USD tries to stabilise

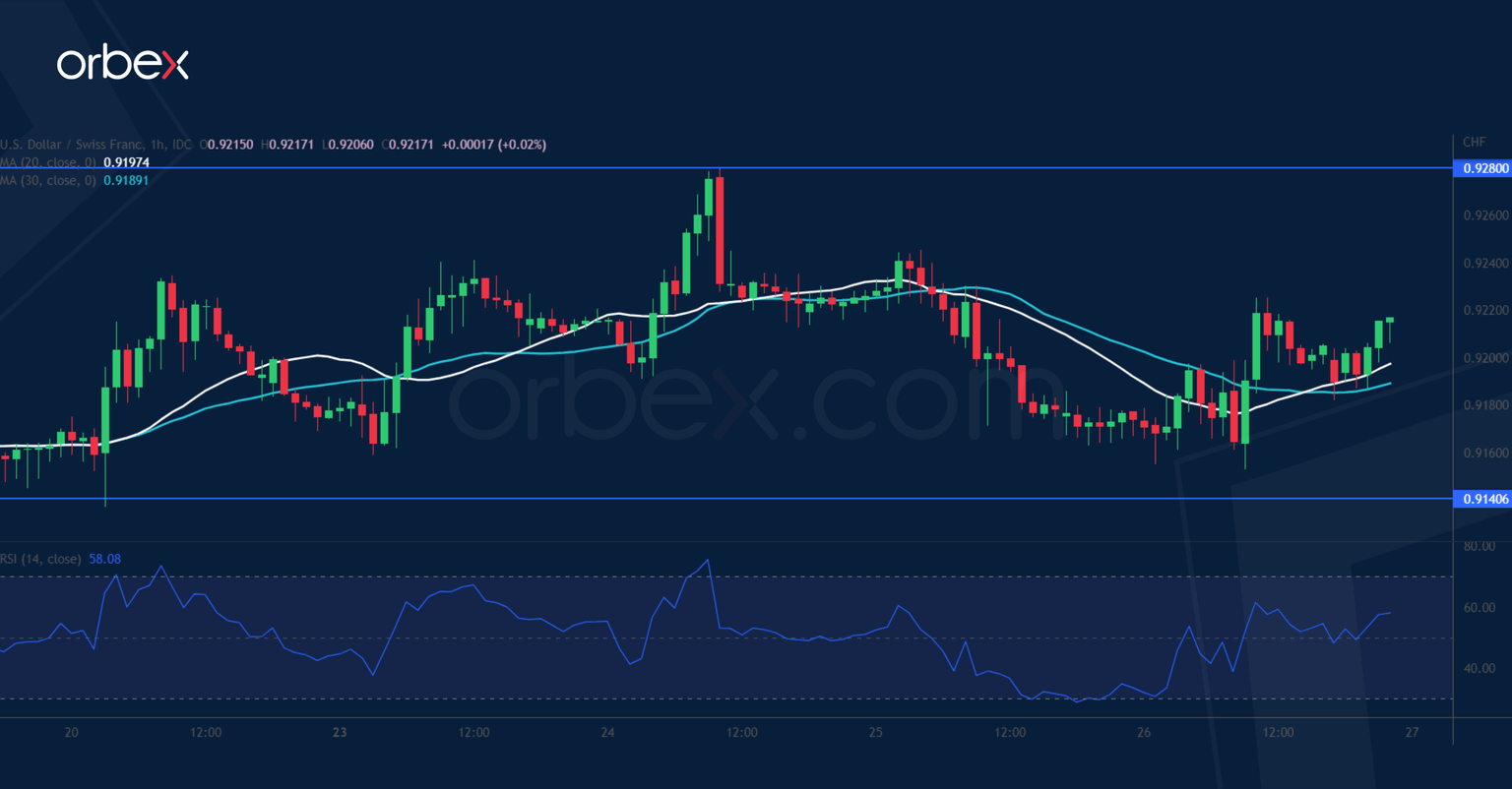

USD/CHF grinds support

The US dollar builds a base ahead of the Fed rate decision next week. An initial pop above 0.9240 has prompted short-term sellers to cover some of their bets. Though 0.9280 along the 30-day moving average has proven to be a tough level to crack for the time being. 0.9140 at the base of the recent momentum is a key support to keep the rebound intact. Its breach could trigger a new round of sell-off and push the greenback below January 2022’s low (0.9100), confirming a bearish continuation in the process.

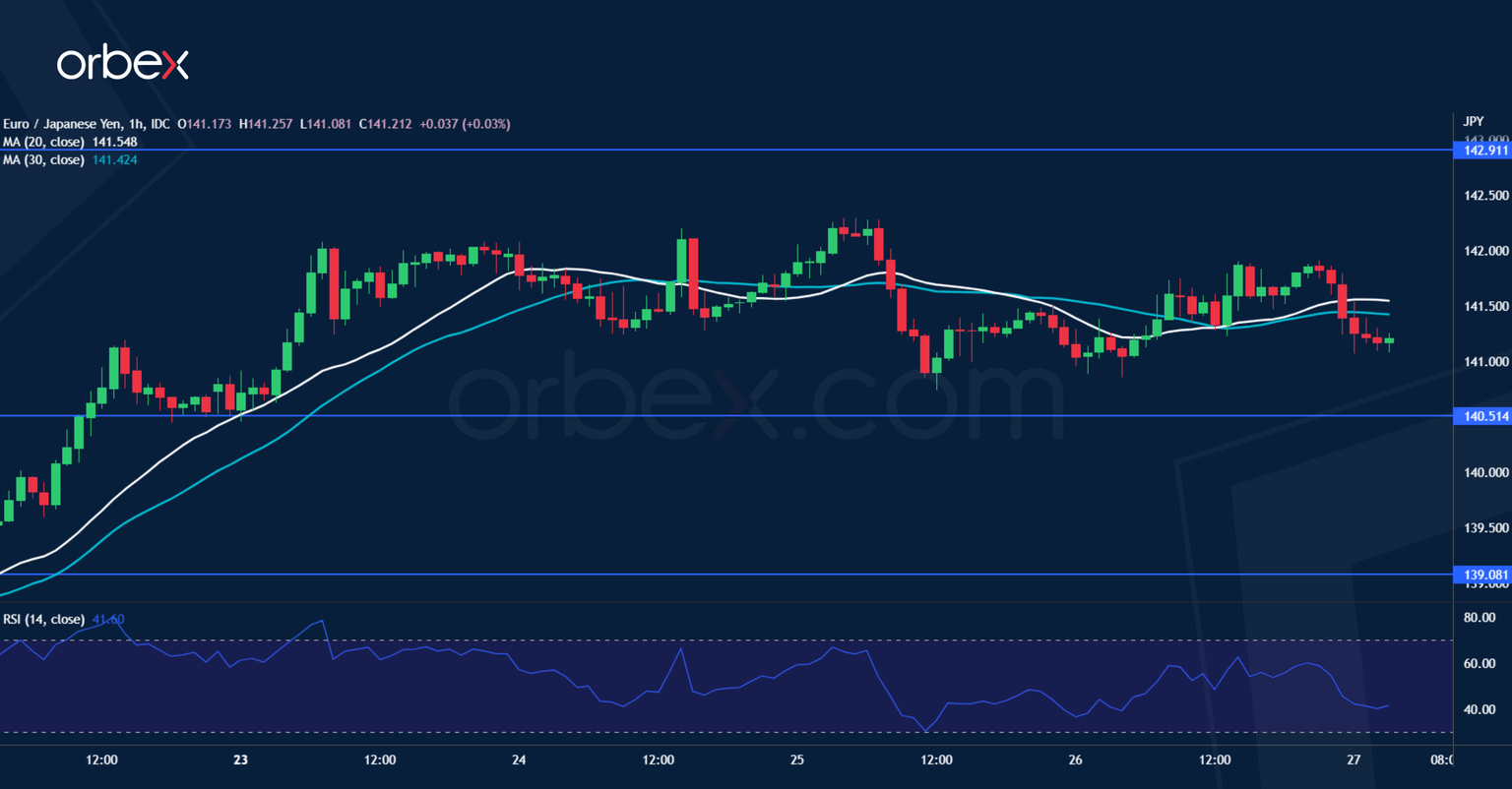

EUR/JPY looks to breakout

The Japanese yen strengthened after Tokyo CPI beat expectations. On the daily chart, the pair is in a horizontal range between 137.60 and 142.90 as it tries to keep the uptrend intact in the medium-term. Recent jitters have found support above 140.50, which is essential to keep intraday buyers committed. A break above the upper band at 142.90 would flush the remaining sellers out and propel the pair above 144.00, putting the euro on a bullish extension. A bearish breakout would send the pair to 139.00.

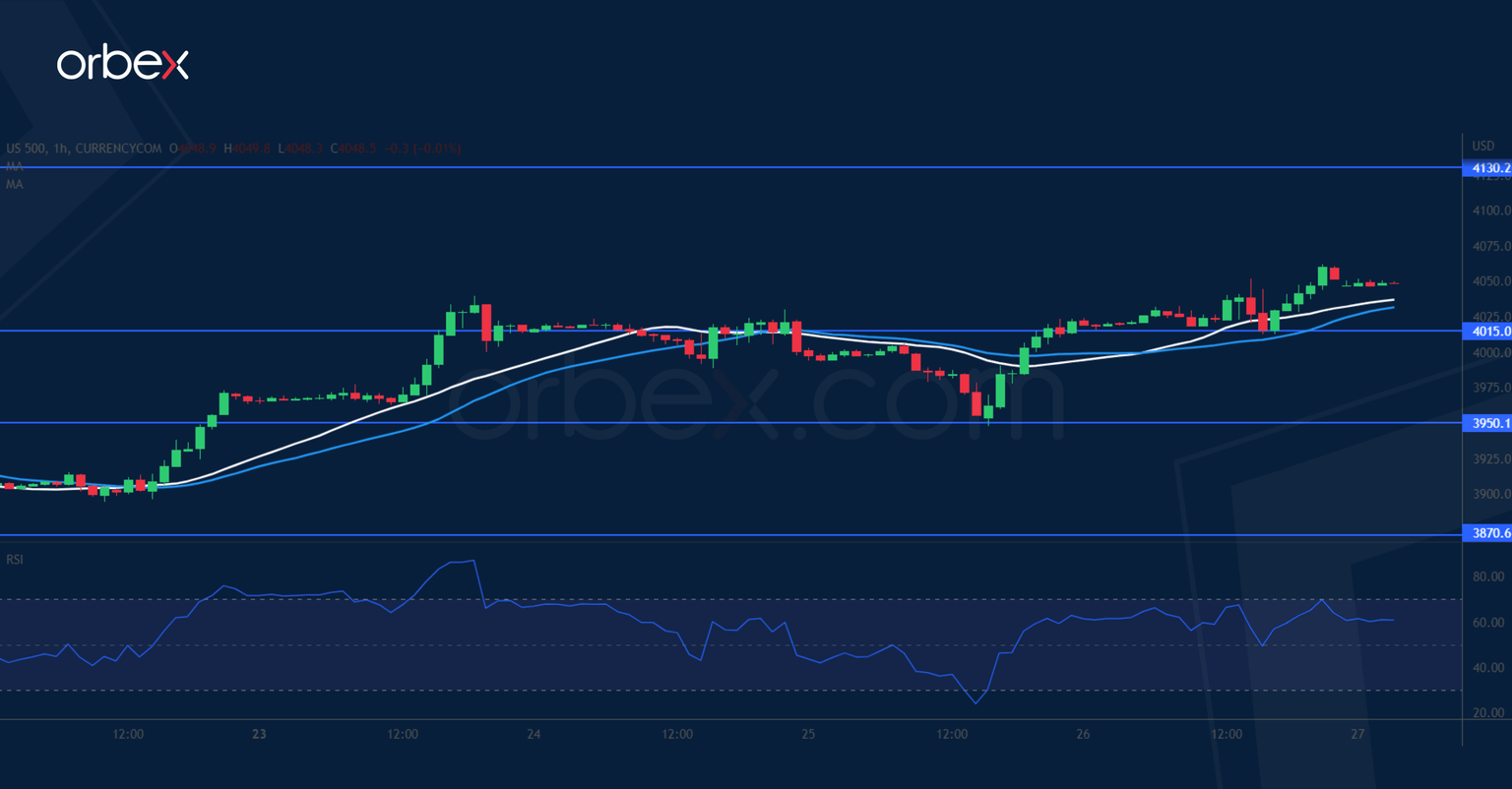

S&P 500 breaks resistance

The S&P 500 rallies as upbeat US GDP eases fears of an economic downturn. On the daily chart, a close above the psychological level of 4000 and a bullish MA cross suggest that sentiment could be turning around. A break above 4050 from the start of the mid-December liquidation indicates solid buying pressure. Its breach would carry the index to the recent spike at 4130, leaving 4015 as a fresh support. Further down, the confluence of the swing low 3950 and the 20-day moving average is a key level to maintain the recovery.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.