Week 48 S&P 500 stock market roundup and a new strong momentum stock [Video]

![Week 48 S&P 500 stock market roundup and a new strong momentum stock [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse1-637299020939878938_XtraLarge.jpg)

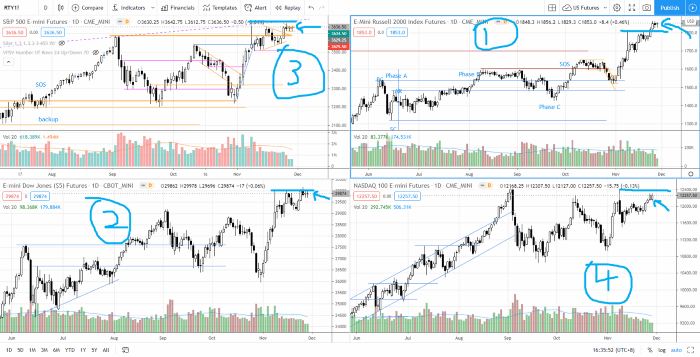

As stated in Week 46 stock market roundup, rotation from NASDAQ to RUSSELL 2000 and the Dow Jones has been confirmed in the past two weeks.

By comparing the current price with the swing high created on 9 Nov 2020 (where profit taking happened) in the chart above, RUSSELL 2000 is the strongest, followed by Dow Jones, S&P 500 and the NASDAQ. Continuation to the upside is expected for all 4 indices since the supply (from 9 Nov) has been absorbed.

Stock Watchlist — Malaysia

VS (V.S INDUSTRY BHD) — VS is within the trading range between 2.25–2.56. Next support at 2.1–2.2. Supply is low.

JHM (JHM CONSOLIDATION BHD) — After JHM hit the all time high, minor profit taking was observed. On 26 Nov 2020, JHM fell below the support at 2 reacting to the earning. Should JHM stay above the support at 1.77, it should resume its up trend.

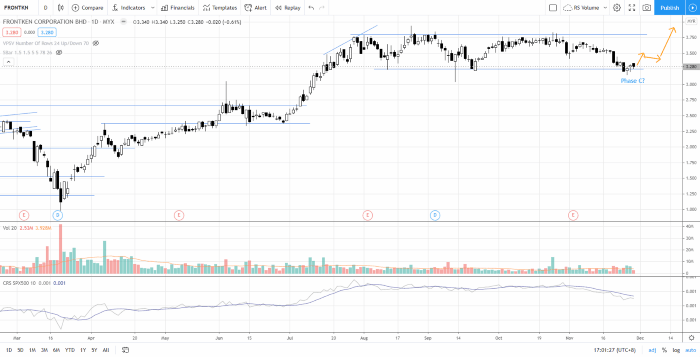

FRONTKN (FRONTKEN CORPORATION BHD) — Increasing of supply attempt to break below the support at 3.25 followed by two days of buying off the support. Watch out for decreasing of supply for FRONTKN to start a sign of rally to break above 3.8. This could be a potential phase C in Wyckoff Phase.

MI (MI TECHNOVATION BERHAD) -Trading range between 3.7–4.7 is still in play. Could MI also be in phase C to start a sign of strength rally similar to FRONTKN?

PENTA (PENTAMASTER CORPORATION BHD) — The support at 5 failed to hold. Support is at 4.3–4.5.

UWC (UWC BERHAD) — A back up action is still in progress after the breakout on 5 Nov 2020. Immediate support is at 7. Supply is low in general which is constructive for bullish scenario.

Stock Watchlist — US

Watch the walkthrough of the US stocks watchlist below. The first stock is revealed in the email to my subscribers.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.