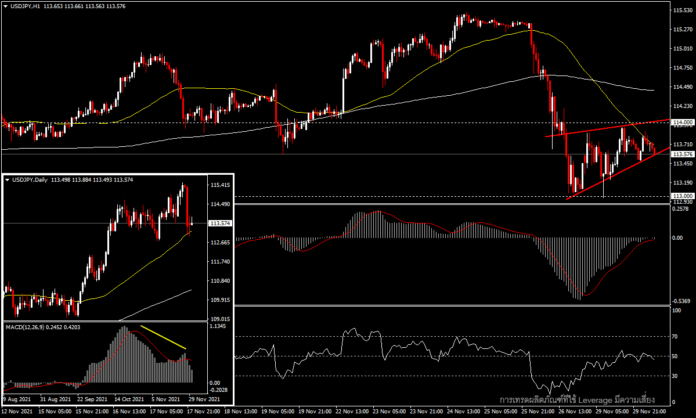

USD/JPY – Struggling to correct after a heavy fall on Friday

USD/JPY, H1

Panic from the emergence of the Omicron variant resulted in the safe-haven currency pair falling sharply on Friday from a high above 115.50 to a low of 113.00 and it is now trading back to this key 113.00 level after panic eased but uncertainty remains. The Omicron variant may not be as dangerous as initially thought, however, it is very early in its development. As a result, US stock markets recovered, with the S&P 500 +1.32%, Nasdaq +1.88%, and Dow +0.68%, as well as the Nikkei 225 up +0.76% this morning at 28,498 points.

In terms of economic data, Japan’s October jobless rate fell to its lowest point since March of this year at 2.7%, lower than the 2.8% forecast, while October industrial production rose for the first time in four months at 1.1%, benefiting from the reopening of factories reducing supply constraints. However, this increase is still below market expectations of 1.8%.

While it is unclear how virulent the Omicron variant is, yesterday the Japanese government announced another lockdown after having just announced the opening of the country earlier this month, as opposed to the US where President Biden has announced that there are currently no plans to implement lockdown, meaning there will be no new restrictions on travel to and from the US.

US data to keep an eye on today is the Chicago PMI Index, Consumer Confidence Index, Fed Chairman Powell’s Testimony and Treasury Secretary Yellen’s Speech before the Senate Banking Committee on the CARES Act, as well as speeches by FOMC Williams and Clarida.

From a technical point of view, the USDJPY is currently undergoing a correction during the downtrend. The price has been rallying in a narrower frame with a rising wedge pattern trend, meaning the pair is likely to go further down if it breaks the lower band and target the downtrend at the original low of 113.00. Conversely, if the US data is good, the pair could move up to test the week high of 114.00.