USD/JPY rockets as the US dollar breaks higher across the board to hit 108.00

USD/JPY – EUR/JPY – CAD/JPY

USDJPY we wrote: rockets as the US dollar breaks higher across the board to hit108.00. Further gains look likely in the bull trend despite overbought conditions aswe look for 108.20/25 & 108.80/95.

We reached 108.63 then dipped to 108.08. No sell signal yet despite severelyoverbought conditions but we do meet 4 year & 200 week moving average resistanceat 109.00/10. A high for the week is likely. I would definitely exit all longs.

EURJPY mostly sideways this week but we are in a 9 month bull trend so we remainbuyers on weakness. Minor support at 128.90/80 certainly holding.

CADJPY longs at support at 8495/85 worked perfectly. We bottomed exactly here &shot higher to 8563.

Daily analysis

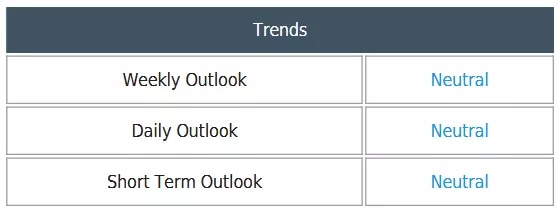

USDJPY struggles as we approach important resistance at 109.00/10. We are likely toconsolidate & trade sideways. We will watch for a sell signal to indicate a correctionto the downside.

First support at 1.0815/05 could hold the downside but below here meets a buyingopportunity at 107.85/75 with stops below 107.60.

EURJPY holds the target of 129.45/55 again on Friday. Further gains in the bull trendcan retest 129.85/95. A break above 130.05 is a buy signal initially targeting130.30/35.

Minor support at 128.90/80 held over the last 3 days but below here risks a slide to128.40/30. Try longs with stops below 128.10.

CADJPY continues higher to 8563. Downside is expected to be limited in the beartrend with support at 8510/00. Longs need stops below 8485. Further losses meetsupport at 8450/40.

A break above 8565 targets 8590/99 then strong resistance at 8615/25 for profittaking on longs.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk