USD/JPY: the mixed signals continue to come for Dollar Yen [Video]

![USD/JPY: the mixed signals continue to come for Dollar Yen [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/japanese-yen-62890274_XtraLarge.jpg)

USD/JPY

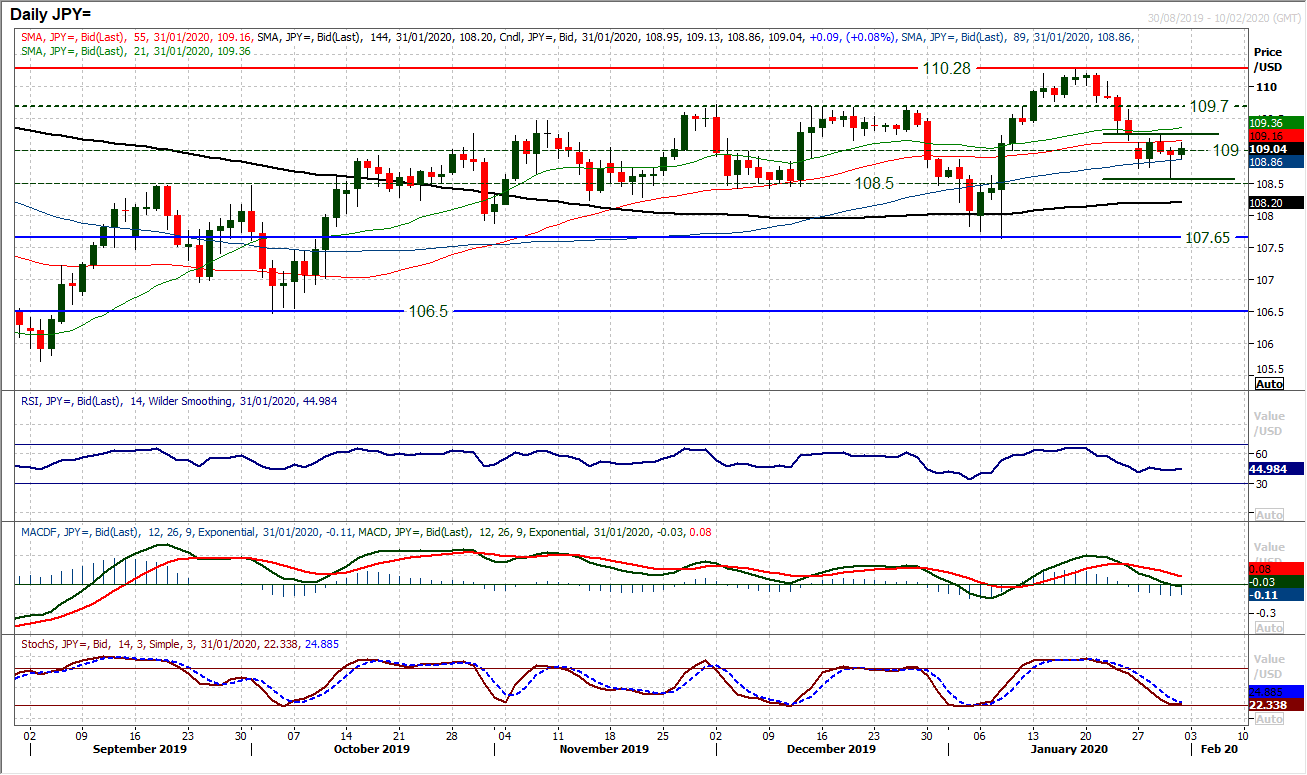

The mixed signals continue to come for Dollar/Yen. Throughout this week, we have been looking at a consolidation between 108.70 and 109.25. For a brief time yesterday it looked as though the next leg lower would be forming, but an intraday rally into the close has once more re-affirmed the market around 109.00. This simply adds to the consolidation now. Momentum indicators are beginning to look far more settled, with the RSI spending the past five sessions now hovering a shade above 40, whilst Stochastics and MACD shallow their deterioration. The hourly chart is also looking more of a consolidation play too. We are still looking for a closing break either way to affect the outlook, which is increasingly at an inflection point now. A close above resistance at 109.25 opens a recovery of around 70 pips, whilst a close below 108.55 would be a continuation towards a test of the 107.65 key low. On balance we are still medium term positive on Dollar/Yen and are buyers into near term weakness. However, we know that with the Coronavirus, this could create extreme moves.

Author

Richard Perry

Independent Analyst