USD/JPY Price Forecast: Seems vulnerable as stronger GDP report lifts BoJ rate hike bets

- USD/JPY drops to a one-week low in reaction to the upbeat GDP print from Japan.

- The strong economic growth figures lift BoJ rate hike bets and underpin the JPY.

- Hawkish Fed expectations revive the USD demand and limit losses for the major.

The USD/JPY pair attracts some follow-through selling for the third successive day and touches a one-week trough, around the 151.50-151.45 region on Monday. The Japanese Yen (JPY) strengthens across the board in reaction to the upbeat domestic Gross Domestic Product (GDP) report, which boosted bets for more interest rate hikes by the Bank of Japan (BoJ). This, along with a weaker US Dollar (USD), exerts downward pressure on the currency pair.

A preliminary government report showed that Japan's economy expanded by 0.7% in the October-December quarter compared to the previous quarter's upwardly revised reading of 0.4%. Furthermore, the yearly growth rate accelerated from a revised 1.7% in the third quarter to 2.8% during the reported period. This comes on top of signs of broadening inflationary pressures in Japan, which supports prospects for further tightening by the BoJ and provides a goodish lift to the JPY.

Meanwhile, hawkish BoJ expectations lift the yield on the benchmark 10-year Japanese government bond (JGB) to the highest level since April 2010. In contrast, the US bond yields remain depressed in the wake of Friday's dismal Retail Sales data, which keeps alive hopes for a rate cut by the Federal Reserve (Fed) later this year. The resultant narrowing of the Japan-US yield differential turns out to be another factor that contributes to driving flows toward the lower-yielding JPY.

Meanwhile, US President Donald Trump ordered officials on Thursday to formulate plans for reciprocal tariffs on countries that impose taxes on US imports, though he stopped short of announcing immediate levies. This helps ease trade war fears, which, along with the optimism over talks between the US and Russia aimed at ending the war in Ukraine, boosts investors' confidence and cap the safe-haven JPY. Apart from this, a modest USD bounce lends support to the USD/JPY pair.

Moving ahead, speeches by influential FOMC members might drive the USD demand in the absence of any relevant macro US data and a holiday in the US. The focus, however, will remain glued to Trump's tariff plans, which will play a key role in providing some meaningful impetus to the USD/JPY pair. Nevertheless, the aforementioned fundamental backdrop seems tilted in favor of the JPY bulls and suggests that the path of least resistance for spot prices remains to the downside.

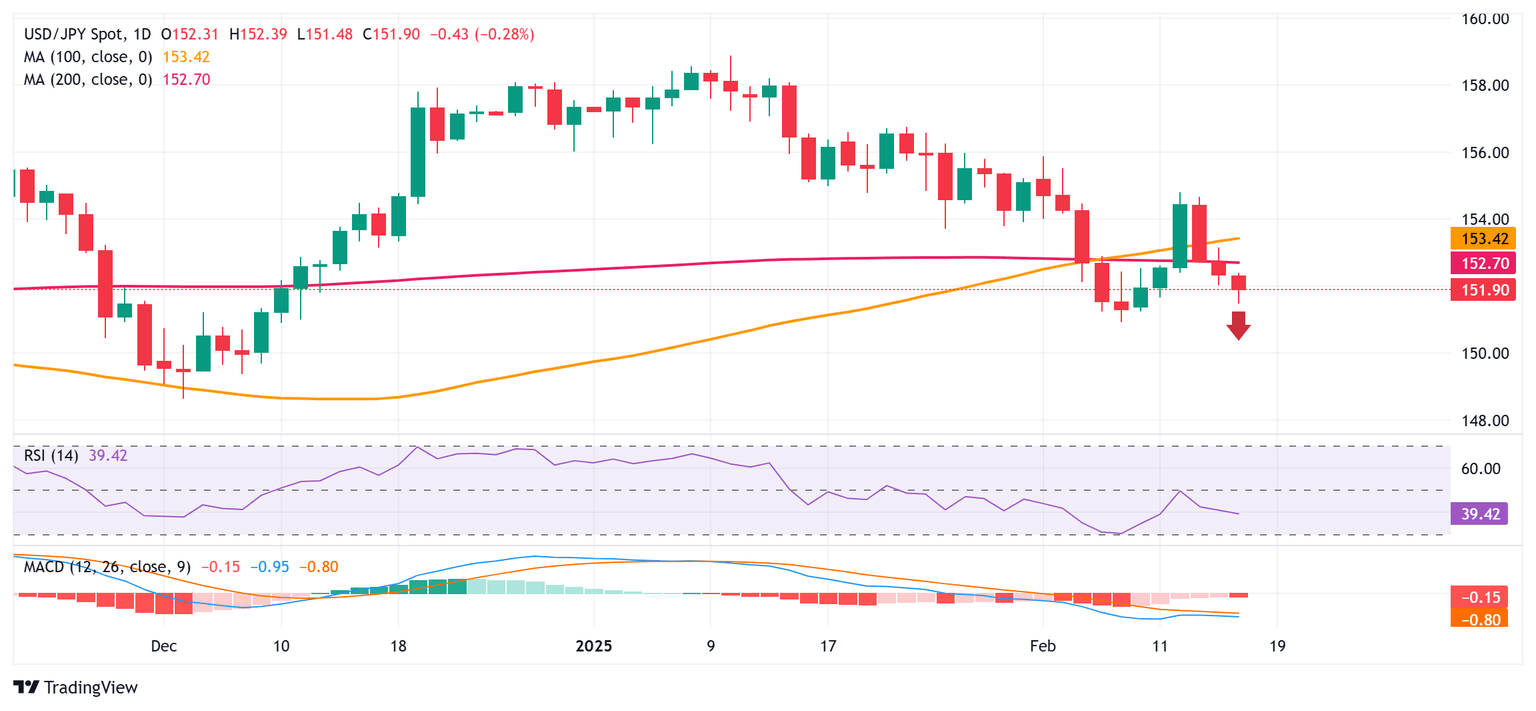

USD/JPY daily chart

Technical Outlook

From a technical perspective, last week's failure near the 50% retracement level of the January-February downfall and the subsequent slide below the very important 200-day Simple Moving Average (SMA) favor bearish traders. Moreover, oscillators on the daily chart are holding in negative territory and further validate the near-term negative outlook for the USD/JPY pair. Hence, some follow-through selling below the 151.45-151.40 area should pave the way for a slide towards the 150.00 psychological mark en route to the 149.60-149.55 zone, the 149.00 round figure, and the December 2024 swing low, around the 148.65 region.

On the flip side, any meaningful recovery beyond the 152.00 mark might confront a strong hurdle near the 152.70 area or the 200-day SMA. This is followed by the 100-day SMA, currently pegged near the 153.15 region, which if cleared decisively could trigger a short-covering rally and lift the USD/JPY pair beyond the 154.00 round figure, towards the 154.45-154.50 supply zone. The momentum could extend further towards the last week's swing high, around the 154.75-154.80 region. Some follow-through buying, leading to a move beyond the 155.00 mark might shift the near-term bias in favor of bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.