USD struggles to recover

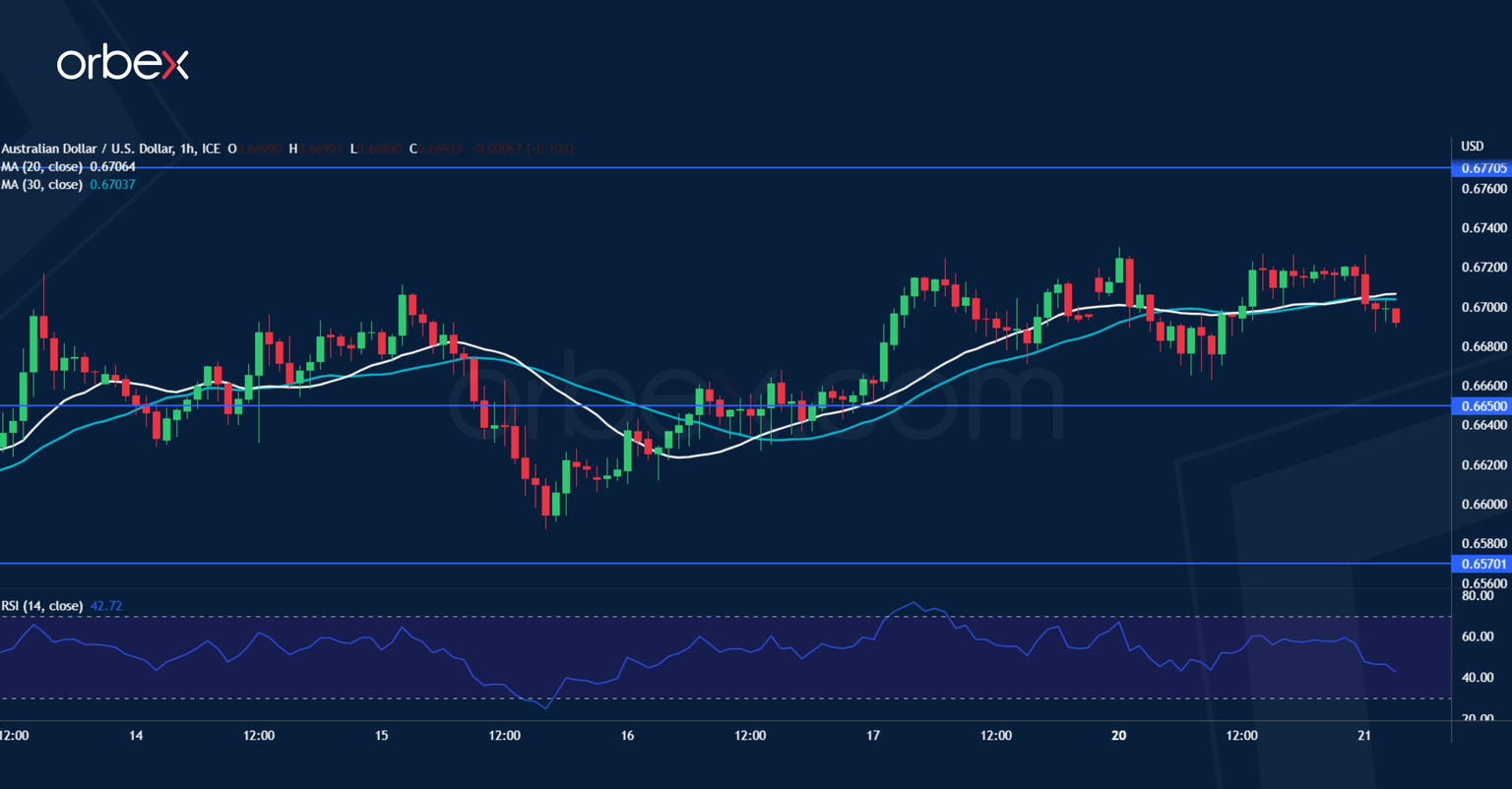

AUD/USD recoups losses

The Australian dollar slid as the RBA minutes showed policymakers may reconsider pausing rate hikes. The selling pressure eased after the pair gained a foothold over 0.6570. A close above last week’s high of 0.6710 reveals interest in keeping the price afloat. The top range of the previous consolidation around 0.6770 is a major resistance and coincides with the 30-day SMA. A bullish breakout could extend the rally towards 0.6900. Otherwise, a drop below 0.6650 would make the aussie resume its downward trajectory.

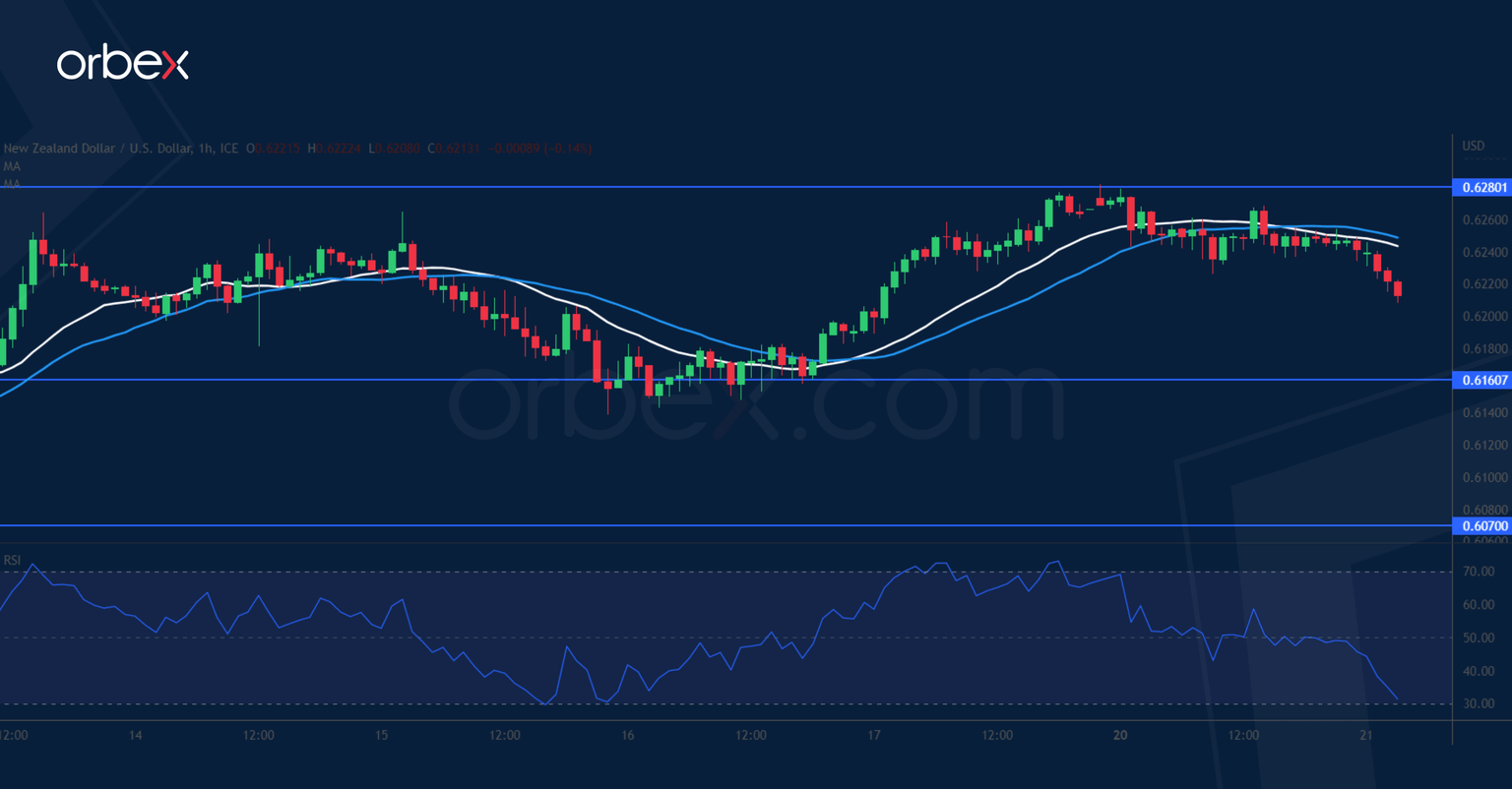

NZD/USD seeks support

The US dollar retreats as markets stabilise amid the UBS-Credit Suisse rescue deal. A close above the double spike at 0.6260 has forced the remaining sellers to cover their positions, turning the short-term mood around. A temporary retracement may allow the bears to switch sides and offer stronger support. A bounce off the accumulation area above 0.6160 would pave the way for a sustained recovery above 0.6280. This would suggest that the correction from early February on the daily chart could be coming to an end.

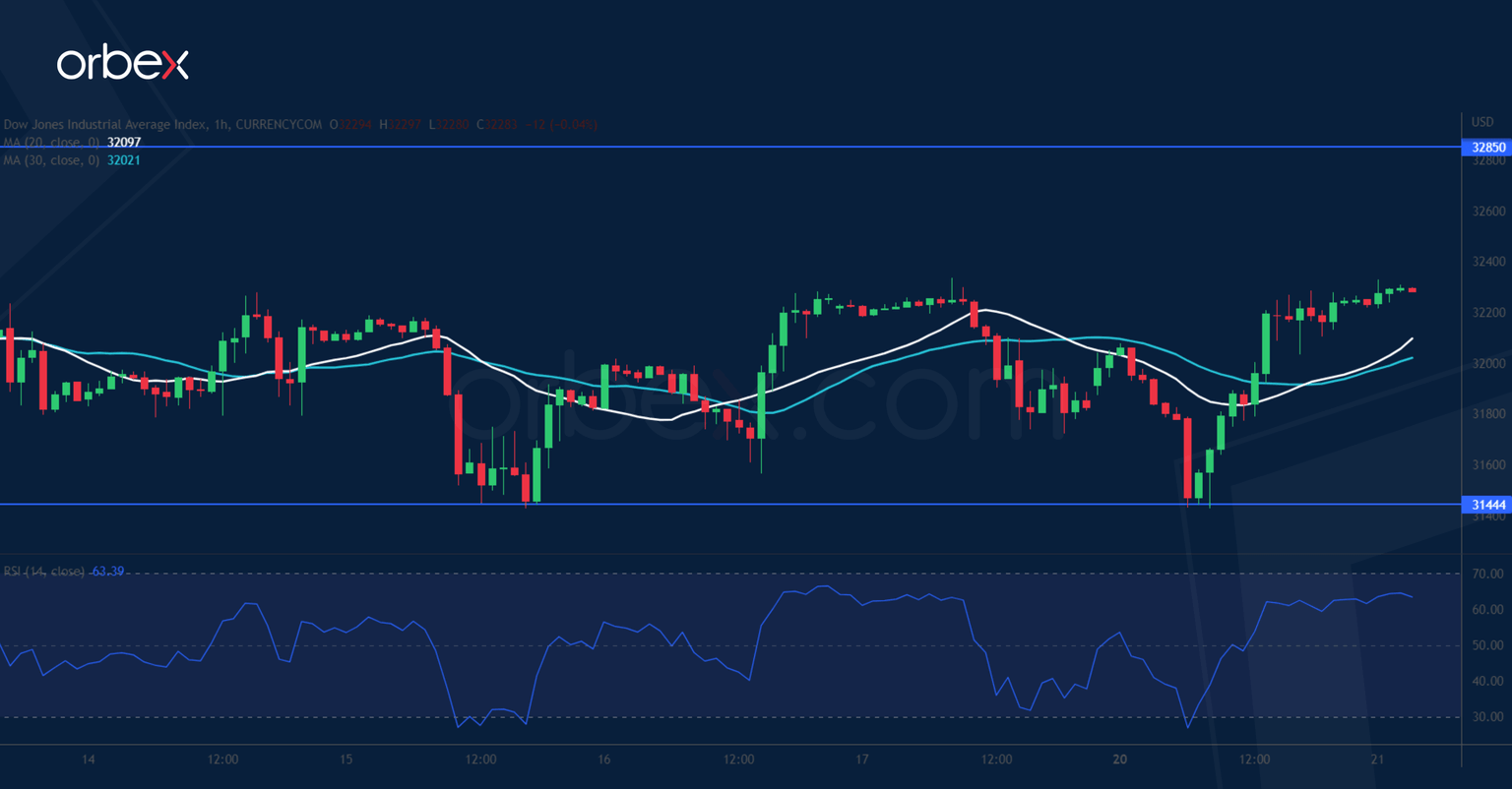

Dow Jones 30 tries to rebound

The Dow Jones 30 clawed back losses as traders raised their bets of a pause from the Fed on Wednesday. A tentative break above 32300 previously took some heat off the index but the bulls are not out of the woods yet. Sentiment would remain cautious unless they manage to lift offers in the supply zone around 32850. Then 33500 would be next if a rebound starts to gain traction. Failing that, the current brief consolidation would be followed by a drop below 31440, opening the door to a deeper correction towards 30200.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.