Week ahead – ISM PMIs and NFP report to shake Fed rate bets [Video]

![Week ahead – ISM PMIs and NFP report to shake Fed rate bets [Video]](https://editorial.fxsstatic.com/images/i/nfp-clock-1_XtraLarge.png)

Powell helps Dollar to extend post-Fed gains

The US dollar stayed relatively strong this week as investors continued to digest the less-dovish-than-expected Fed. Although the new dot plot suggested that policymakers agree with the market on two more rate cuts this year, the median dot for 2026 pointed to only one additional quarter-point reduction, with the market remaining convinced that three more cuts may be required next year.

That said, investors decided to somewhat scale back their bets after Fed Chair Powell struck a cautious tone on Tuesday, saying that the Fed needs to continue balancing the competing risks of high inflation and a weakening job market in coming decisions.

Indeed, the risks of high inflation did not disappear. After all, the Organization for Economic Cooperation and Development (OECD) noted this week that the full impact of tariff hikes is still unfolding. What is also justifying Powell’s view is that, despite the weakening labor market, the Fed’s own projections showed optimism for the forecast horizon, while economic activity remains solid, with the Atlanta Fed GDPNow model forecasting a 3.3% growth for Q3.

ISM PMIs and NFP to challenge investors’ dovish bets

With all that in mind, next week, dollar traders may lock their gaze on the ISM manufacturing and non-manufacturing PMIs for September, due out on Wednesday and Friday, respectively, but the highlight is likely to be the US jobs report for the same month due out on Friday as well.

The preliminary S&P Global PMIs revealed some weakness in business activity, which if confirmed by the ISM figures, could add some credence to the market view that more than one rate cut may be required next year. However, most of the reshaping in the implied path could be motivated by the nonfarm payrolls.

The last couple of reports came in well below market expectations, while there have been strong downside revisions to prior months as well. Overall, the trend in employment growth points to a significant slowdown and investors will be eager to find out whether this continued in September. Another weak print could prompt traders to sell their dollars again as it will confirm their dovish rate outlook, but equities are unlikely to cheer the prospect of lower borrowing costs. They could pull back on concerns about the broader economic outlook. The opposite reactions may be true if the data surprises to the upside.

Ahead of the employment data, market participants may also want to hear from several Fed officials, including Vice Chair Jefferson, New York President Williams, Atlanta President Bostic, Chicago President Goolsbe, and Dallas President Logan. The ADP private employment report on Wednesday could provide an early glimpse of how the labor market performed during September.

Dovish RBA could weigh on the Aussie

Although China will be closed from Wednesday onwards in celebration of their National Day, aussie traders will not have an easy week as the RBA decides on monetary policy on Tuesday, with China’s official PMIs scheduled to be released a few hours earlier.

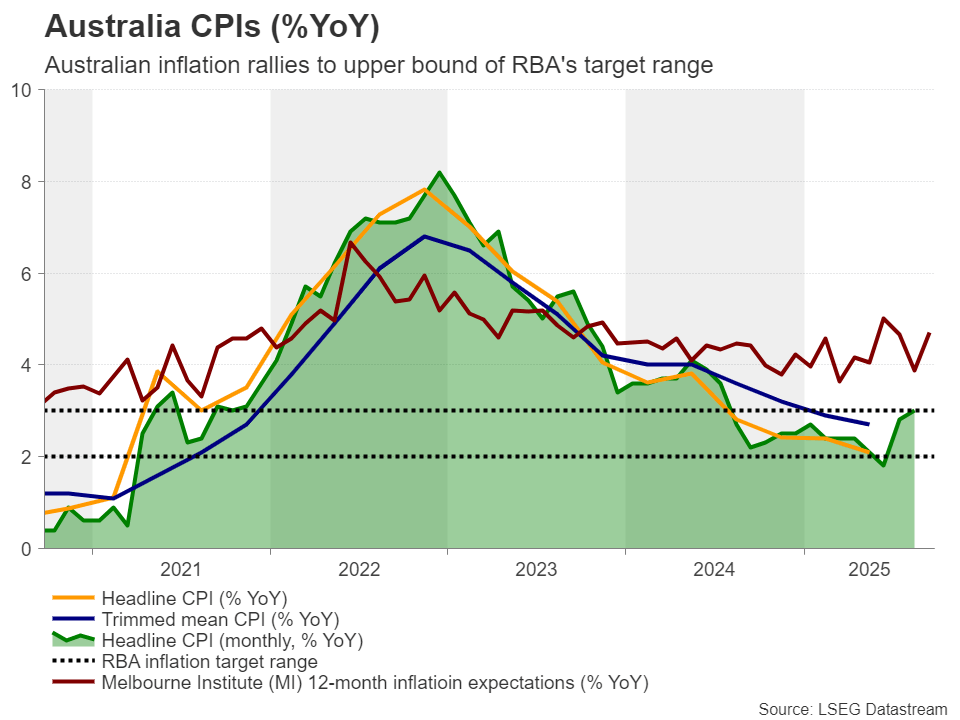

The latest RBA decision was back on August 12, when policymakers cut interest rates by 25bps, citing a substantial cooling of inflation. Their updated economic projections suggested that underlying inflation will continue to moderate, and that interest rates will stay in a gradual easing path.

That said, since then, the unemployment rate declined to 4.2% in July and stayed there in August, and most importantly the monthly CPI y/y rate surged to 2.8% in July from 1.9% and rose even further to 3.0% in August. This encouraged market participants to push back expectations of the next quarter-point reduction, fully pricing it in for February 2026. For this meeting there is only a 7% chance of a cut, with the remaining 93% pointing to no action.

On Monday, Governor Bullock said that, since the August meeting, data have been in line or slightly stronger than their expectations, though the economic outlook continues to be clouded by uncertainty. “We need to be alert to the risk that circumstances may change and be prepared to respond, if necessary,” she added.

Therefore, if the statement echoes that message, investors may be tempted to bring forward the timing of when they expect the next rate cut, perhaps to December, or even November. Currently, the probability of a rate cut at the November gathering is resting at 40%. This could weigh on the aussie, especially if the Chinese PMIs reveal that the manufacturing sector of the world’s second largest economy and Australia’s main trading partner shrank for the sixth straight month.

Will the CPI spark speculation about an ECB “contingency cut”

Euro traders will have to digest the preliminary CPI data for September from Italy, France and Germany on Tuesday, and from the whole Eurozone on Wednesday.

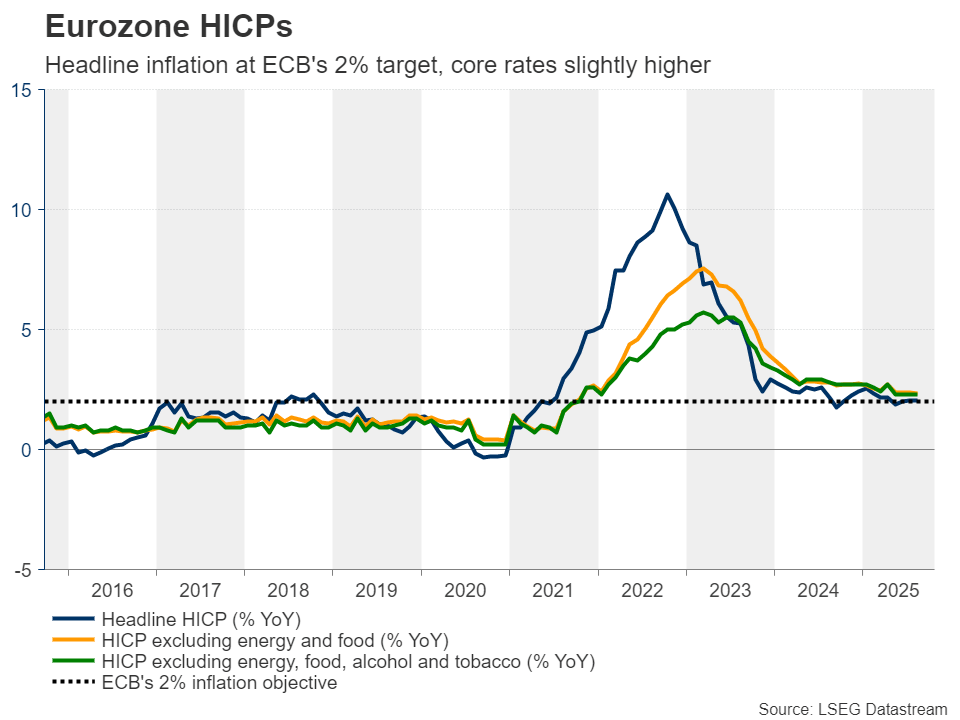

The ECB kept interest rates unchanged at its latest meeting, maintaining a positive view on growth and inflation, while President Lagarde noted that the Bank is in a “good place”, with inflation being where they wanted it to be. The decision led investors to scale back their rate cut expectations, baking into the cake only a 35% probability of another 25bps rate reduction by June 2026. In other words, most investors believe that the ECB has completed its rate-cut cycle.

That said, ECB Vice President de Guindos recently said that they are closely monitoring the euro’s nominal effective exchange rate rather than just its levels against the US dollar. That effective exchange rate is hovering at a record high, up 27% over the past decade. This means that a stronger euro will not only cause inflation to undershoot the ECB’s target but also harm trade and the Euro-area economy.

Having all that in mind, further cooling in next week’s inflation data could increase the chances of a “contingency cut” by the ECB to protect the economy, something that could weigh on the common currency.

Will the summary of opinions confirm a hawkish BoJ?

The Bank of Japan appeared more hawkish than expected at its latest meeting, with two members voting in favour of a rate hike and Governor Ueda saying that if their economic forecasts materialise, they will continue to raise interest rates.

According to Japan’s Overnight Index Swaps (OIS) there is a strong 55% chance of a 25bps rate hike at the Bank’s upcoming decision, with the probability of that happening by the end of the year rising to around 80%. A hike is almost fully priced in for January.

The Summary of Opinions on Monday may offer more clarity on how officials are planning to move forward. However, those awaiting a crystal-clear message may be disappointed. The Liberal Democratic Party (LDP) will hold an election on October 4 for PM Ishiba’s successor, a choice that could prove influential for monetary policy thereafter.

Thus, even if policymakers lean towards raising interest rates in coming months, a hike will not be set in stone. The yen failed to capitalize on the BoJ’s hawkishness, and even if it rebounds in the case of a hawkish Summary of Opinions, it is unlikely to recover all its recent losses. Some traders may remain sceptical that the Bank may proceed at a slower pace should Ishiba’s successor be seen as pro-monetary easing.

Author

Charalampos joined the XM Investment Research department in August 2022 as a senior investment analyst.