that the price subindices of both the ISM manufacturing and non-manufacturing PMI surveys declined, the risks to the CPIs may be tilted to the downside. A further slowdown in inflation may convince more market participants to bet on two Fed rate cuts by December and thereby weigh on the US dollar.

Kiwi traders may cheer hawkish RBNZ

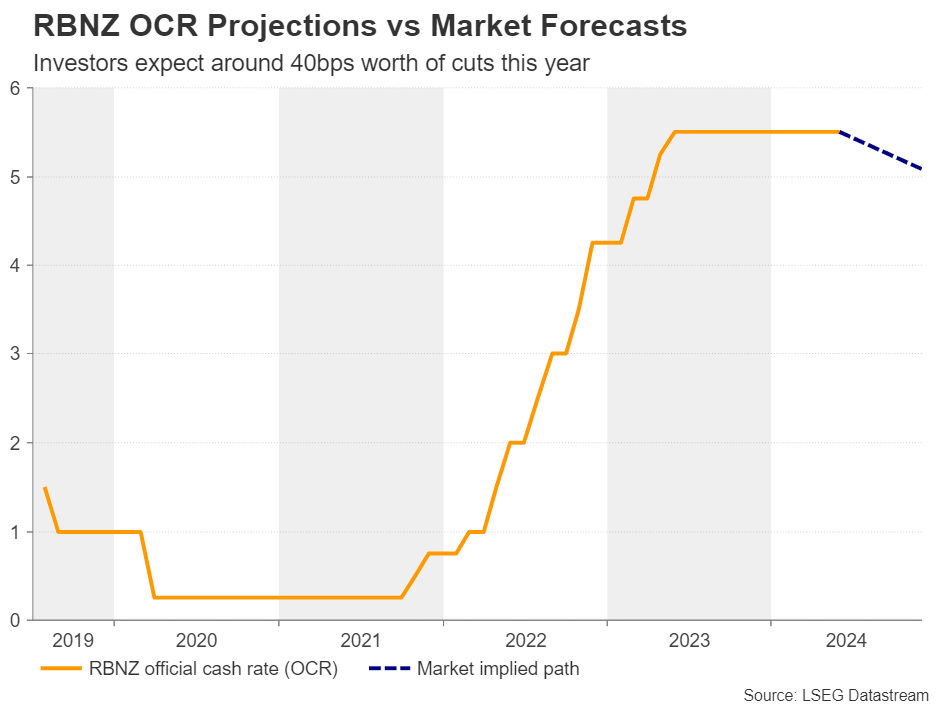

There is also a central bank meeting on next week’s agenda. During the Asian session on Wednesday, the RBNZ will announce its decision on monetary policy, but no change on interest rates is expected. There is only a small 5% chance for a 25bps rate cut.

At its latest gathering back in May, this Bank said that they need to maintain policy at restrictive levels to ensure that inflation returns to target, while more importantly, they discussed the possibility of raising interest rates at that gathering.

Since then, retail sales for Q1 came in better than expected, while the GDP data revealed that the economy grew by more than expected during that period. Although inflation numbers were not released, the aforementioned data corroborate the Bank’s hawkish stance.

Yet, investors are penciling in slightly more than 40bps worth of rate cuts by the end of the year. With the RBNZ having little reason to shift to a less hawkish stance, a reiteration of the May message may prompt investors to scale back rate cut bets, thereby boosting the kiwi.

Kiwi traders alongside their aussie friends will also pay attention to the Chinese CPI and PPI data, due out just half an hour ahead of the RBNZ decision.

UK data and sterling in post-election era

In the UK, with the general election behind them, pound traders may turn their attention back to economic releases. On Thursday, the monthly GDP for May alongside the industrial and manufacturing production numbers for the month are coming out.

With the Labor Party securing a majority in Parliament, the BoE may speed up its easing process on expectations of a more fiscally responsible government, which could prove negative for the pound in the medium term. Thus, improving GDP during the month of May is unlikely to severely alter market expectations with regards to the BoE’s plans.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.