Week ahead: US June PCE rates and fundamentals to lead the markets

As the week draws to a close we open a window at what next week has in store for the markets. On Monday we note the release of the preliminary PMI figures for June of Australia, Japan, France, Germany and the Euro Zone as a whole, the UK and the US. On Tuesday we get Japan’s chain store sales for May, Germany’s Ifo indicators for June, UK’s CBI industrial orders for June and Canada’s CPI rates for May. On Wednesday, we note the release of New Zealand’s trade data for May, Japan’s BoJ is to release the summary of opinions for its last meeting, Australia’s CPI rates for May and from the Czech Republic CNB’s interest rate decision. On Thursday, we get Germany’s GfK consumer Sentiment for July, UK’s CBI distributive trades for June, the US durable goods orders for May, the final US GDP rate for Q1 and the weekly initial jobless claims figure.

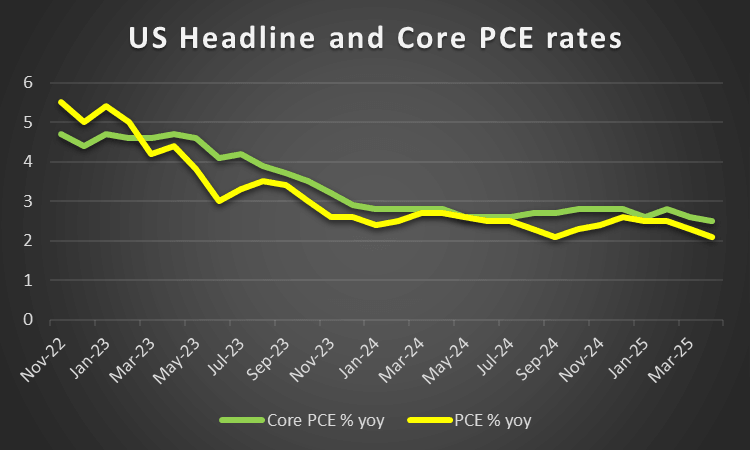

On Friday, we get from Japan, Tokyo’s CPI rates for June, France’s preliminary HICP rate also for June, the Czech Republic’s revised GDP rate for Q1, Euro Zone’s economic sentiment for June, Canada’s GDP rate for April, the US consumption rate for May, we highlight the release of the US PCE rates for May and finally note the final University of Michigan Consumer Sentiment for June.

USD – May’s PCE rates in focus

- On a monetary level, we note the Fed’s interest rate decision last Wednesday. The Fed remained on hold as was widely expected yesterday. The bank mentioned the solid pace of economic activity expansion, the tightness of the US employment market and that inflation remains somewhat elevated in its accompanying statement. All the comments tend to point towards a delay in any further easing of the bank’s monetary policy yet in the bank’s projections the new dot plot implies Fed policymakers’ expectations for two more rate cuts until the end of the year which seems to be in line with the market’s expectations. Should we see Fed policymakers proceeding in the coming week with hawkish comments contradicting the market’s expectations we may see the USD getting some support.

- On a macroeconomic level, we highlight the release of the US PCE rates for May next Friday. Should we see the rates accelerating implying persisting inflationary pressures in the US economy, the release could provide support for the USD as the Fed’s doubts for easing its monetary policy could be enhanced. On the contrary in the case of easing inflationary pressures in the US economy, we may see the USD slipping as it could enhance market expectations for the Fed to expedite its rate cutting path.

- On a fundamental level, we see the ongoing political unrest in the US but also on an international level, given US President Trump’s erratic behaviour. Further uncertainty could weigh on the USD and we tend to maintain our worries for a possible involvement of the US in the Israel-Iran war. We also note the substantial resistance to a possible US involvement in the war, even within the Republican party or MAGA supporters, which may be the main reason behind US President Trump’s hesitation.

Analyst’s opinion (USD)

“In the coming week, we highlight the release of the US PCE rates for May and a possible acceleration could provide support for the USD and vice versa. On a monetary level, any hawkish comments by Fed policymakers could also provide some support for the USD.”

GBP – Fundamentals to lead

- We make a start by noting on a monetary level that BoE decided to remain on hold at 4.25% yesterday as was widely expected, thus with little effect on the pound’s direction. However the bank also hinted at future rate cuts. BoE Governor Andrew Bailey stated after the release that interest rates are to remain on a gradual downward path yet at the same time stressed the uncertainty on a global level, and highlighted worries for the UK employment market. In the coming week, we have a number of BoE policymakers that are scheduled to make statements, including BoE Governor Bailey on Tuesday and should we see a dovish tone prevailing, implying that more rate cuts are in the pipeline, we may see the statements weighing on the pound.

- On a macroeconomic level, we note the slowdown of the CPI rates on a headline and core level, yet we still view the CPI rates as being at still relatively high level. In the coming week, we highlight therelease of the preliminary PMI figures for June with special focus on the services sector. A rise of the PMI indicator’s reading could imply a faster expansion of economic activity in the critical UK services sector thus supporting the sterling.

- On a fundamental level, we note that US President Trump has signed off a deal which lifts some of the US-UK trade barriers. The news were on the positive side, yet in our opinion it still is too little for the UK economy. Also on a fundamental level, we maintain our worries for the possible involvement of the UK in Israel-Iran conflict, especially given the UK air base in Cyprus, which may have a possibly bearish effect on the pound.

Download the full report

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.