USD/CAD trapped in a bear market; trendline resistance in focus [Video]

![USD/CAD trapped in a bear market; trendline resistance in focus [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/canadian-money-11699219_XtraLarge.jpg)

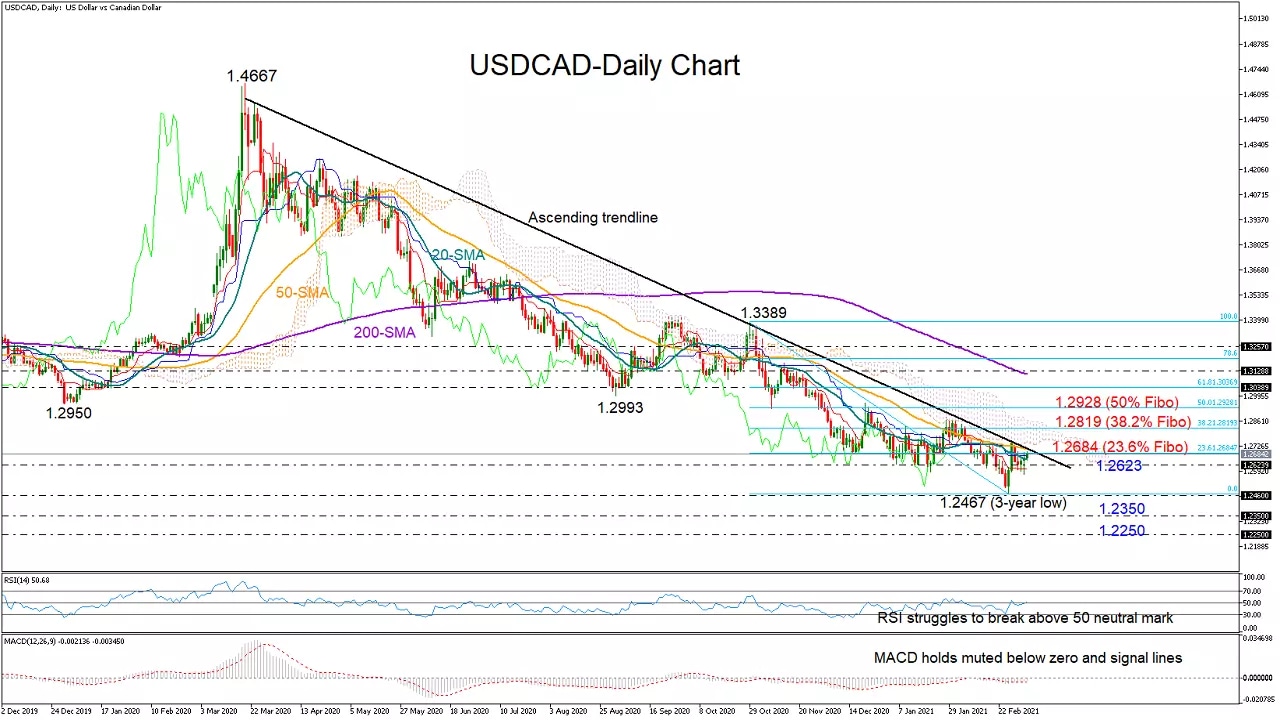

USDCAD attempted to quickly recover from a three-year low of 1.2467 as it did back in 2016, but the tough ascending trendline and the surface of the Ichimoku cloud put the brakes on bullish forces, leaving the pair on the sidelines this week.

The RSI and the MACD keep the odds for a meaningful rally muted as the former has been struggling to sustain strength above its 50 neutral mark, while the latter could not climb into the positive territory for the past few weeks.

Hence, a forceful break above the ascending trendline remains the key for extended recovery, though such a move could come with some delay if the 23.6% Fibonacci of the 1.3332 – 1.2467 downleg at 1.2684 holds firm. If the bulls manage to overcome that double block, the pair may try to climb above the cloud and the 38.2% Fibonacci of 1.2819. A decisive close above the 50% Fibonacci of 1.2928 would raise optimism for trend improvement, and therefore could be a more important achievement.

In the negative scenario where the price closes below 1.2623, all attention will turn to the 3-year low of 1.2467. A step below that floor could mark a new lower low around the 1.2350 barrier, while a steeper decline may also reach the 1.2250 restrictive region, taken from February 2018.

Summarizing, USDCAD continues to trade in a bear market, with traders likely waiting for a clear close above the persisting descending trendline to gain buying confidence.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.