Week ahead – Dollar set to end 2024 on a high as bulls face few obstacles

-

Another quiet holiday week looms for financial markets.

-

Manufacturing PMIs, including the US ISM, are the only highlight.

-

But rising US yields and sliding yen may spark New Year’s fireworks.

Manufacturing PMIs in the spotlight

The mid-week market closure in celebration of New Year’s Day across much of the world has left little space for any major data releases. S&P Global’s manufacturing PMIs and the equivalent ISM gauge are likely to be the only indicators capable of generating some significant market moves over the coming week.

However, any policy-related headlines about US President-elect Donald Trump could also spur volatility, while yen traders will probably be on intervention watch as the Japanese currency continues to bleed following the widening policy gap after the Fed and BoJ meetings.

But first, it’s important to highlight that 2024 hasn’t been a great year for global manufacturers. Although most major economies enjoyed a modest rebound in manufacturing activity from the troughs of 2023, the recovery in most regions has been patchy at best, while in the Eurozone, it’s remained in contractionary territory for the entire year.

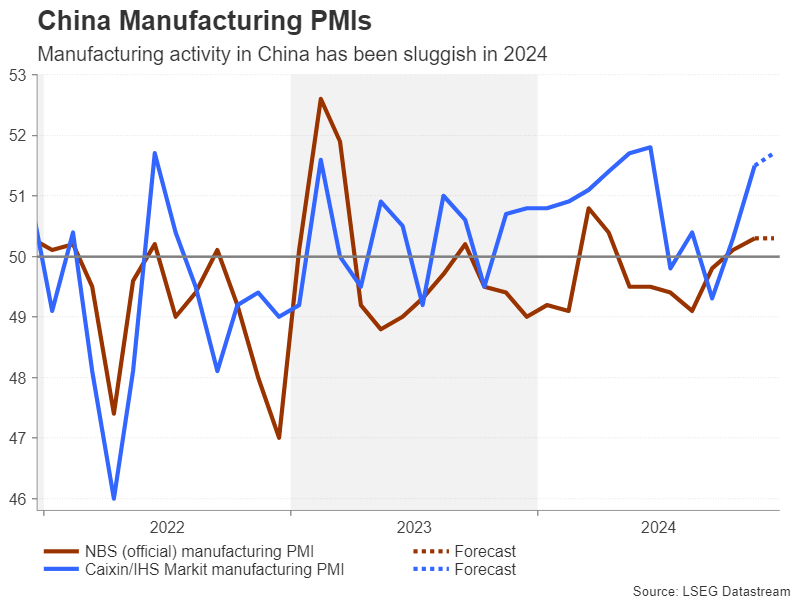

In China, there’s been some divergence between the official and S&P Global/Caixin manufacturing gauges. The government’s metric, which includes mainly large and state-owned enterprises, has barely managed to hold above 50, but the S&P Global/Caixin PMI has performed much better.

For December, they’re expected to rise modestly, maintaining their recent trend. Unless there’s a big upside surprise in either of them, the data is unlikely to provide much of a boost to regional stocks, but a negative surprise could dent sentiment.

Can ISM Mfg. PMI stop the Dollar’s advance?

In the United States, the manufacturing sector had a stronger first half but has been a drag on the rest of the economy in the second half. More worryingly, the disinflation process that started in 2022 ended at the start of 2024. However, the prices index now appears to be settling close to the 50-neutral level, suggesting that cost pressures are easing, which may help reduce the recent sharp layoffs in the sector.

In December, the ISM manufacturing PMI is forecast to have edged down from 48.4 to 48.3, with the prices index expected to pick up from 50.3 to 52.2. A weaker-than-expected reading for the latter could pressure the US dollar slightly, although in the absence of any crucial updates on the economy, investors will likely be tuning into Trump’s commentary.

Neither the Chicago PMI nor pending home sales due on Monday are anticipated to attract much attention. But Thursday’s weekly jobless claims could be a bigger driver if there’s an unexpected increase in those claiming unemployment benefits. Any data suggesting the Fed was overly cautious about inflation and too optimistic about the labour market could see the dollar’s latest bull run unravel.

Trump a risk for New Year’s volatility

With just a month to go to Trump’s inauguration, speculation is mounting about what policies he will prioritise in his first few months in office. The recent debacle with the spending bill when the government came close to shutting down suggests that not all Republicans are on board with Trump’s fiscal ideology. Meanwhile, Trump has already upped the ante when it comes to tariffs, threatening America’s allies – Canada, Mexico and the European Union – with higher levies.

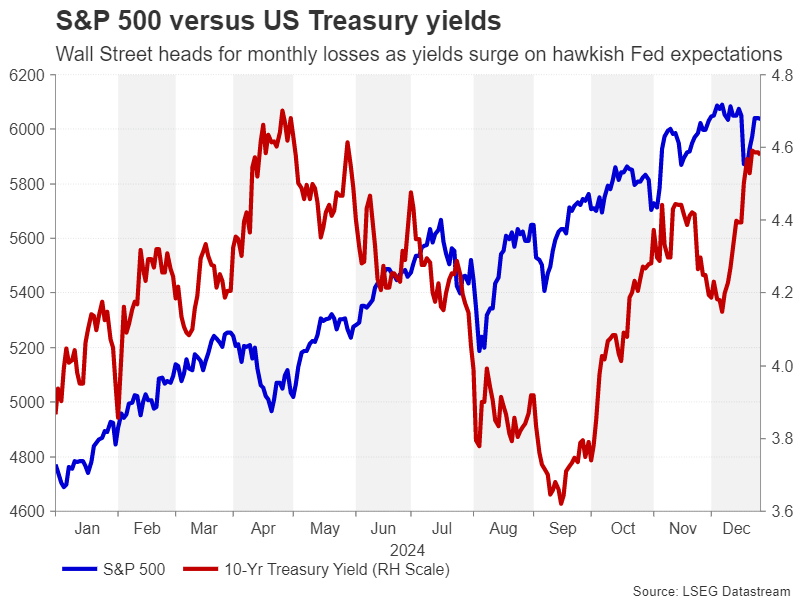

Any developments on tariffs or fiscal policy during the holiday lull when trading volumes tend to be extremely thin could bring about some big spikes in Treasury yields, which would then have ripple effects in FX and equity markets.

Can yields go even higher?

The benchmark 10-year yield has crossed above 4.60% and could soon surpass the 2024 high of just under 4.74%, while the dollar index is trading at more than two-year highs. This leaves the greenback vulnerable to a downside correction. But if both yields and the dollar continue to climb, it could force Japanese authorities to intervene to prop up the yen, which is down more than 5% in December.

Stocks on Wall Street could also suffer, although it’s mainly small-caps and non-tech stocks that seem to be struggling under the weight of higher yields. The tech-dominated Nasdaq 100 is even on track to end the month in positive territory, unlike the Dow Jones.

Author

Mr Boyadjian graduated from the London School of Economics in 1999 with a BSc in Business Mathematics and Statistics. Following graduation, he joined PricewaterhouseCoopers in the Business Recoveries team, where he was responsibl